- United Kingdom

- /

- Infrastructure

- /

- LSE:BMS

I Built A List Of Growing Companies And Braemar Shipping Services (LON:BMS) Made The Cut

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Braemar Shipping Services (LON:BMS). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Braemar Shipping Services

Braemar Shipping Services's Improving Profits

Over the last three years, Braemar Shipping Services has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Braemar Shipping Services boosted its trailing twelve month EPS from UK£0.20 to UK£0.24, in the last year. I doubt many would complain about that 19% gain.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. To cut to the chase Braemar Shipping Services's EBIT margins dropped last year, and so did its revenue. That is, not a hint of euphemism here, suboptimal.

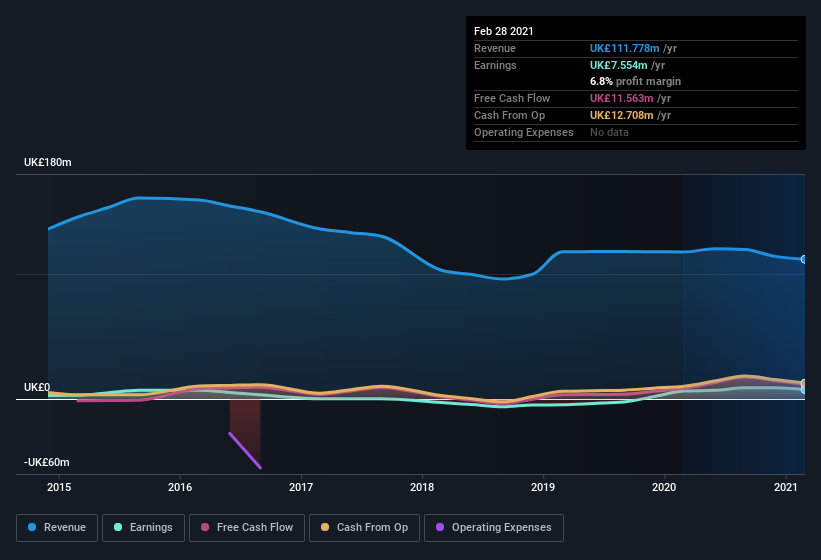

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Braemar Shipping Services isn't a huge company, given its market capitalization of UK£94m. That makes it extra important to check on its balance sheet strength.

Are Braemar Shipping Services Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Not only did Braemar Shipping Services insiders refrain from selling stock during the year, but they also spent UK£67k buying it. That puts the company in a nice light, as it makes me think its leaders are feeling confident. It is also worth noting that it was Group CEO & Executive Director James Christopher Gundy who made the biggest single purchase, worth UK£51k, paying UK£2.55 per share.

The good news, alongside the insider buying, for Braemar Shipping Services bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have UK£9.9m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 11% of the company, demonstrating a degree of high-level alignment with shareholders.

Should You Add Braemar Shipping Services To Your Watchlist?

One important encouraging feature of Braemar Shipping Services is that it is growing profits. On top of that, we've seen insiders buying shares even though they already own plenty. To me, that all makes it well worth a spot on your watchlist, as well as continuing research. However, before you get too excited we've discovered 3 warning signs for Braemar Shipping Services that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Braemar Shipping Services, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade Braemar Shipping Services, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Braemar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:BMS

Braemar

Provides shipbroking services in the United Kingdom, Singapore, Australia, Switzerland, the United States, Germany, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives