The harsh reality for easyJet plc (LON:EZJ) shareholders is that its auditors, PricewaterhouseCoopers LLP, expressed doubts about its ability to continue as a going concern, in its reported results to September 2021. This means that, based on the financial results to that date, the company arguably should raise capital, or otherwise strengthen the balance sheet, as soon as possible.

If the company does have to issue more shares, potential investors will be sure to consider how desperate it is for capital. So current risks on the balance sheet could have a big impact on how shareholders fare from here. Debt is always a risk factor in these cases, as creditors could be in a position to wind up the company, in the worst case scenario.

View our latest analysis for easyJet

How Much Debt Does easyJet Carry?

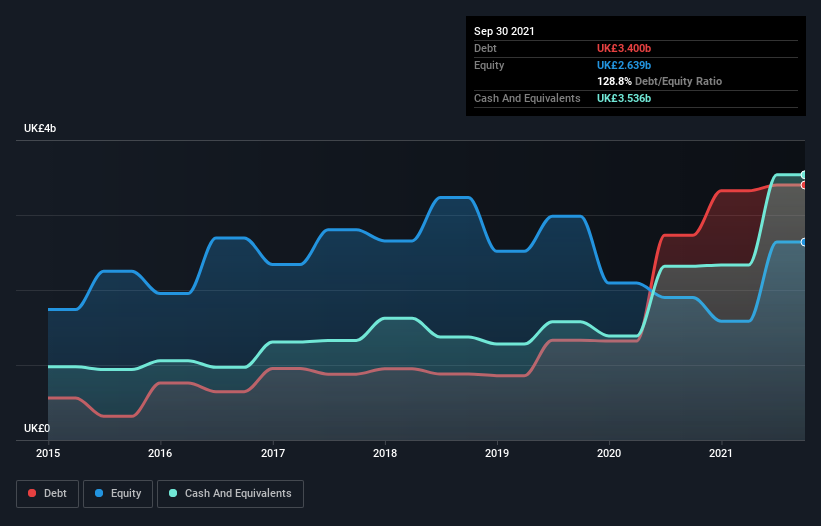

You can click the graphic below for the historical numbers, but it shows that as of September 2021 easyJet had UK£3.40b of debt, an increase on UK£2.73b, over one year. However, its balance sheet shows it holds UK£3.54b in cash, so it actually has UK£136.0m net cash.

How Healthy Is easyJet's Balance Sheet?

The latest balance sheet data shows that easyJet had liabilities of UK£2.68b due within a year, and liabilities of UK£4.46b falling due after that. Offsetting this, it had UK£3.54b in cash and UK£198.0m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by UK£3.40b.

This is a mountain of leverage relative to its market capitalization of UK£3.84b. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. While it does have liabilities worth noting, easyJet also has more cash than debt, so we're pretty confident it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine easyJet's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, easyJet made a loss at the EBIT level, and saw its revenue drop to UK£1.5b, which is a fall of 52%. To be frank that doesn't bode well.

So How Risky Is easyJet?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And we do note that easyJet had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of UK£1.2b and booked a UK£858m accounting loss. With only UK£136.0m on the balance sheet, it would appear that its going to need to raise capital again soon. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. We prefer to avoid a company after its auditor has expressed any uncertainty about its ability to continue as a going concern. That's because we find it more comfortable to invest in companies that always keep the balance sheet reasonably strong. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for easyJet (of which 1 is potentially serious!) you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:EZJ

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives