- Greece

- /

- Construction

- /

- ATSE:DOMIK

Domiki Kritis S.A.'s (ATH:DOMIK) Share Price Is Still Matching Investor Opinion Despite 26% Slump

To the annoyance of some shareholders, Domiki Kritis S.A. (ATH:DOMIK) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 61% loss during that time.

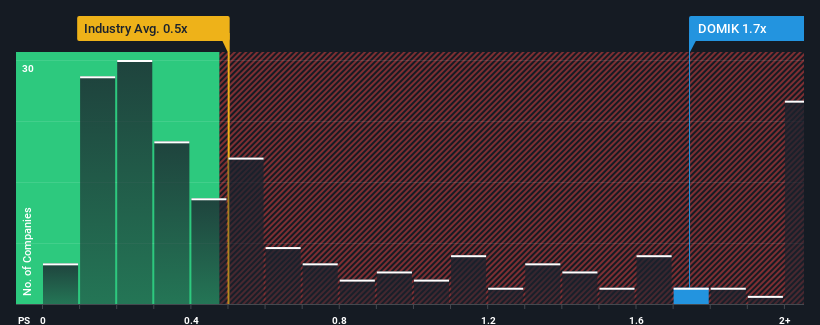

Even after such a large drop in price, given close to half the companies operating in Greece's Construction industry have price-to-sales ratios (or "P/S") below 0.9x, you may still consider Domiki Kritis as a stock to potentially avoid with its 1.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Domiki Kritis

How Has Domiki Kritis Performed Recently?

For example, consider that Domiki Kritis' financial performance has been poor lately as its revenue has been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Domiki Kritis will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Domiki Kritis?

Domiki Kritis' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a frustrating 25% decrease to the company's top line. Even so, admirably revenue has lifted 42% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 5.0%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's understandable that Domiki Kritis' P/S sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

There's still some elevation in Domiki Kritis' P/S, even if the same can't be said for its share price recently. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's no surprise that Domiki Kritis can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Before you settle on your opinion, we've discovered 5 warning signs for Domiki Kritis (2 are potentially serious!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ATSE:DOMIK

Domiki Kritis

Primarily engages in the construction of heavy infrastructure projects for public and private sectors in Greece.

Moderate with mediocre balance sheet.

Market Insights

Community Narratives