- United Kingdom

- /

- Airlines

- /

- LSE:IAG

Is International Consolidated Airlines Group (LON:IAG) Using Debt In A Risky Way?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies International Consolidated Airlines Group S.A. (LON:IAG) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out the opportunities and risks within the GB Airlines industry.

What Is International Consolidated Airlines Group's Net Debt?

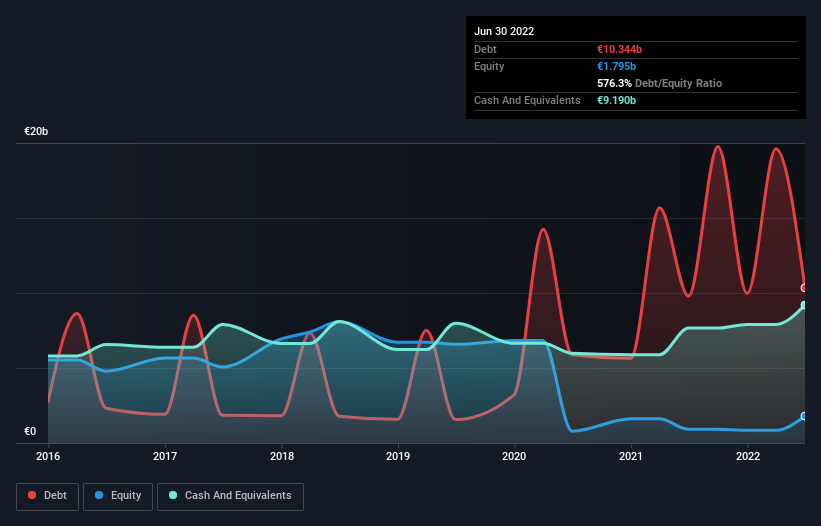

As you can see below, at the end of June 2022, International Consolidated Airlines Group had €10.3b of debt, up from €9.79b a year ago. Click the image for more detail. However, because it has a cash reserve of €9.19b, its net debt is less, at about €1.15b.

A Look At International Consolidated Airlines Group's Liabilities

Zooming in on the latest balance sheet data, we can see that International Consolidated Airlines Group had liabilities of €17.0b due within 12 months and liabilities of €21.0b due beyond that. Offsetting this, it had €9.19b in cash and €1.54b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €27.3b.

This deficit casts a shadow over the €6.44b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, International Consolidated Airlines Group would probably need a major re-capitalization if its creditors were to demand repayment. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine International Consolidated Airlines Group's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, International Consolidated Airlines Group reported revenue of €16b, which is a gain of 230%, although it did not report any earnings before interest and tax. That's virtually the hole-in-one of revenue growth!

Caveat Emptor

Despite the top line growth, International Consolidated Airlines Group still had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost a very considerable €1.1b at the EBIT level. Combining this information with the significant liabilities we already touched on makes us very hesitant about this stock, to say the least. Of course, it may be able to improve its situation with a bit of luck and good execution. Nevertheless, we would not bet on it given that it lost €1.5b in just last twelve months, and it doesn't have much by way of liquid assets. So while it's not wise to assume the company will fail, we do think it's risky. For riskier companies like International Consolidated Airlines Group I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:IAG

International Consolidated Airlines Group

Engages in the provision of passenger and cargo transportation services in the United Kingdom, Spain, the United States, and rest of the world.

Undervalued with proven track record.