- United Kingdom

- /

- Transportation

- /

- LSE:ZIG

Zigup (LSE:ZIG) Strengthens Position with Dividend Increase and CFO Transition Plan

Reviewed by Simply Wall St

Zigup (LSE:ZIG) is navigating a period of transition and opportunity, highlighted by the recent resignation of CFO Philip Vincent, who will ensure a smooth transition before departing early next year. Internal challenges such as projected earnings decline and operational inefficiencies are present, yet Zigup's strong revenue growth and high dividend yield reflect its financial health. As the company prepares to release its interim results in December, readers should anticipate insights into strategic initiatives and potential growth avenues amidst regulatory and economic challenges.

Get an in-depth perspective on Zigup's performance by reading our analysis here.

Key Assets Propelling Zigup Forward

With a forecasted revenue growth of 4.3% annually, Zigup Plc is outpacing the UK market's 3.6% growth rate. This indicates strong financial health, bolstered by a high-quality earnings record. The company also boasts a dividend yield of 7.26%, placing it among the top 25% of UK dividend payers. The experienced management team, with an average tenure of 3.8 years, drives strategic initiatives effectively. Notably, Zigup's SWS fair ratio of 6.3x is significantly lower than the industry average of 16.1x, suggesting potential undervaluation and a strong market position.

To dive deeper into how Zigup's valuation metrics are shaping its market position, check out our detailed analysis of Zigup's Valuation.Internal Limitations Hindering Zigup's Growth

Zigup faces challenges with a projected earnings decline of 5.7% annually over the next three years. The Return on Equity is expected to drop from 12% to 9.1%, reflecting financial strain. Additionally, net profit margins have reduced from 9.3% to 6.8%, and the dividend history has been volatile. Operational inefficiencies, particularly in the supply chain, pose further risks to sustained growth.

Learn about Zigup's dividend strategy and how it impacts shareholder returns and financial stability.Growth Avenues Awaiting Zigup

Analysts predict a potential 29.9% rise in Zigup's stock price, highlighting growth opportunities. The company's focus on product innovation, as evidenced by new product lines, positions it well to capture emerging market segments. Strategic alliances and product-related announcements could further enhance its competitive edge and market share.

To gain deeper insights into Zigup's historical performance, explore our detailed analysis of past performance.Regulatory Challenges Facing Zigup

External threats include economic headwinds and high debt levels, with a net debt to equity ratio of 55.4%. Supply chain disruptions and potential regulatory changes also threaten operational stability. The resignation of Philip Vincent, CFO, underscores the need for strategic leadership to navigate these challenges effectively.

Explore the current health of Zigup and how it reflects on its financial stability and growth potential.Conclusion

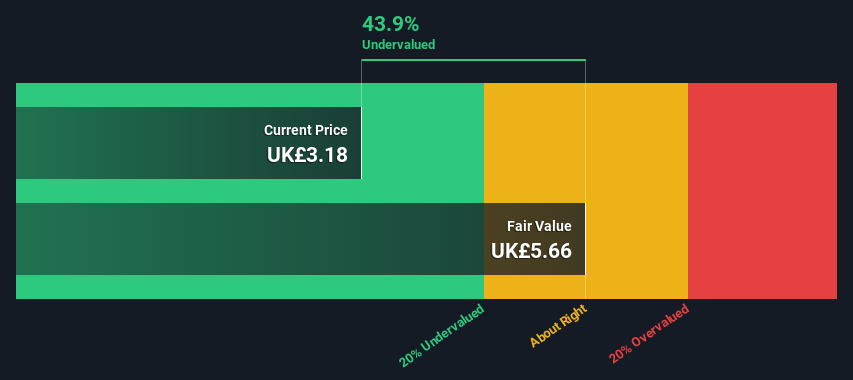

Zigup Plc is well-positioned for future growth, evidenced by its forecasted revenue increase of 4.3% annually, surpassing the UK market's rate. This growth trajectory, coupled with a strong dividend yield of 7.26%, highlights its financial health and attractiveness to investors. Internal challenges such as projected earnings decline and supply chain inefficiencies remain, yet Zigup's focus on product innovation and strategic alliances presents significant opportunities for market expansion. The company's Price-To-Earnings ratio of 6.3x, lower than both industry and peer averages, indicates it is a compelling investment opportunity with potential for stock price appreciation. However, navigating external threats, including economic headwinds and regulatory changes, will require strategic leadership, especially following the CFO's resignation, to maintain and enhance its competitive position.

Where To Now?

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Zigup might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:ZIG

Zigup

Engages in the provision of mobility solutions and automotive services to business and personal customers in the United Kingdom, Spain, and Ireland.

Very undervalued average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026