- United Kingdom

- /

- Electric Utilities

- /

- AIM:OPG

Some OPG Power Ventures (LON:OPG) Shareholders Have Taken A Painful 80% Share Price Drop

OPG Power Ventures Plc (LON:OPG) shareholders should be happy to see the share price up 18% in the last quarter. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. Indeed, the share price is down a whopping 80% in that time. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The fundamental business performance will ultimately determine if the turnaround can be sustained.

Check out our latest analysis for OPG Power Ventures

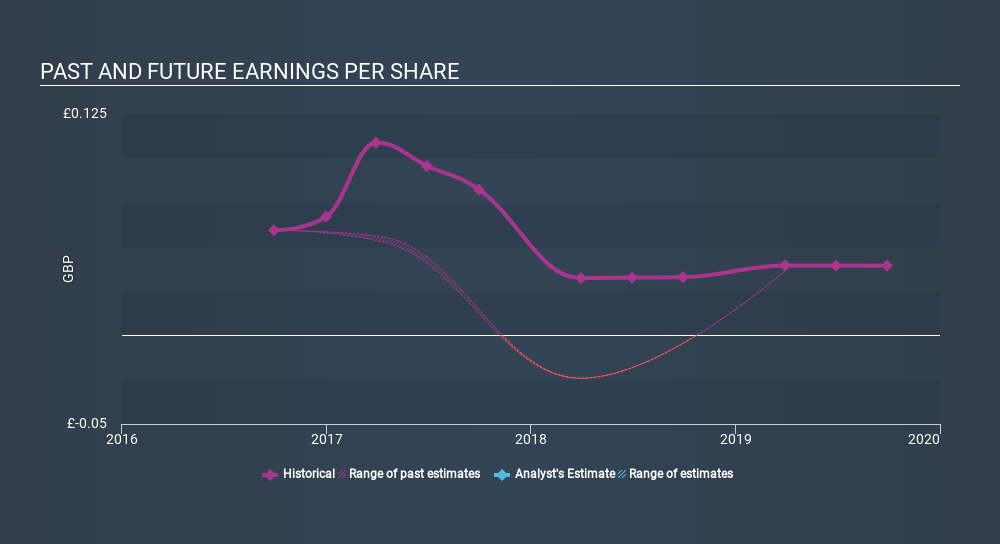

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Looking back five years, both OPG Power Ventures's share price and EPS declined; the latter at a rate of 1.7% per year. Readers should note that the share price has fallen faster than the EPS, at a rate of 28% per year, over the period. This implies that the market was previously too optimistic about the stock. The less favorable sentiment is reflected in its current P/E ratio of 4.38.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We know that OPG Power Ventures has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

A Different Perspective

OPG Power Ventures shareholders are down 25% for the year, but the market itself is up 12%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 27% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Be aware that OPG Power Ventures is showing 3 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About AIM:OPG

OPG Power Ventures

Develops, owns, operates, and maintains private sector power projects in India.

Flawless balance sheet and good value.

Market Insights

Community Narratives