- United Kingdom

- /

- Electrical

- /

- AIM:VLX

Elixirr International And 2 Other Promising UK Small Caps To Watch

Reviewed by Simply Wall St

The United Kingdom market has experienced a flat performance over the last week, yet it has shown a notable 7.5% increase over the past year with earnings anticipated to grow by 14% annually in the coming years. In such an environment, identifying promising small-cap stocks like Elixirr International can offer unique opportunities for investors seeking growth potential and innovation.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| Metals Exploration | NA | 12.92% | 73.62% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Elixirr International (AIM:ELIX)

Simply Wall St Value Rating: ★★★★★★

Overview: Elixirr International plc, with a market cap of £323.46 million, offers management consultancy services through its subsidiaries in the United Kingdom, the United States, and internationally.

Operations: Elixirr generates revenue primarily from management consulting services, amounting to £97.37 million. The company's financial performance includes a focus on optimizing its cost structure to enhance profitability.

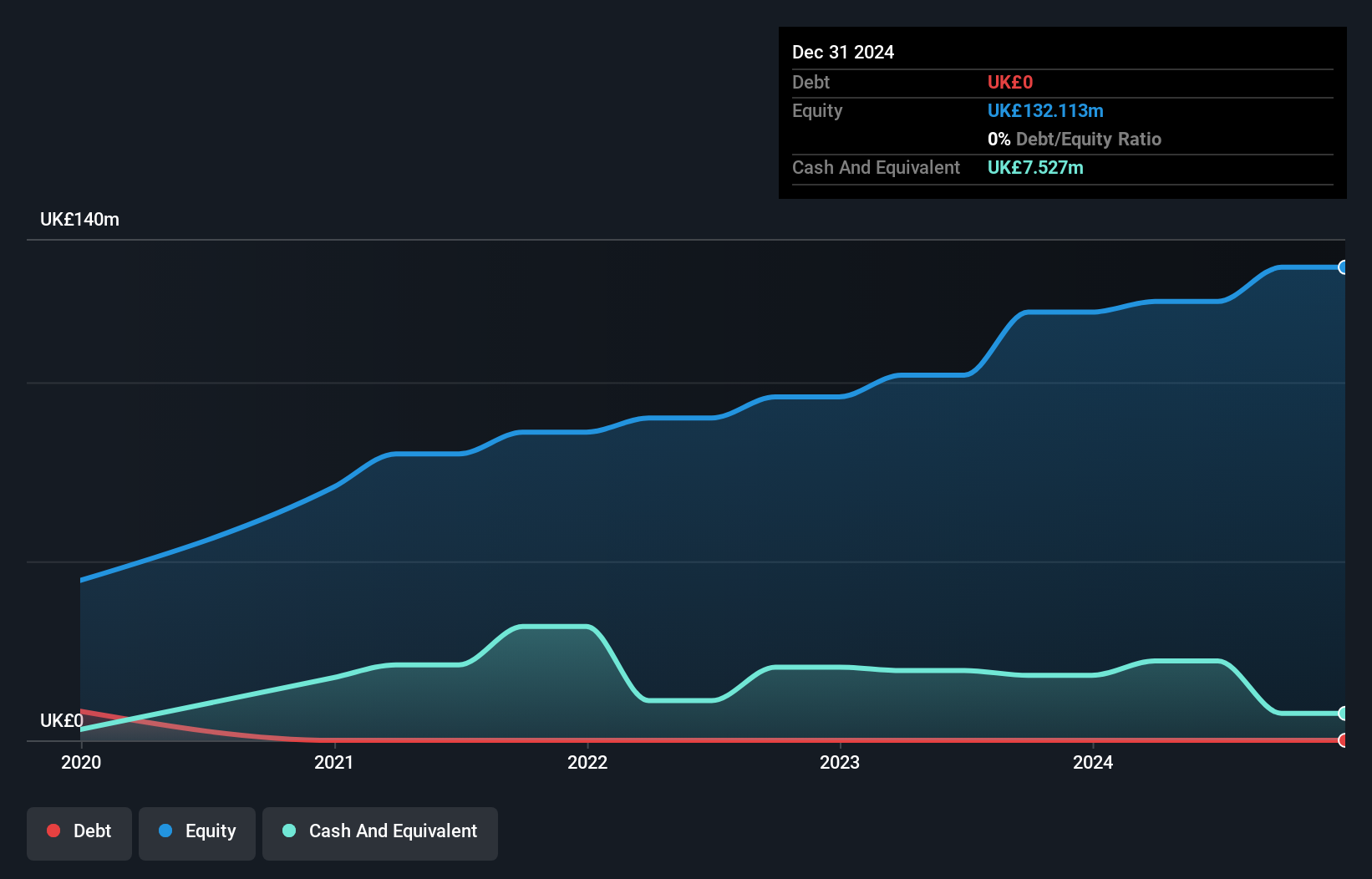

Elixirr, a nimble player in the professional services sector, has seen earnings leap 32.8% over the past year, outpacing industry trends. The company reported half-year sales of £53.03 million and net income of £8.84 million, showcasing robust growth compared to previous figures. With no debt on its books and trading at 55.5% below estimated fair value, Elixirr offers promising potential for investors seeking undervalued opportunities in the market.

Volex (AIM:VLX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Volex plc manufactures and sells power and data cables across North America, Europe, and Asia, with a market cap of £582.79 million.

Operations: Volex generates revenue primarily from North America ($372.30 million), Europe ($355.40 million), and Asia ($185.10 million).

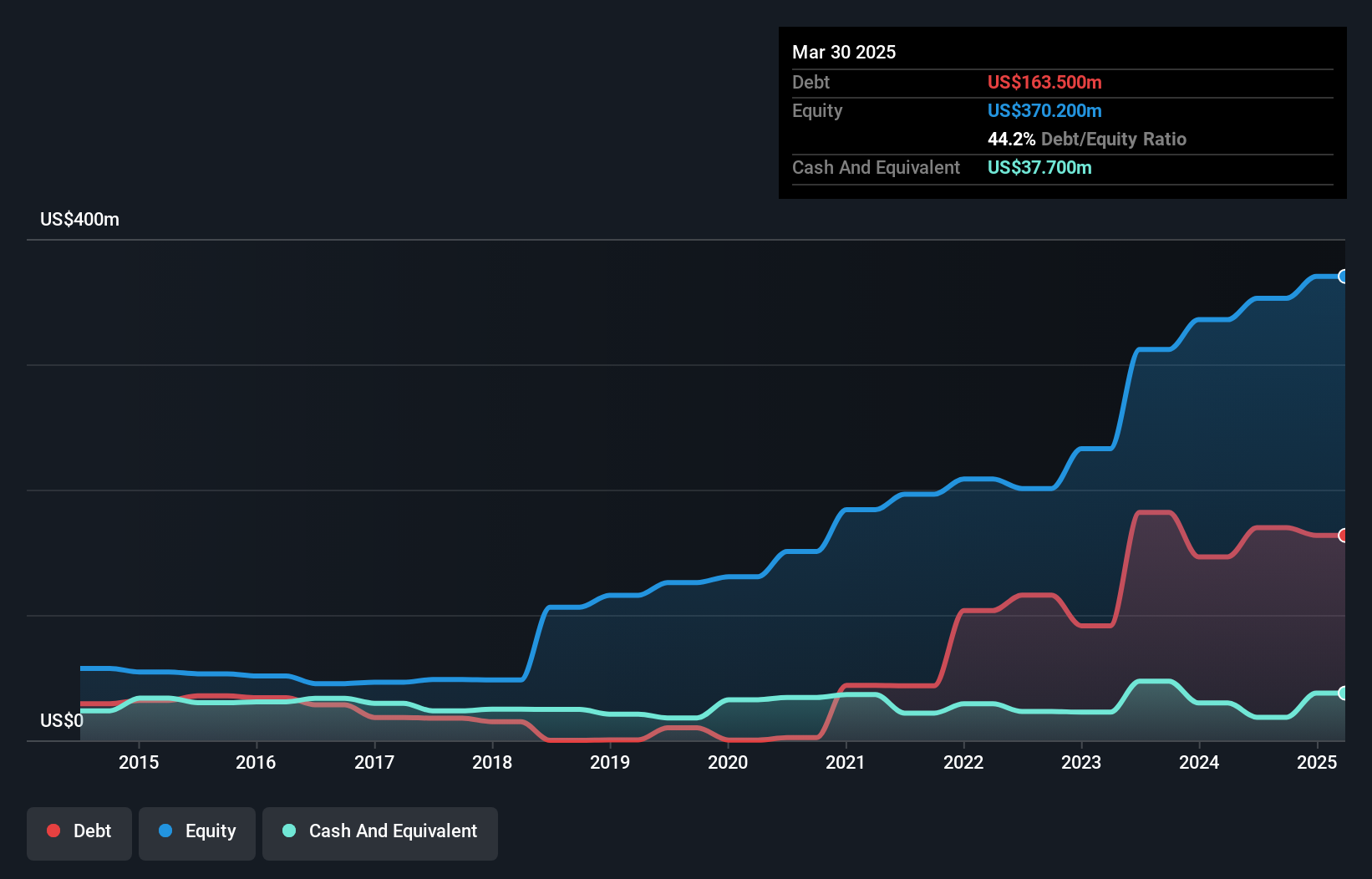

Volex, a nimble player in the electrical sector, has demonstrated robust financial health with a net debt to equity ratio of 34.7%, deemed satisfactory. The company's interest payments are well covered by EBIT at 4.7 times, showcasing solid earnings quality. Over the past year, Volex's earnings grew by 7%, outpacing industry growth of 1.6%. Despite shareholder dilution recently, Volex remains profitable with positive free cash flow and is forecasting revenue growth at nearly 9% annually.

- Click to explore a detailed breakdown of our findings in Volex's health report.

Explore historical data to track Volex's performance over time in our Past section.

Yü Group (AIM:YU.)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yü Group PLC, with a market cap of £268.55 million, supplies energy and utility solutions primarily in the United Kingdom through its subsidiaries.

Operations: Yü Group generates revenue from supplying energy and utility solutions in the UK. The company's financial performance is highlighted by its net profit margin, which has shown fluctuations over recent periods.

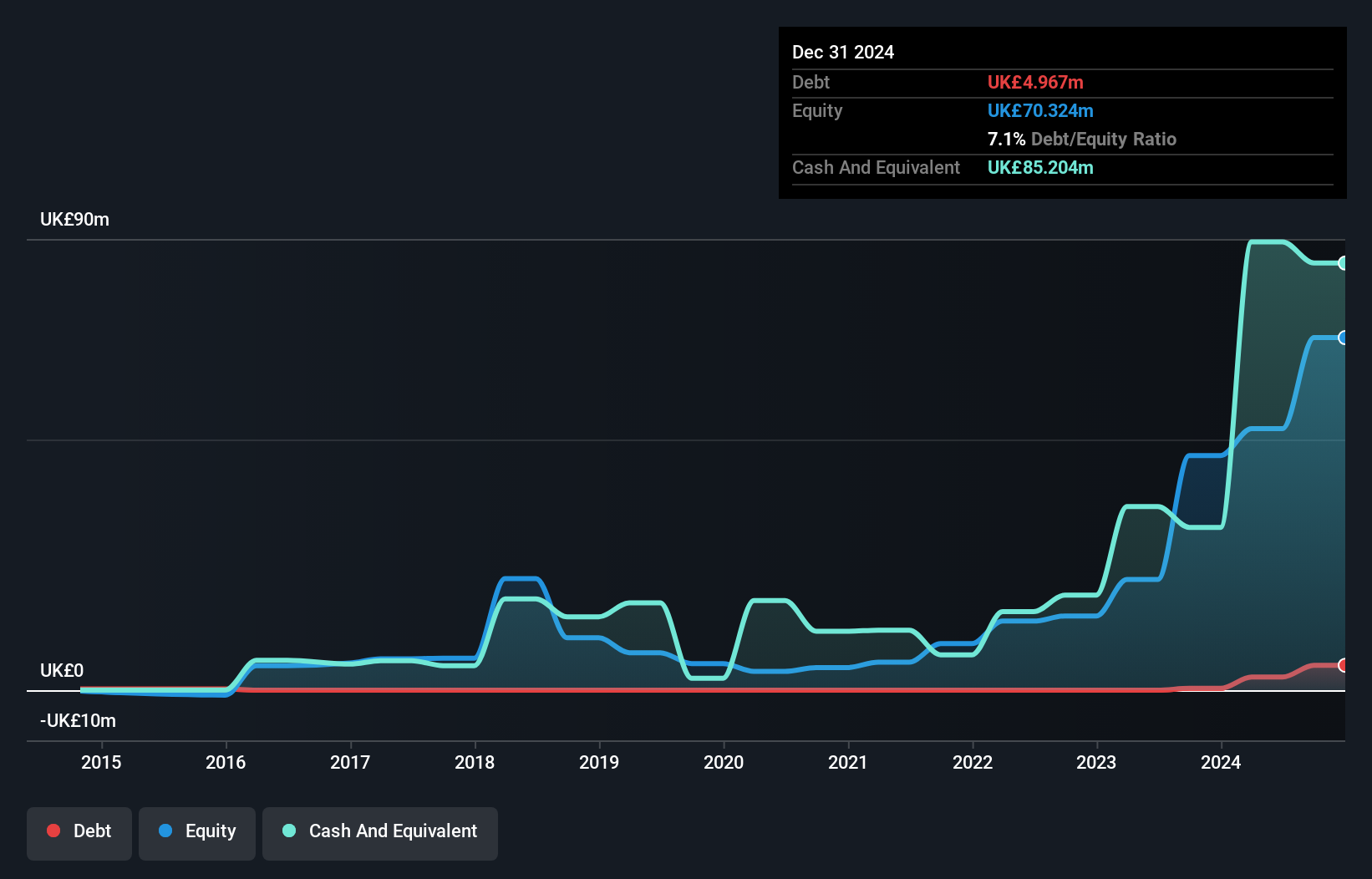

Yü Group, a smaller player in the energy sector, has shown impressive growth with earnings surging by 400% over the past year, outpacing the industry average. Trading at 63.6% below its estimated fair value, it offers good relative value compared to peers. The firm reported half-year sales of £312.68 million and net income of £14.69 million, both significantly up from last year. Recently, Yü repurchased shares worth £3.99 million, enhancing shareholder value amidst a volatile share price environment.

Summing It All Up

- Access the full spectrum of 82 UK Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:VLX

Volex

Manufactures and sells power and connectivity in North America, Europe, and Asia.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion