- United Kingdom

- /

- Airlines

- /

- LSE:IAG

International Consolidated Airlines Group (LSE:IAG) Hosts Investor Day Focusing On Iberia Group Opportunities

Reviewed by Simply Wall St

International Consolidated Airlines Group (LSE:IAG) is set to host an Analyst/Investor Day to highlight the Iberia Group's opportunities, amid a recent 5% price rise. The company's first-quarter earnings reported significant growth, with EUR 7,044 million in revenue and EUR 176 million in net income. IAG also completed a substantial share buyback program and announced new aircraft orders, which may bolster future capabilities. Market volatility tied to geopolitical tensions and the anticipation surrounding the Federal Reserve's interest rate decision have broadly influenced stocks, with IAG's movements aligning with positive market trends over the last year.

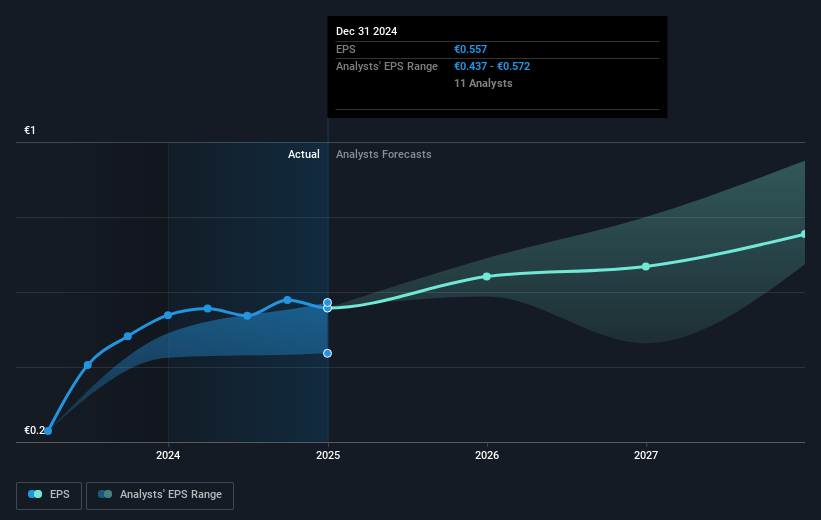

The recent Analyst/Investor Day for International Consolidated Airlines Group highlights key opportunities for the Iberia Group, potentially impacting the company’s broader narrative of growth and shareholder returns. The announcement of new aircraft orders aligns with the company's strategy of strengthening core markets and improving service efficiency, which could bolster future revenue and earnings. Such initiatives may support anticipated revenue growth of 4% annually over the next three years, despite potential challenges like increased competition and supply chain constraints. The share buyback program underscores a commitment to enhance shareholder value, potentially translating into a higher earnings per share as capital is strategically returned to investors.

Over the past three years, IAG’s total shareholder return, including share price appreciation and dividends, was 165.89%. This period contrasts with a more recent, one-year performance where the company exceeded the UK Airlines industry, which returned 31.4%. Additionally, the company's shares rose by 5% recently amid overall positive market trends, suggesting resilience amid volatility tied to geopolitical tensions and interest rate uncertainties. However, the current share price of £2.6 stands at a significant 29% discount to the consensus analyst price target of £3.66, indicating potential for further upside if market conditions and company performance align with analysts' expectations. These factors may influence investor perceptions and the company's financial outlook positively.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:IAG

International Consolidated Airlines Group

Engages in the provision of passenger and cargo transportation services in the North Atlantic, Latin America, the Caribbean, Europe, Africa, the Middle East, South Asia, the Asia Pacific, and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives