- Greece

- /

- Construction

- /

- ATSE:ELLAKTOR

Despite shrinking by €52m in the past week, Ellaktor (ATH:ELLAKTOR) shareholders are still up 241% over 3 years

It might be of some concern to shareholders to see the Ellaktor S.A. (ATH:ELLAKTOR) share price down 15% in the last month. In contrast, the return over three years has been impressive. The share price marched upwards over that time, and is now 189% higher than it was. To some, the recent share price pullback wouldn't be surprising after such a good run. The fundamental business performance will ultimately dictate whether the top is in, or if this is a stellar buying opportunity.

Since the long term performance has been good but there's been a recent pullback of 7.5%, let's check if the fundamentals match the share price.

Check out our latest analysis for Ellaktor

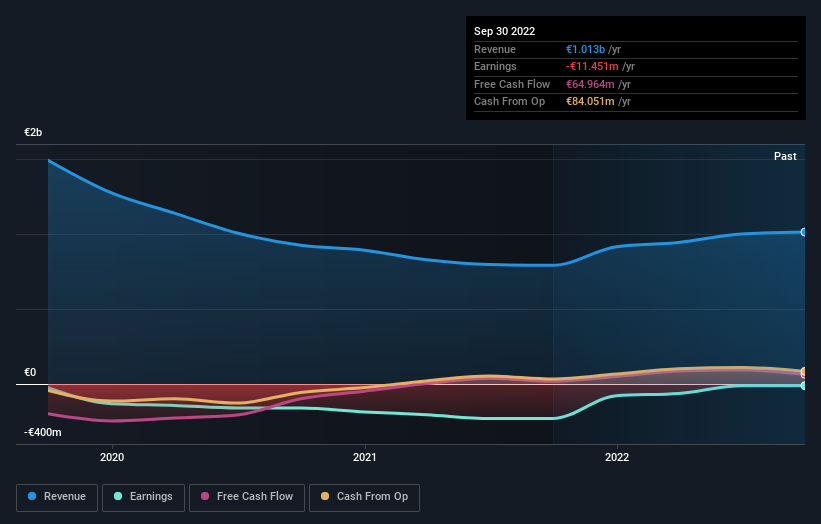

Ellaktor isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Ellaktor actually saw its revenue drop by 12% per year over three years. So the share price gain of 42% per year is quite surprising. It's fair to say shareholders are definitely counting on a bright future.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Ellaktor's financial health with this free report on its balance sheet.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Ellaktor's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Ellaktor's TSR of 241% over the last 3 years is better than the share price return.

A Different Perspective

We're pleased to report that Ellaktor shareholders have received a total shareholder return of 53% over one year. That's better than the annualised return of 5% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Ellaktor (of which 1 shouldn't be ignored!) you should know about.

Of course Ellaktor may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Greek exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Ellaktor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:ELLAKTOR

Ellaktor

Through its subsidiaries, operates as an infrastructure company in Greece, other European countries, Gulf countries, and the Americas.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives