- United Kingdom

- /

- Renewable Energy

- /

- LSE:DRX

Time To Worry? Analysts Just Downgraded Their Drax Group plc (LON:DRX) Outlook

The latest analyst coverage could presage a bad day for Drax Group plc (LON:DRX), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

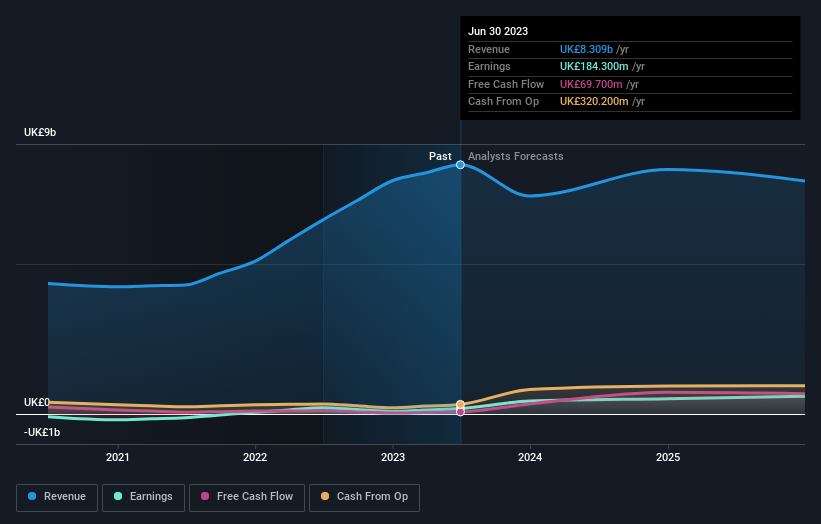

Following the latest downgrade, the seven analysts covering Drax Group provided consensus estimates of UK£7.3b revenue in 2023, which would reflect a not inconsiderable 13% decline on its sales over the past 12 months. Statutory earnings per share are presumed to soar 127% to UK£1.07. Before this latest update, the analysts had been forecasting revenues of UK£8.3b and earnings per share (EPS) of UK£1.13 in 2023. It looks like analyst sentiment has fallen somewhat in this update, with a measurable cut to revenue estimates and a small dip in earnings per share numbers as well.

Check out our latest analysis for Drax Group

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 23% by the end of 2023. This indicates a significant reduction from annual growth of 15% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue decline 9.0% annually for the foreseeable future. The forecasts do look bearish for Drax Group, since they're expecting it to shrink faster than the industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Unfortunately they also cut their revenue estimates for this year, and they expect sales to lag the wider market. That said, earnings per share are more important for creating value for shareholders. Given the stark change in sentiment, we'd understand if investors became more cautious on Drax Group after today.

A high debt burden combined with a downgrade of this magnitude always gives us some reason for concern, especially if these forecasts are just the first sign of a business downturn. See why we're concerned about Drax Group's balance sheet by visiting our risks dashboard for free on our platform here.

We also provide an overview of the Drax Group Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:DRX

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion