- United Kingdom

- /

- Airlines

- /

- AIM:JET2

Dart Group PLC's (LON:DTG) Shares Lagging The Market But So Is The Business

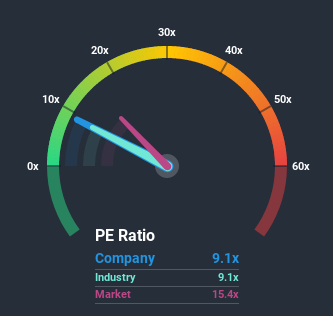

When close to half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") above 16x, you may consider Dart Group PLC (LON:DTG) as an attractive investment with its 9.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Dart Group could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Dart Group

Is There Any Growth For Dart Group?

There's an inherent assumption that a company should underperform the market for P/E ratios like Dart Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's bottom line. Even so, admirably EPS has lifted 45% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the four analysts covering the company suggest earnings growth is heading into negative territory, declining 19% each year over the next three years. With the market predicted to deliver 9.6% growth per annum, that's a disappointing outcome.

With this information, we are not surprised that Dart Group is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Dart Group's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 5 warning signs for Dart Group you should be aware of.

You might be able to find a better investment than Dart Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a P/E below 20x (but have proven they can grow earnings).

If you decide to trade Dart Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:JET2

Jet2

Engages in the leisure travel business primarily in the United Kingdom.

Very undervalued with flawless balance sheet.