- United Kingdom

- /

- Oil and Gas

- /

- AIM:YCA

Undiscovered Gems in the United Kingdom to Watch This October 2024

Reviewed by Simply Wall St

The United Kingdom market has shown a positive trend, climbing 1.1% in the last week and rising 12% over the past year, with earnings expected to grow by 14% annually. In this dynamic environment, identifying stocks that are not only poised for growth but also offer unique value propositions can be key to uncovering potential investment opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 24.01% | 24.81% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

Yellow Cake (AIM:YCA)

Simply Wall St Value Rating: ★★★★★★

Overview: Yellow Cake plc operates in the uranium sector with a market capitalization of approximately £1.29 billion.

Operations: Yellow Cake generates revenue primarily from its holdings of U3O8 for long-term capital appreciation, amounting to $735.02 million.

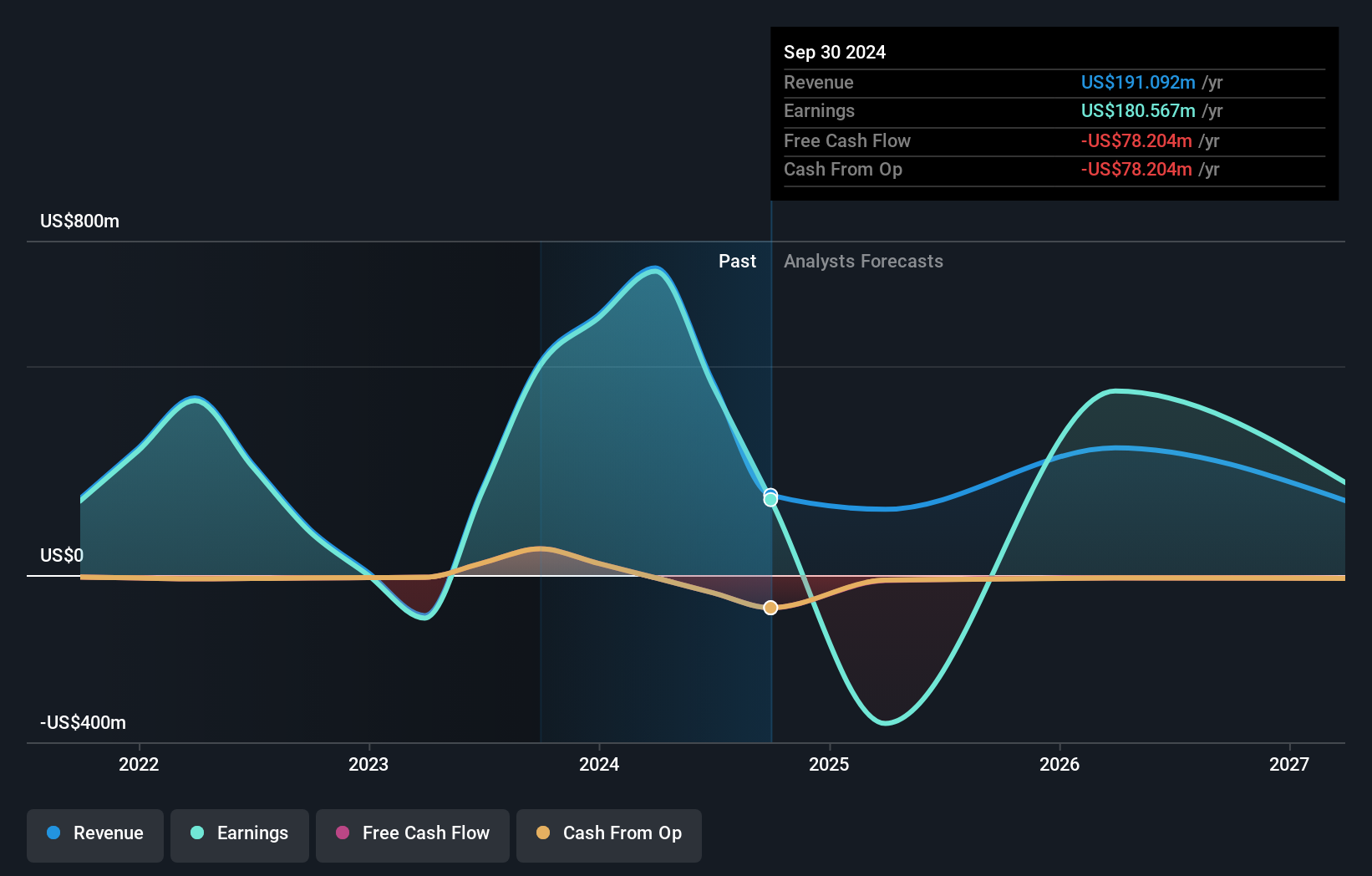

Yellow Cake, a UK-based player, stands out in the uranium sector with its debt-free status for over five years and a price-to-earnings ratio of 2.3x, significantly lower than the UK's market average of 16.5x. This company has recently turned profitable, which is notable given the oil and gas industry's earnings drop of 46.9%. Despite high non-cash earnings quality, its free cash flow remains negative at -A$6.48 million as of March 2024. While profitability is promising, forecasts suggest an average annual earnings decline of 78% over the next three years might temper growth expectations.

- Click here to discover the nuances of Yellow Cake with our detailed analytical health report.

Examine Yellow Cake's past performance report to understand how it has performed in the past.

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cairn Homes plc is a holding company that functions as a home and community builder in Ireland, with a market capitalization of £1.11 billion.

Operations: Cairn Homes generates revenue primarily from building and property development, amounting to €813.40 million.

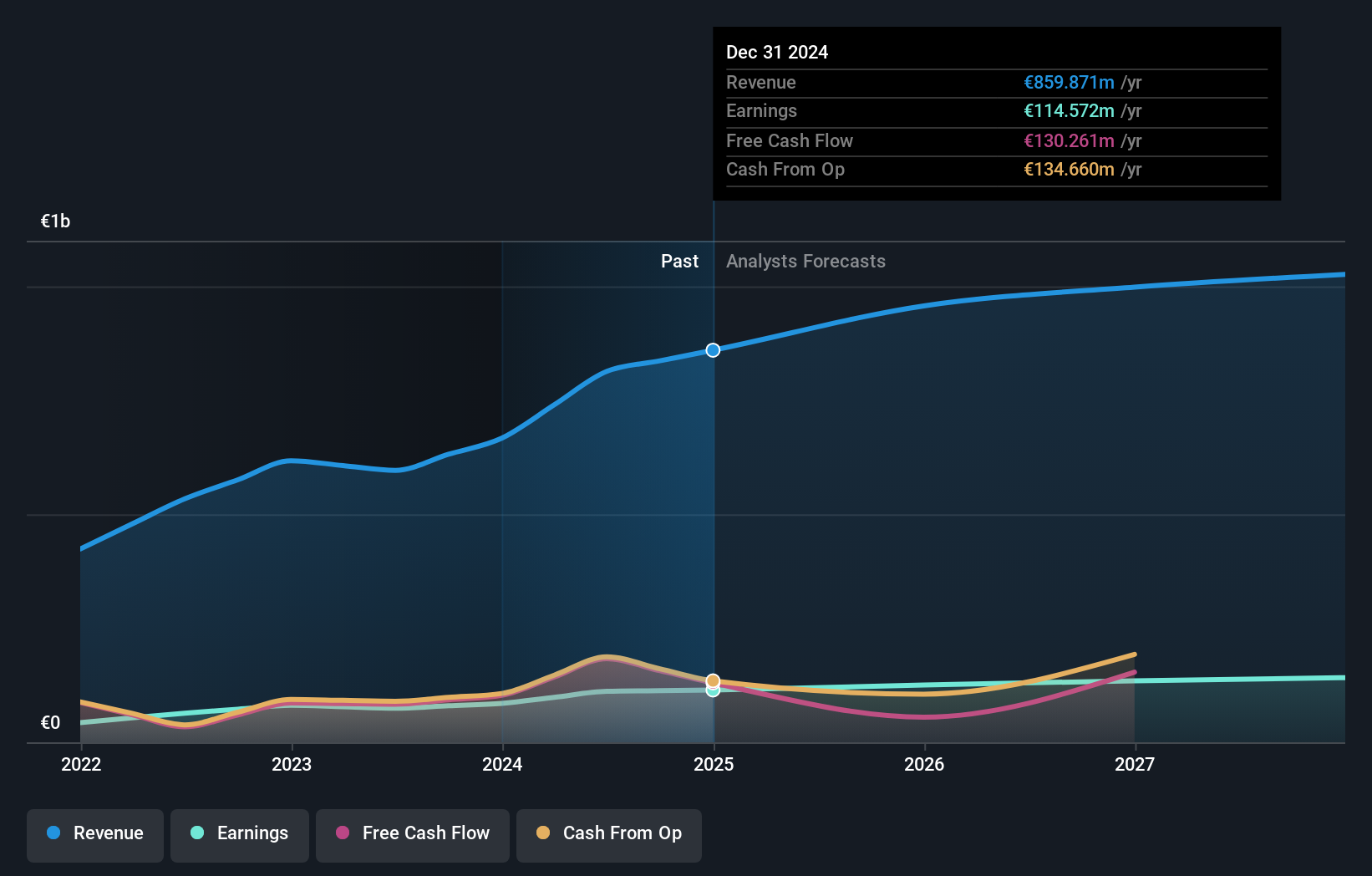

Cairn Homes, a notable player in the UK market, has shown impressive financial growth with earnings rising by 49.5% over the past year, outpacing its industry peers. The company’s net income for the first half of 2024 reached €46.89 million, up from €20.7 million in the previous year, reflecting strong operational performance and effective cost management. With a price-to-earnings ratio of 11.9x compared to the UK market average of 16.5x, it seems attractively valued relative to its peers and industry standards. Recent share buybacks totaling €70 million highlight strategic capital allocation decisions aimed at enhancing shareholder value further.

- Get an in-depth perspective on Cairn Homes' performance by reading our health report here.

Gain insights into Cairn Homes' historical performance by reviewing our past performance report.

Ocean Wilsons Holdings (LSE:OCN)

Simply Wall St Value Rating: ★★★★★★

Overview: Ocean Wilsons Holdings Limited is an investment holding company providing maritime and logistics services in Brazil, with a market cap of £535.75 million.

Operations: Ocean Wilsons generates revenue primarily from its maritime services in Brazil, amounting to $519.35 million.

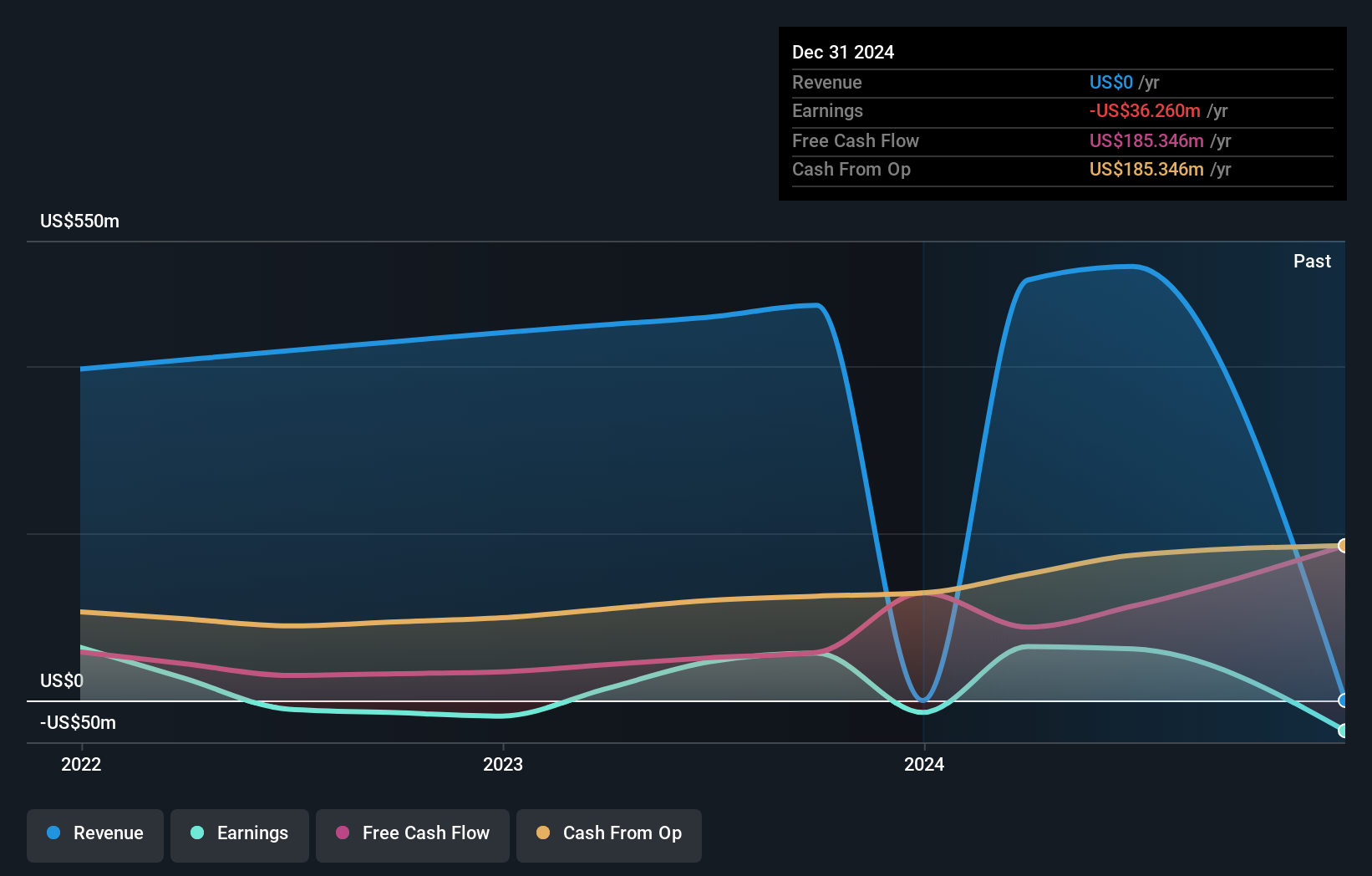

With a strong foothold in the infrastructure sector, Ocean Wilsons Holdings has seen its earnings surge by 32.7% over the past year, outpacing industry growth of 16.1%. The company seems well-positioned financially, boasting more cash than its total debt and maintaining a favorable debt-to-equity ratio that improved from 42.7% to 38% over five years. A notable $28.8M one-off gain impacted recent results, showcasing potential volatility but also opportunity for strategic maneuvers like ongoing discussions about selling its stake in Wilson Sons S.A., which could reshape future operations and valuation prospects significantly.

- Click to explore a detailed breakdown of our findings in Ocean Wilsons Holdings' health report.

Assess Ocean Wilsons Holdings' past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Click this link to deep-dive into the 81 companies within our UK Undiscovered Gems With Strong Fundamentals screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:YCA

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives