- United Kingdom

- /

- Other Utilities

- /

- LSE:NG.

National Grid (LSE:NG.) Strengthens Leadership with Sally Librera Appointment, Eyes Future Growth Opportunities

Reviewed by Simply Wall St

Click to explore a detailed breakdown of our findings on National Grid.

Strengths: Core Advantages Driving Sustained Success For National Grid

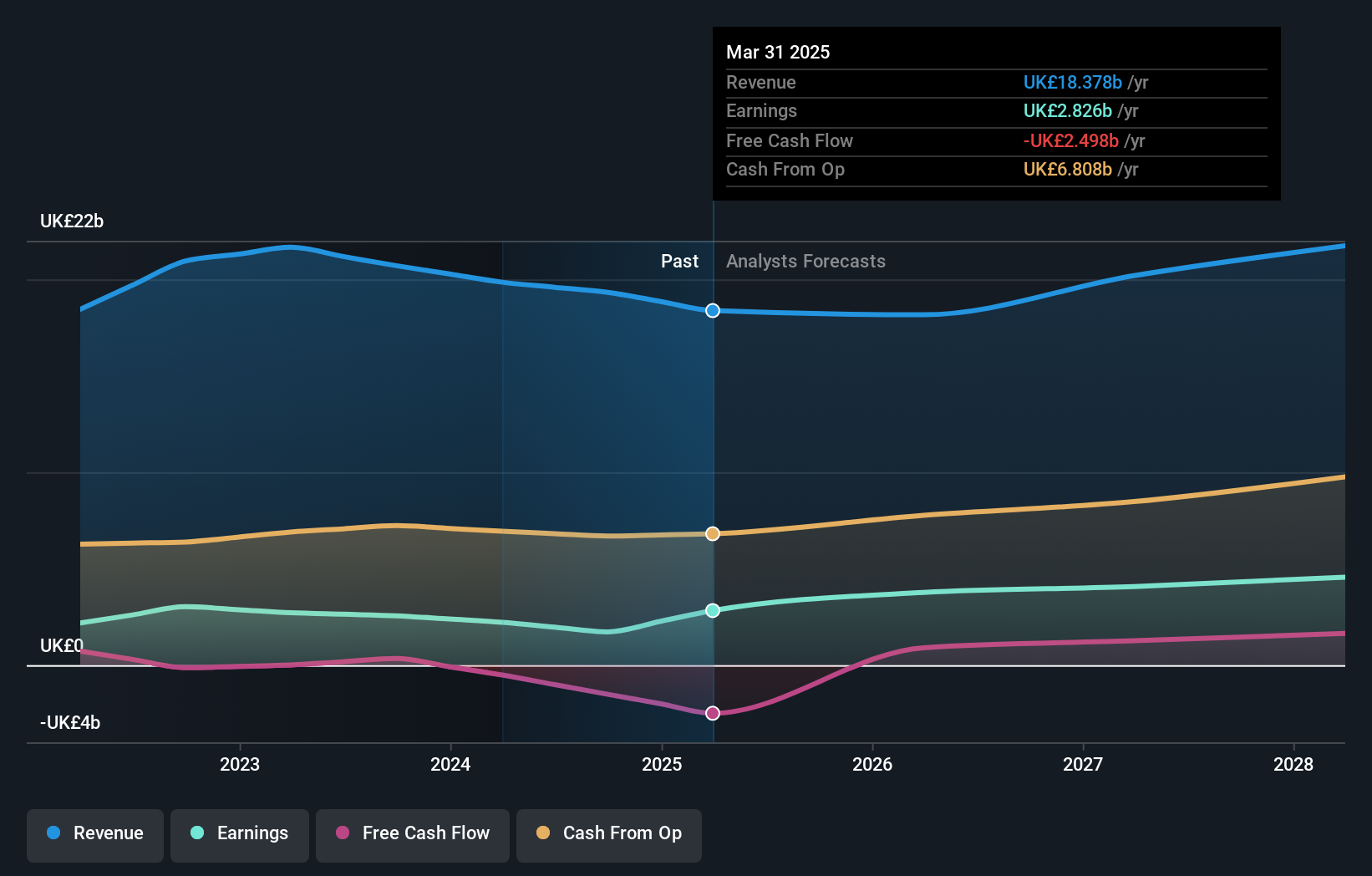

National Grid's robust financial performance is a significant strength, demonstrated by an underlying operating profit of £4.8 billion and underlying earnings per share of 78p, both up 6% on the prior year at constant currency, as highlighted by CEO John Pettigrew. The company has also committed to substantial growth, with around £60 billion of capital investment planned between now and 2029, nearly double the past five years, driving annual group asset growth of around 10%. Additionally, National Grid has delivered over 30 percentage points more total shareholder return than the FTSE 100 over the past decade, a testament to its strong shareholder returns. Regulatory support is another advantage, with enabling infrastructure for net zero at pace included as one of the five pillars in its recent strategy update. Furthermore, the company is considered good value based on its Price-To-Earnings Ratio of 22.6x compared to the peer average of 23.8x, while also trading below its estimated fair value of £12.59.

Weaknesses: Critical Issues Affecting National Grid's Performance and Areas For Growth

Despite its strengths, National Grid faces several weaknesses. The company is deemed expensive based on its Price-To-Earnings Ratio of 22.6x compared to the Global Integrated Utilities industry average of 16.7x. Additionally, the underlying operating profit was £1.15 billion, £78 million lower than the prior year, reflecting the shift from RIIO-ED1 to ED2, as noted by CFO Andrew Agg. Safety incidents have also overshadowed performance, with two tragic incidents resulting in the loss of colleagues. The company's earnings growth has been negative over the past year (-18.3%), making it difficult to compare to the Integrated Utilities industry average of 4.5%. Furthermore, National Grid's Return on Equity is forecast to be low at 9.9% in three years, and its current net profit margins of 11.2% are lower than last year's 12.5%.

Opportunities: Potential Strategies for Leveraging Growth and Competitive Advantage

National Grid has several opportunities to leverage for growth. Regulatory changes on both sides of the Atlantic are pushing for an accelerated transition to clean energy, which aligns with National Grid's strategic goals. The company has filed for $2 billion of ESMP funding in Massachusetts, an important milestone for investment over the next five years to help the state meet its clean energy goals. Market trends such as the acceleration of artificial intelligence and the increased load from data centers present additional growth opportunities. National Grid's revenue is forecast to grow at 6.7% per year, faster than the UK market's 3.7%, positioning the company to capitalize on emerging opportunities. Furthermore, the company's dividend yield of 5.72% is in the top 25% of dividend payers in the UK market, providing a competitive edge.

Threats: Key Risks and Challenges That Could Impact National Grid's Success

National Grid faces several threats that could impact its success. Regulatory risks are significant, with Ofgem's upcoming methodology decision document for RIIO-T3 forming the basis of future negotiations. Market challenges include the potential dilution from a rights issue, as acknowledged by CFO Andrew Agg, which could impact shareholder value. Economic factors such as higher interest rates feeding through the holdco debt book are expected to cause a slight drag on earnings. Additionally, the company's dividend payments are not well covered by earnings or free cash flows, with a high payout ratio of 97.5%. Insider selling over the past three months and shareholder dilution, with total shares outstanding growing by 32.5%, further exacerbate these challenges. Lastly, large one-off items, such as a £1.0 billion loss impacting the last 12 months of financial results, pose a threat to the company's financial stability.

Conclusion

National Grid's strong financial performance, highlighted by a significant underlying operating profit and earnings growth, positions it well for future success. The company's substantial capital investment plans and regulatory support for net zero initiatives further enhance its growth prospects. However, challenges such as high relative valuation compared to the Global Integrated Utilities industry, recent negative earnings growth, and safety incidents could impact its performance. Despite these weaknesses, National Grid's strategic alignment with clean energy trends and its competitive dividend yield offer substantial opportunities. The company is considered good value compared to peers but is deemed expensive relative to the industry average, while also trading below its estimated fair value, suggesting potential for future appreciation. Nonetheless, regulatory risks, economic factors, and shareholder dilution remain key threats that could affect its long-term stability and performance.

Seize The Opportunity

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if National Grid might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:NG.

National Grid

Engages in the transmission and distribution of electricity and gas.

Solid track record and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)