Readers hoping to buy Royal Mail plc (LON:RMG) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. In other words, investors can purchase Royal Mail's shares before the 29th of July in order to be eligible for the dividend, which will be paid on the 6th of September.

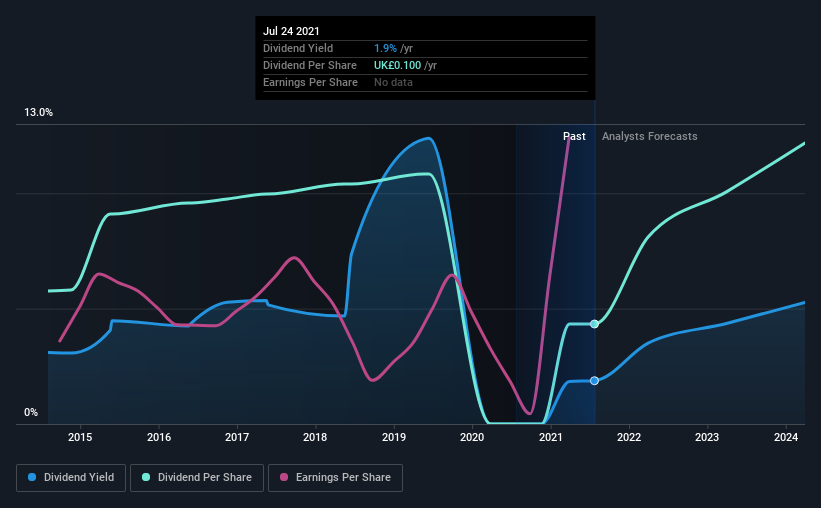

The company's next dividend payment will be UK£0.10 per share, on the back of last year when the company paid a total of UK£0.10 to shareholders. Looking at the last 12 months of distributions, Royal Mail has a trailing yield of approximately 1.9% on its current stock price of £5.332. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether Royal Mail can afford its dividend, and if the dividend could grow.

View our latest analysis for Royal Mail

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Royal Mail is paying out just 16% of its profit after tax, which is comfortably low and leaves plenty of breathing room in the case of adverse events.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If earnings fall far enough, the company could be forced to cut its dividend. It's encouraging to see Royal Mail has grown its earnings rapidly, up 24% a year for the past five years. Royal Mail looks like a real growth company, with earnings per share growing at a cracking pace and the company reinvesting most of its profits in the business.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Royal Mail's dividend payments per share have declined at 4.0% per year on average over the past seven years, which is uninspiring. Royal Mail is a rare case where dividends have been decreasing at the same time as earnings per share have been improving. It's unusual to see, and could point to unstable conditions in the core business, or more rarely an intensified focus on reinvesting profits.

To Sum It Up

Has Royal Mail got what it takes to maintain its dividend payments? Typically, companies that are growing rapidly and paying out a low fraction of earnings are keeping the profits for reinvestment in the business. This strategy can add significant value to shareholders over the long term - as long as it's done without issuing too many new shares. Royal Mail ticks a lot of boxes for us from a dividend perspective, and we think these characteristics should mark the company as deserving of further attention.

In light of that, while Royal Mail has an appealing dividend, it's worth knowing the risks involved with this stock. In terms of investment risks, we've identified 2 warning signs with Royal Mail and understanding them should be part of your investment process.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Royal Mail, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:IDS

International Distribution Services

Operates as a universal postal service provider in the United Kingdom and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives