- United Kingdom

- /

- Renewable Energy

- /

- LSE:GLO

We Think ContourGlobal plc's (LON:GLO) CEO Compensation Package Needs To Be Put Under A Microscope

The results at ContourGlobal plc (LON:GLO) have been quite disappointing recently and CEO Joe Brandt bears some responsibility for this. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 12 May 2021. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. From our analysis, we think CEO compensation may need a review in light of the recent performance.

Check out our latest analysis for ContourGlobal

How Does Total Compensation For Joe Brandt Compare With Other Companies In The Industry?

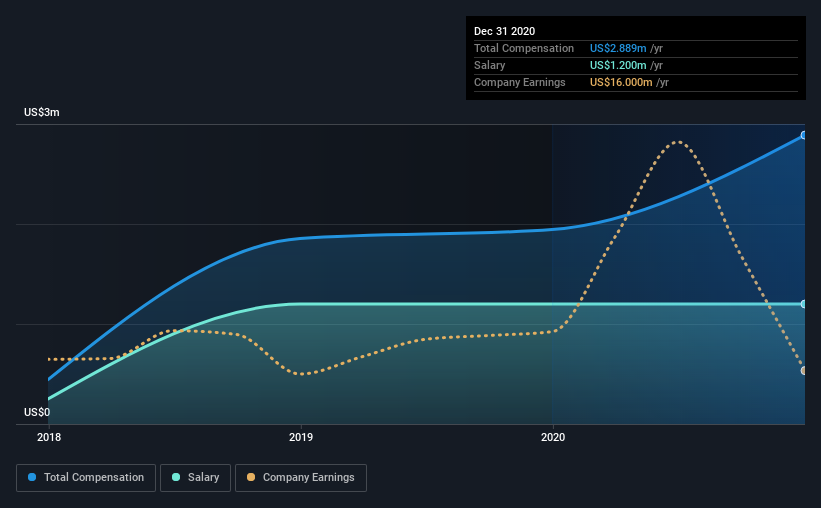

According to our data, ContourGlobal plc has a market capitalization of UK£1.3b, and paid its CEO total annual compensation worth US$2.9m over the year to December 2020. That's a notable increase of 49% on last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$1.2m.

On comparing similar companies from the same industry with market caps ranging from UK£721m to UK£2.3b, we found that the median CEO total compensation was US$1.6m. This suggests that Joe Brandt is paid more than the median for the industry. Furthermore, Joe Brandt directly owns UK£3.7m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$1.2m | US$1.2m | 42% |

| Other | US$1.7m | US$744k | 58% |

| Total Compensation | US$2.9m | US$1.9m | 100% |

Talking in terms of the industry, salary represented approximately 77% of total compensation out of all the companies we analyzed, while other remuneration made up 23% of the pie. In ContourGlobal's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

ContourGlobal plc's Growth

Over the last three years, ContourGlobal plc has shrunk its earnings per share by 8.7% per year. It achieved revenue growth of 6.0% over the last year.

Few shareholders would be pleased to read that EPS have declined. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has ContourGlobal plc Been A Good Investment?

Given the total shareholder loss of 6.9% over three years, many shareholders in ContourGlobal plc are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 4 warning signs for ContourGlobal (of which 2 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Important note: ContourGlobal is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading ContourGlobal or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:GLO

ContourGlobal

ContourGlobal plc engages in the wholesale power generation businesses in Europe, Latin America, the United States, and Africa.

Good value with mediocre balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion