- United Kingdom

- /

- Airlines

- /

- LSE:IAG

Here's Why International Consolidated Airlines Group (LON:IAG) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like International Consolidated Airlines Group (LON:IAG), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for International Consolidated Airlines Group

How Fast Is International Consolidated Airlines Group Growing Its Earnings Per Share?

Over the last three years, International Consolidated Airlines Group has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. To the delight of shareholders, International Consolidated Airlines Group's EPS soared from €0.41 to €0.54, over the last year. That's a commendable gain of 33%.

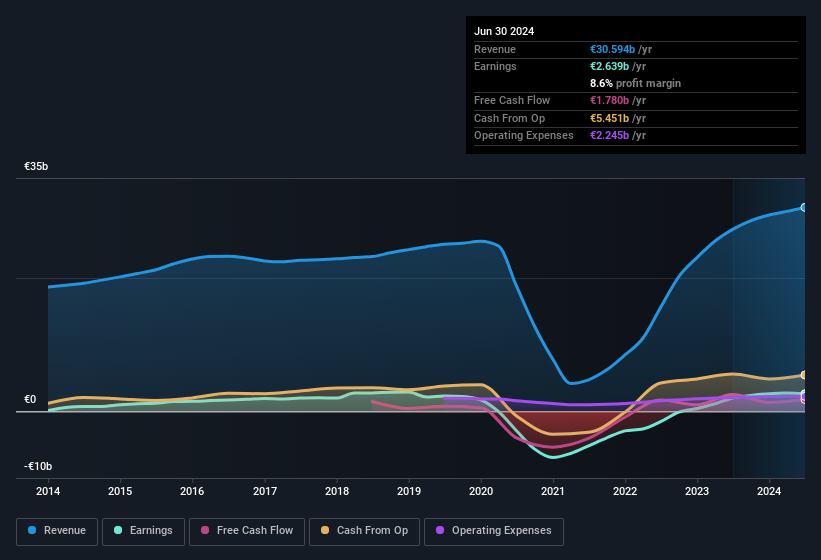

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of International Consolidated Airlines Group's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. International Consolidated Airlines Group maintained stable EBIT margins over the last year, all while growing revenue 12% to €31b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for International Consolidated Airlines Group's future profits.

Are International Consolidated Airlines Group Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. The median total compensation for CEOs of companies similar in size to International Consolidated Airlines Group, with market caps over €7.4b, is around €5.4m.

International Consolidated Airlines Group offered total compensation worth €3.5m to its CEO in the year to December 2023. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add International Consolidated Airlines Group To Your Watchlist?

You can't deny that International Consolidated Airlines Group has grown its earnings per share at a very impressive rate. That's attractive. The fast growth bodes well while the very reasonable CEO pay assists builds some confidence in the board. So this stock is well worth an addition to your watchlist as it has the potential to provide great value to shareholders. It's still necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with International Consolidated Airlines Group (at least 1 which is concerning) , and understanding them should be part of your investment process.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in GB with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:IAG

International Consolidated Airlines Group

Engages in the provision of passenger and cargo transportation services in the North Atlantic, Latin America, the Caribbean, Europe, Africa, the Middle East, South Asia, the Asia Pacific, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives