- United Kingdom

- /

- Communications

- /

- AIM:FTC

3 Undiscovered Gems In The UK Market To Consider For Your Portfolio

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 and FTSE 250 indices react to global economic challenges, particularly the sluggish recovery in China, investors are keenly observing how these developments might affect market dynamics. In such an environment, identifying stocks with strong fundamentals and growth potential becomes crucial for building a resilient portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 38.21% | 41.39% | ★★★★★★ |

| BioPharma Credit | NA | 7.22% | 7.91% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -7.87% | -8.41% | ★★★★★★ |

| Bioventix | NA | 7.39% | 5.15% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.08% | 5.03% | ★★★★★★ |

| Nationwide Building Society | 277.32% | 10.61% | 23.42% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| FW Thorpe | 2.95% | 11.79% | 13.49% | ★★★★★☆ |

| AltynGold | 73.21% | 26.90% | 31.85% | ★★★★☆☆ |

| Law Debenture | 17.80% | 11.81% | 7.59% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Filtronic (AIM:FTC)

Simply Wall St Value Rating: ★★★★★★

Overview: Filtronic plc is a company that designs, develops, manufactures, and sells radio frequency (RF) technology across the United Kingdom, Europe, the Americas, and other international markets with a market cap of £367.92 million.

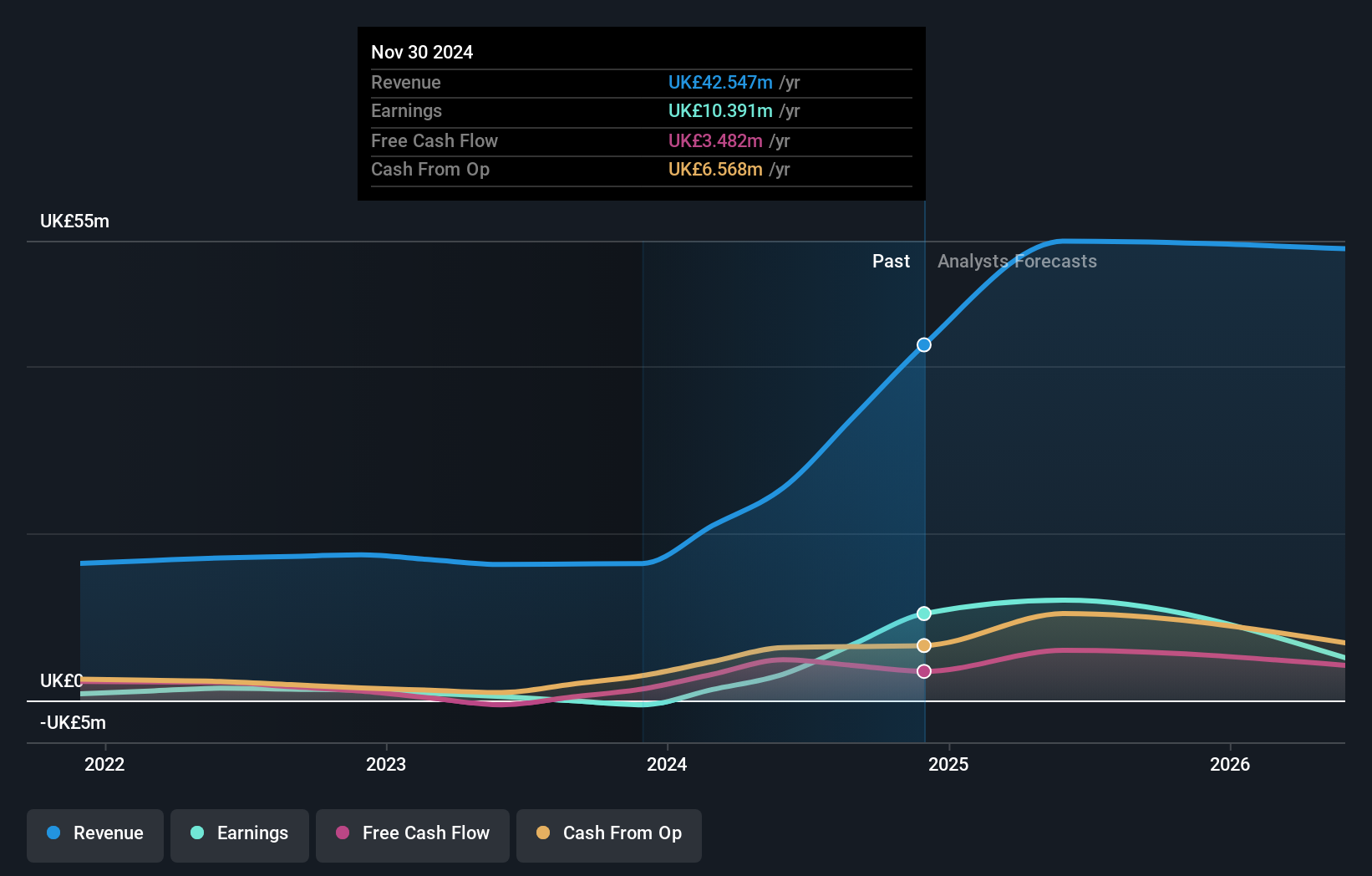

Operations: Revenue from wireless communications equipment stands at £42.55 million.

Filtronic, a nimble player in the UK tech space, has shown remarkable financial strides. With no debt now compared to a 12% debt-to-equity ratio five years ago, it's clear Filtronic's balance sheet is solid. The company turned profitable this year and forecasts revenue growth of 12.27% annually. Recent contract wins with SpaceX and Airbus highlight its strategic industry partnerships, while the award of a $32.5 million order from SpaceX underscores its market-leading position in E-band technology. Despite high volatility in share price over the past three months, these developments suggest promising prospects for Filtronic's future trajectory.

- Dive into the specifics of Filtronic here with our thorough health report.

Evaluate Filtronic's historical performance by accessing our past performance report.

Yü Group (AIM:YU.)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yü Group PLC, with a market cap of £292.98 million, operates through its subsidiaries to supply energy and utility solutions primarily in the United Kingdom.

Operations: The company's primary revenue streams include Retail (£645.26 million) and Smart (£12.73 million), with a minor contribution from Metering Assets (£0.66 million). Intra-segment Trading reflects a negative impact of £13.20 million on overall revenue.

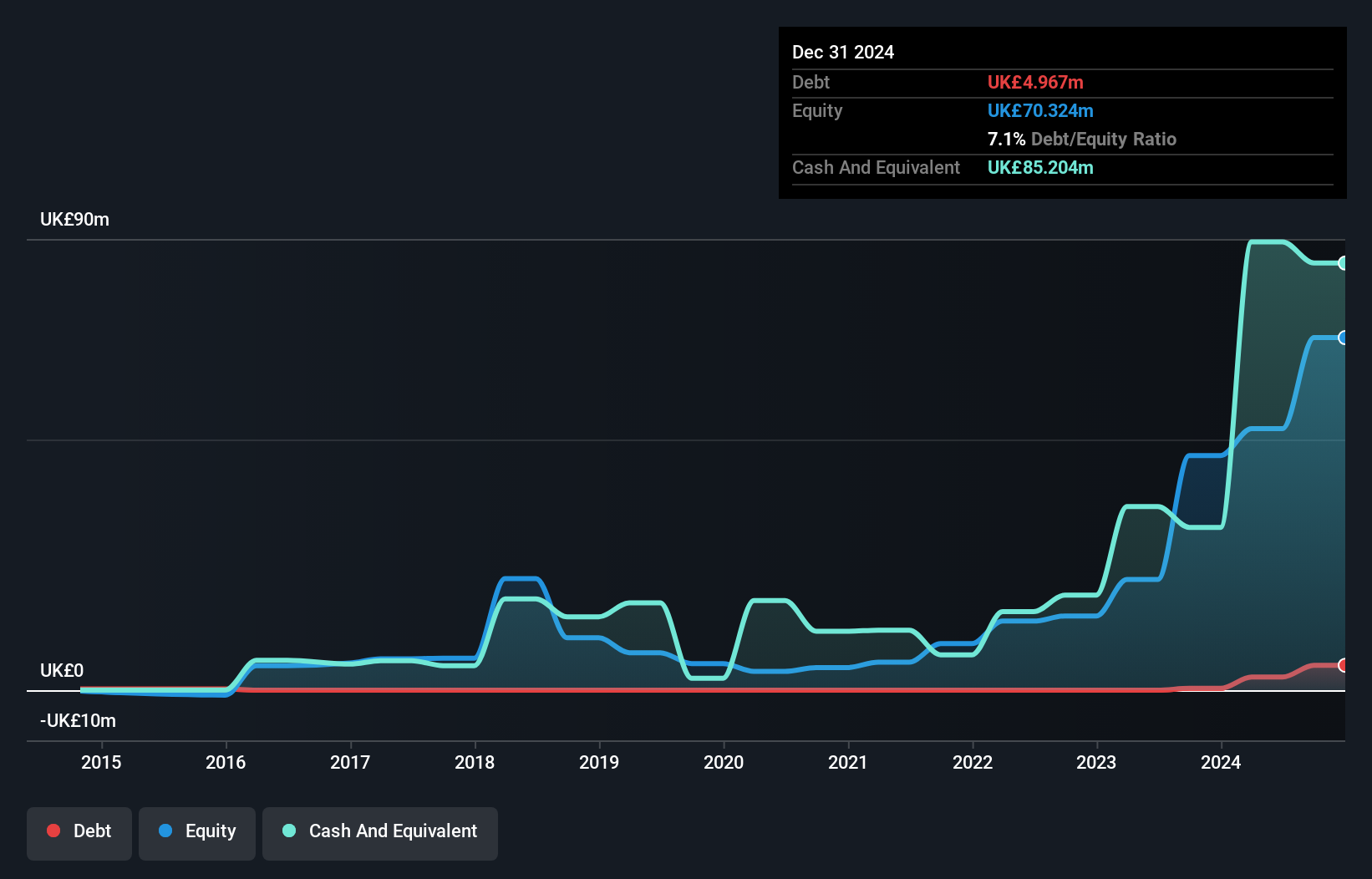

Yü Group, a small player in the UK market, stands out with its impressive financial health and growth trajectory. Over the last year, earnings grew by 8.6%, surpassing the Renewable Energy sector's -6.2% performance. The company is trading at a compelling 31% below its estimated fair value, suggesting potential upside compared to industry peers. Despite an increase in debt to equity from 0% to 7.1% over five years, Yü maintains more cash than total debt and has high-quality earnings that cover interest payments comfortably. With forecasted annual earnings growth of 7.55%, Yü seems poised for continued success in its niche market space.

- Take a closer look at Yü Group's potential here in our health report.

Review our historical performance report to gain insights into Yü Group's's past performance.

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cairn Homes plc is a homebuilder operating in Ireland with a market capitalization of £1.18 billion.

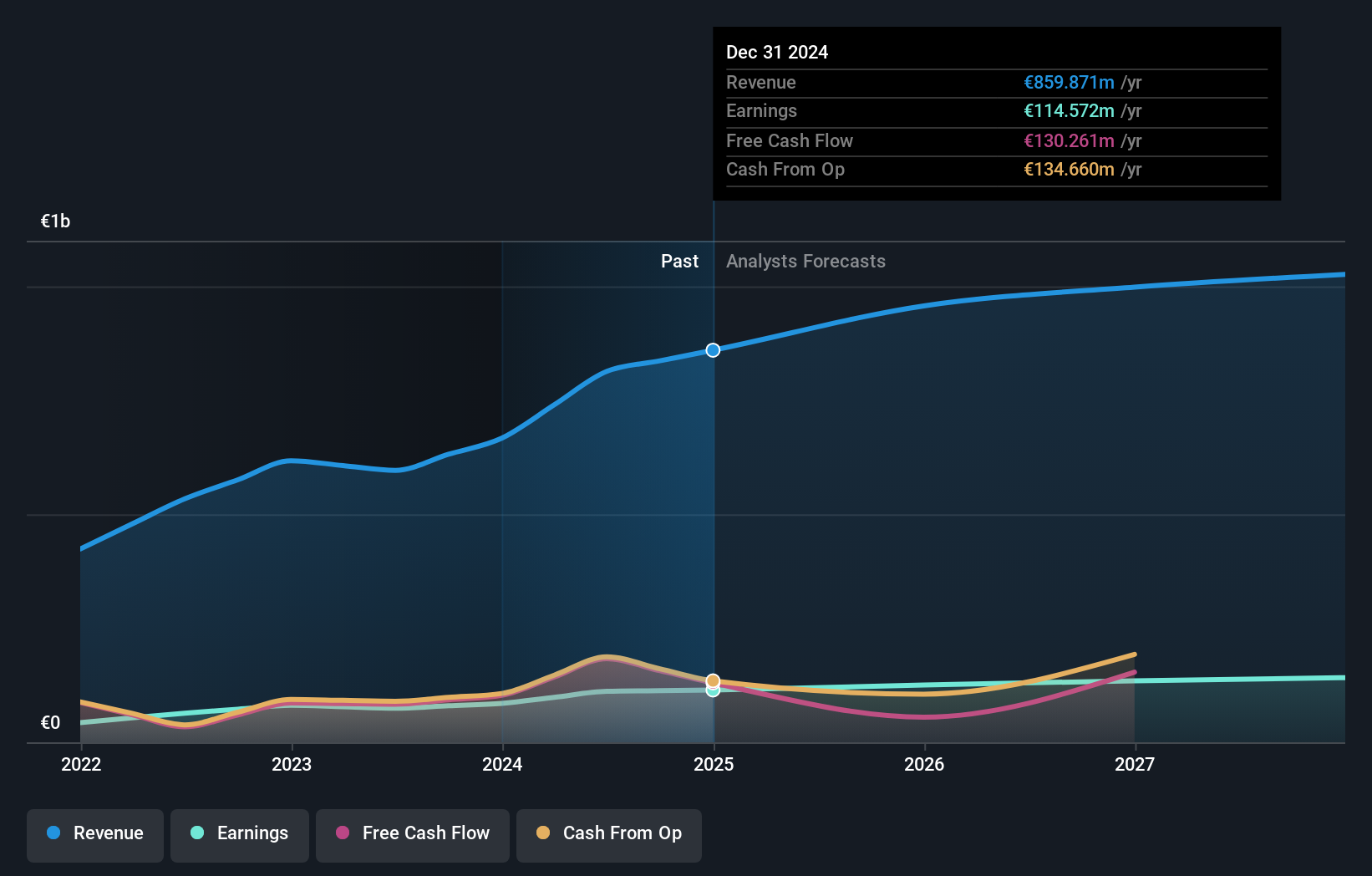

Operations: Cairn Homes generates revenue primarily from building and property development, amounting to €859.87 million. The company's financial performance can be assessed by examining its net profit margin, which reflects the efficiency of converting revenue into actual profit after all expenses are deducted.

Cairn Homes, an Irish homebuilder, is capitalizing on its strategic land acquisitions and efficient construction practices to boost profitability. With a solid order book close to €1 billion, the company is well-positioned for future revenue growth. Government initiatives like Help to Buy and green mortgage incentives are likely to sustain demand for energy-efficient homes. However, financial challenges such as market volatility and high leverage could pose risks. Analysts forecast a 6.2% annual revenue increase over three years with earnings projected at €137 million by May 2028. The stock's price target ranges from £1.77 to £2.23 per share, highlighting potential investment opportunities amidst uncertainties.

Next Steps

- Reveal the 59 hidden gems among our UK Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FTC

Filtronic

Designs, develops, manufactures, and sells radio frequency (RF) technology in the United Kingdom, Europe, the Americas, and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives