- United Kingdom

- /

- Other Utilities

- /

- LSE:NG.

Assessing National Grid After Its Strong Multi Year Share Price Run

Reviewed by Bailey Pemberton

- If you are wondering whether National Grid is still a solid value play after its strong multi year run, this piece will walk through the numbers so you can judge whether the current price still stacks up.

- Despite dipping around 1.0% over the last week and 1.5% over the last month, the stock is still up 18.2% year to date and 23.7% over the past year, with gains of 42.1% over 3 years and 82.2% over 5 years, which some investors may view as a sign of a long term re rating.

- Recent moves have come against a backdrop of ongoing UK energy transition spending, regulatory updates around grid investment, and periodic debate about political risk in regulated utilities. Together, these factors have helped shape sentiment on how reliable National Grid's future cash flows may be.

- On our framework, National Grid scores a 3 out of 6 valuation checks. This suggests the market may be paying fair to slightly rich prices for some metrics while overlooking value on others. Next, we will break down those methods before finishing with a more structured way to think about the company’s worth.

Find out why National Grid's 23.7% return over the last year is lagging behind its peers.

Approach 1: National Grid Dividend Discount Model (DDM) Analysis

The Dividend Discount Model estimates what a share is worth by projecting all future dividends, assuming a long term growth rate, and discounting them back to today's value. For National Grid, the model starts from a current dividend of about £0.50 per share and uses a payout ratio near 53%, which looks sustainable given a return on equity of around 8%.

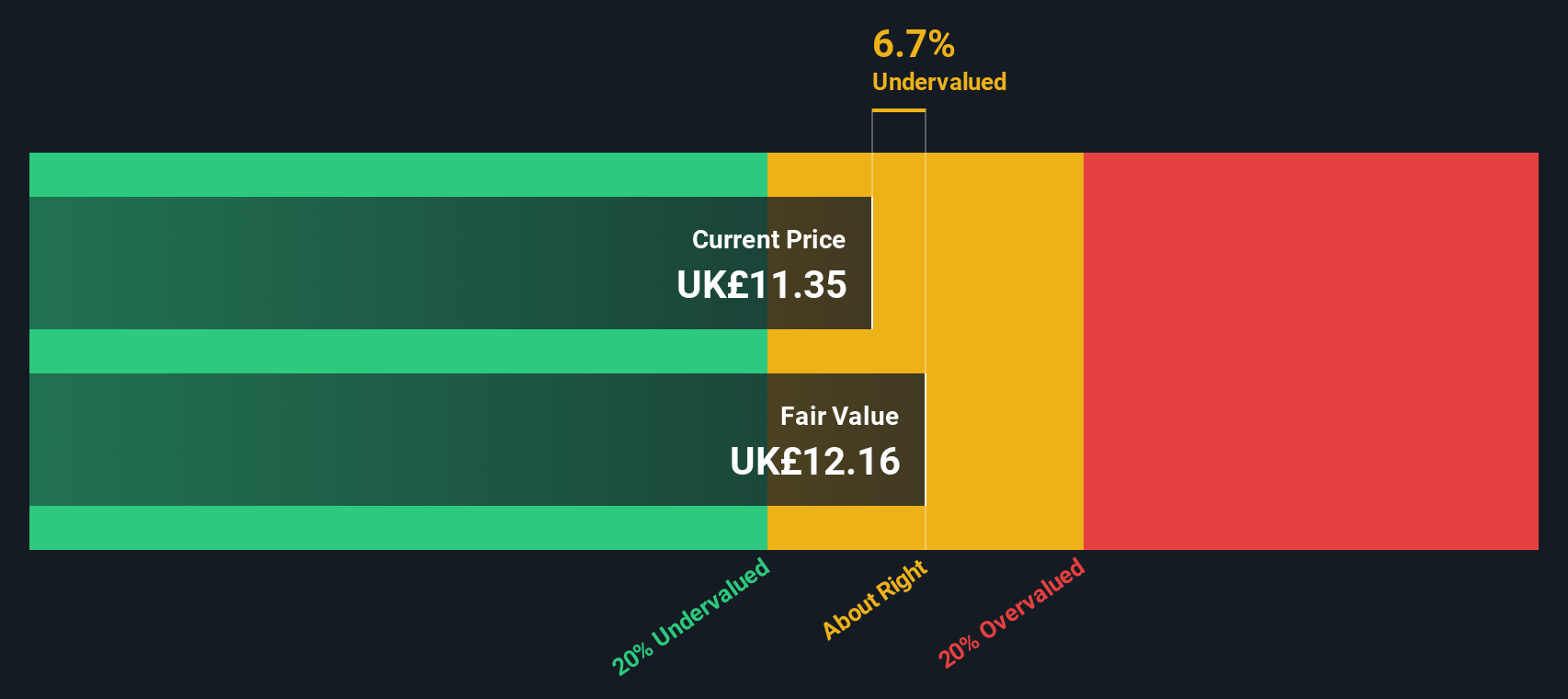

Simply Wall St caps the long run dividend growth rate at 2.99%, slightly below the model's raw 3.8% input, and assumes overall earnings can grow at just over 3.8% a year. On these assumptions, the DDM arrives at an intrinsic value of roughly £12.16 per share. The current market price implied by the model is about 6.7% lower. That places National Grid in the mildly undervalued camp rather than screamingly cheap.

In plain terms, the model suggests investors are being paid a fair, growing dividend stream with a small valuation cushion attached.

Result: ABOUT RIGHT

National Grid is fairly valued according to our Dividend Discount Model (DDM), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: National Grid Price vs Earnings

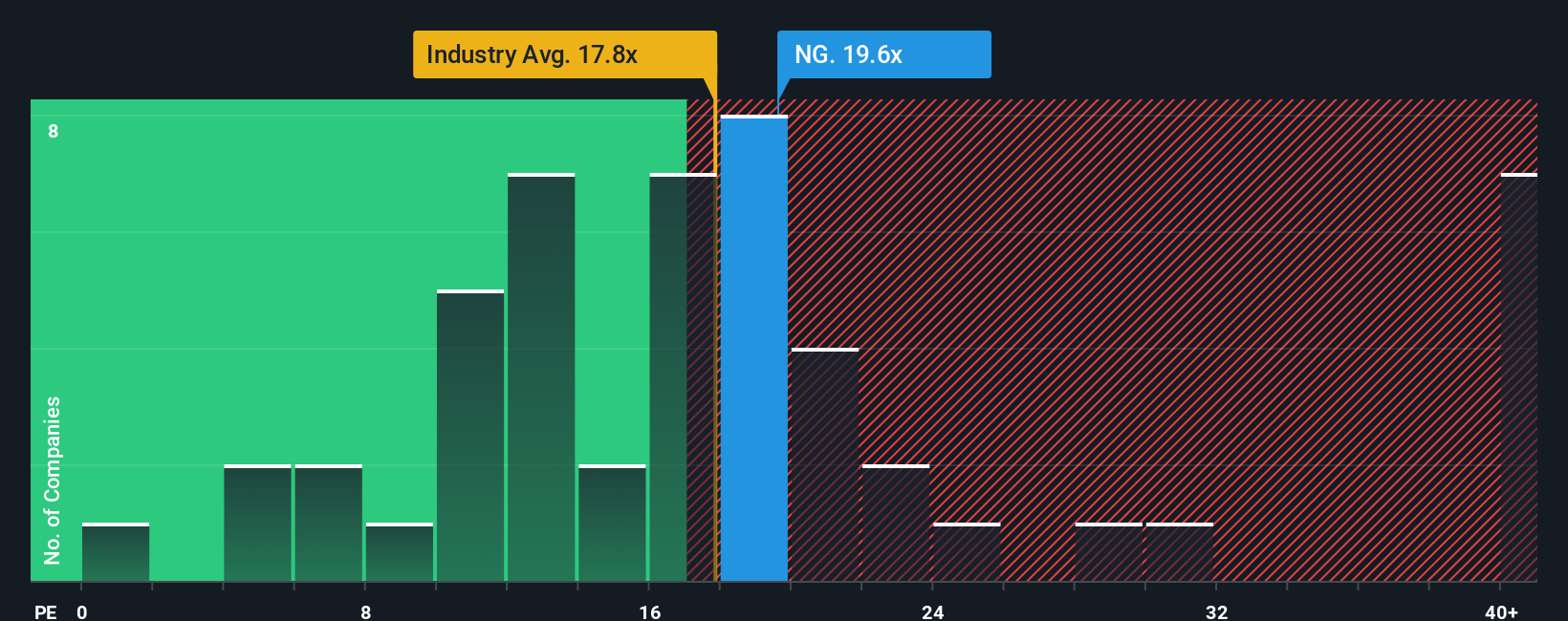

For a mature, profitable utility like National Grid, the price to earnings ratio is a practical yardstick because earnings are relatively stable and closely tied to its regulated asset base. In general, faster growth and lower perceived risk justify a higher PE, while slower growth or higher political and regulatory risk should pull a normal or fair PE lower.

National Grid currently trades on a PE of about 19.6x, slightly below the Integrated Utilities industry average of roughly 17.8x and just under the peer group average of around 20.6x. Simply Wall St's Fair Ratio for the stock comes in higher, at about 23.3x, which reflects what investors might reasonably pay once you factor in its earnings growth outlook, margins, size, sector and risk profile.

This Fair Ratio is more informative than a simple peer or industry comparison because it adjusts for National Grid's own fundamentals rather than assuming every utility deserves the same multiple. With the actual PE sitting meaningfully below the Fair Ratio, the multiple based view points to the shares being modestly undervalued rather than stretched.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

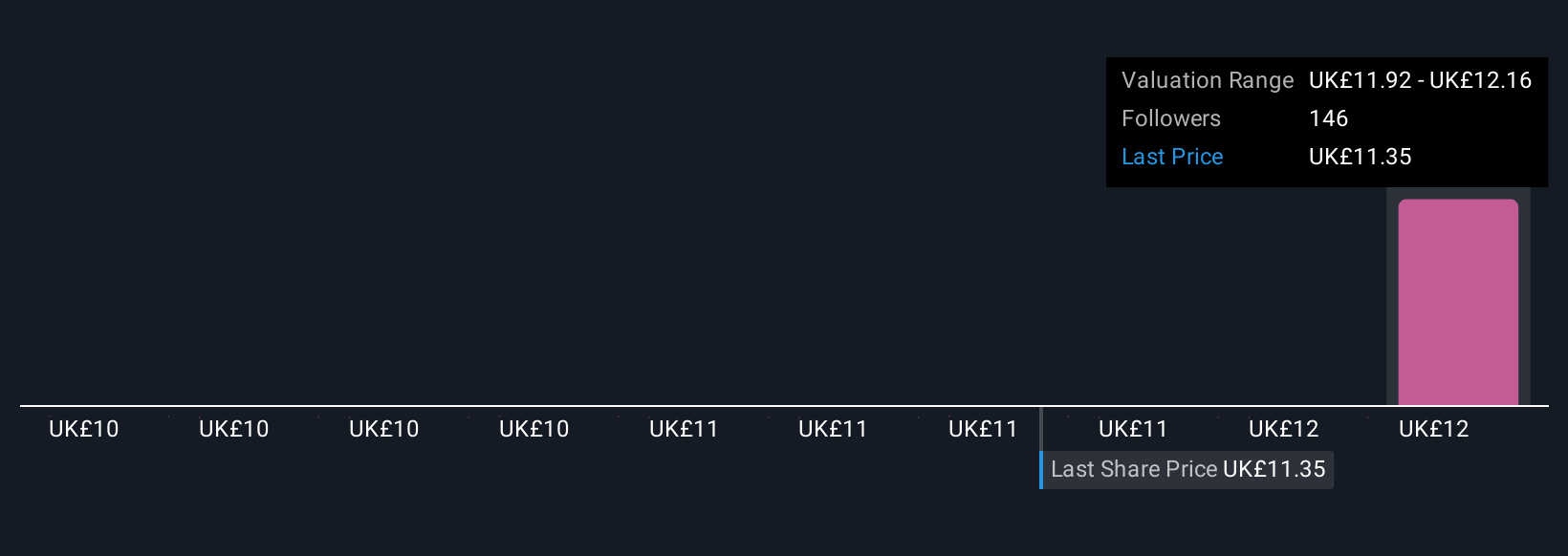

Upgrade Your Decision Making: Choose your National Grid Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way for you to attach a clear story about National Grid’s future revenues, earnings and margins to a financial forecast and, ultimately, a fair value estimate. A Narrative is your personal view of the company written into numbers, linking what you believe about grid investment, regulation and risks to a set of projected cash flows that can be directly compared with today’s share price. On Simply Wall St, Narratives live in the Community page used by millions of investors, where you can quickly see how others are thinking and build or adjust your own with just a few inputs. Once you have a Narrative, the platform continuously compares its Fair Value to the current Price, helping you consider whether National Grid might be a buy, hold or sell for your own strategy, and automatically refreshes that view when new results, news or regulatory updates arrive. For example, one investor might plug in higher revenue growth and improving margins and arrive at a fair value near £11.93, while a more cautious investor could assume slower growth and more pressure on returns and land closer to £10 per share, yet both viewpoints are made transparent and comparable through their Narratives.

Do you think there's more to the story for National Grid? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Grid might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:NG.

National Grid

Engages in the transmission and distribution of electricity and gas.

Solid track record and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026