- United Kingdom

- /

- Renewable Energy

- /

- LSE:GLO

These 4 Measures Indicate That ContourGlobal (LON:GLO) Is Using Debt Extensively

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies ContourGlobal plc (LON:GLO) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for ContourGlobal

What Is ContourGlobal's Debt?

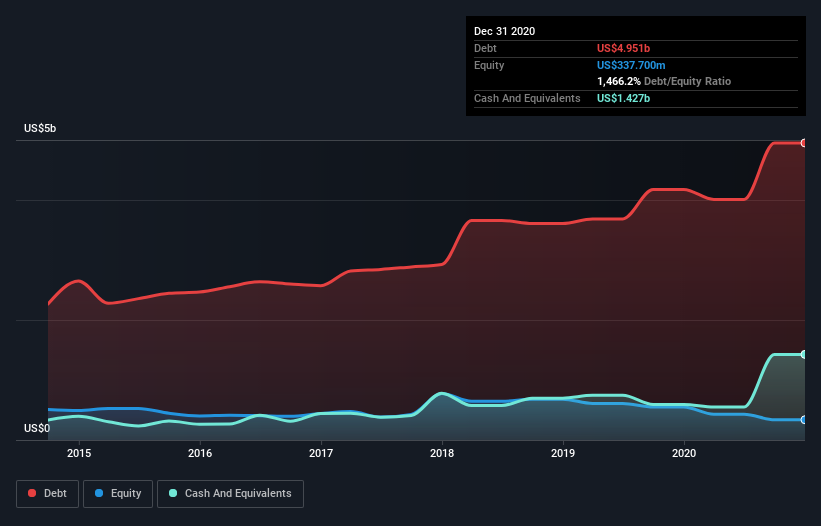

As you can see below, at the end of December 2020, ContourGlobal had US$4.95b of debt, up from US$4.18b a year ago. Click the image for more detail. However, it does have US$1.43b in cash offsetting this, leading to net debt of about US$3.52b.

How Strong Is ContourGlobal's Balance Sheet?

We can see from the most recent balance sheet that ContourGlobal had liabilities of US$1.54b falling due within a year, and liabilities of US$4.49b due beyond that. On the other hand, it had cash of US$1.43b and US$285.3m worth of receivables due within a year. So its liabilities total US$4.32b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the US$1.81b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, ContourGlobal would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

ContourGlobal shareholders face the double whammy of a high net debt to EBITDA ratio (5.6), and fairly weak interest coverage, since EBIT is just 1.6 times the interest expense. The debt burden here is substantial. The good news is that ContourGlobal improved its EBIT by 5.6% over the last twelve months, thus gradually reducing its debt levels relative to its earnings. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if ContourGlobal can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Happily for any shareholders, ContourGlobal actually produced more free cash flow than EBIT over the last three years. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

To be frank both ContourGlobal's interest cover and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. But on the bright side, its conversion of EBIT to free cash flow is a good sign, and makes us more optimistic. Overall, we think it's fair to say that ContourGlobal has enough debt that there are some real risks around the balance sheet. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 4 warning signs for ContourGlobal you should be aware of, and 2 of them are potentially serious.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade ContourGlobal, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:GLO

ContourGlobal

ContourGlobal plc engages in the wholesale power generation businesses in Europe, Latin America, the United States, and Africa.

Good value with mediocre balance sheet.

Market Insights

Community Narratives