- United Kingdom

- /

- Consumer Durables

- /

- LSE:VTY

3 UK Stocks Estimated To Be Trading At Discounts Of Up To 40.3%

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 and FTSE 250 indices have recently faced challenges, closing lower due to weak trade data from China, which has struggled to recover post-pandemic. In this environment of global economic uncertainty, identifying undervalued stocks can be a strategic move for investors seeking opportunities at potentially discounted prices.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Pan African Resources (LSE:PAF) | £0.966 | £1.82 | 46.9% |

| Motorpoint Group (LSE:MOTR) | £1.49 | £2.87 | 48% |

| Lords Group Trading (AIM:LORD) | £0.224 | £0.40 | 44.6% |

| Likewise Group (AIM:LIKE) | £0.274 | £0.50 | 45.4% |

| Fintel (AIM:FNTL) | £2.10 | £3.81 | 44.9% |

| Fevertree Drinks (AIM:FEVR) | £8.25 | £16.06 | 48.6% |

| Begbies Traynor Group (AIM:BEG) | £1.10 | £2.20 | 50% |

| Barratt Redrow (LSE:BTRW) | £3.861 | £7.42 | 47.9% |

| Airtel Africa (LSE:AAF) | £3.114 | £5.82 | 46.5% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.165 | £4.17 | 48.1% |

Here we highlight a subset of our preferred stocks from the screener.

Kainos Group (LSE:KNOS)

Overview: Kainos Group plc provides digital technology services across the United Kingdom, Ireland, the Americas, Central Europe, and internationally with a market cap of £1.16 billion.

Operations: The company's revenue is derived from three main segments: Digital Services (£203.43 million), Workday Products (£76.28 million), and Workday Services (£100.56 million).

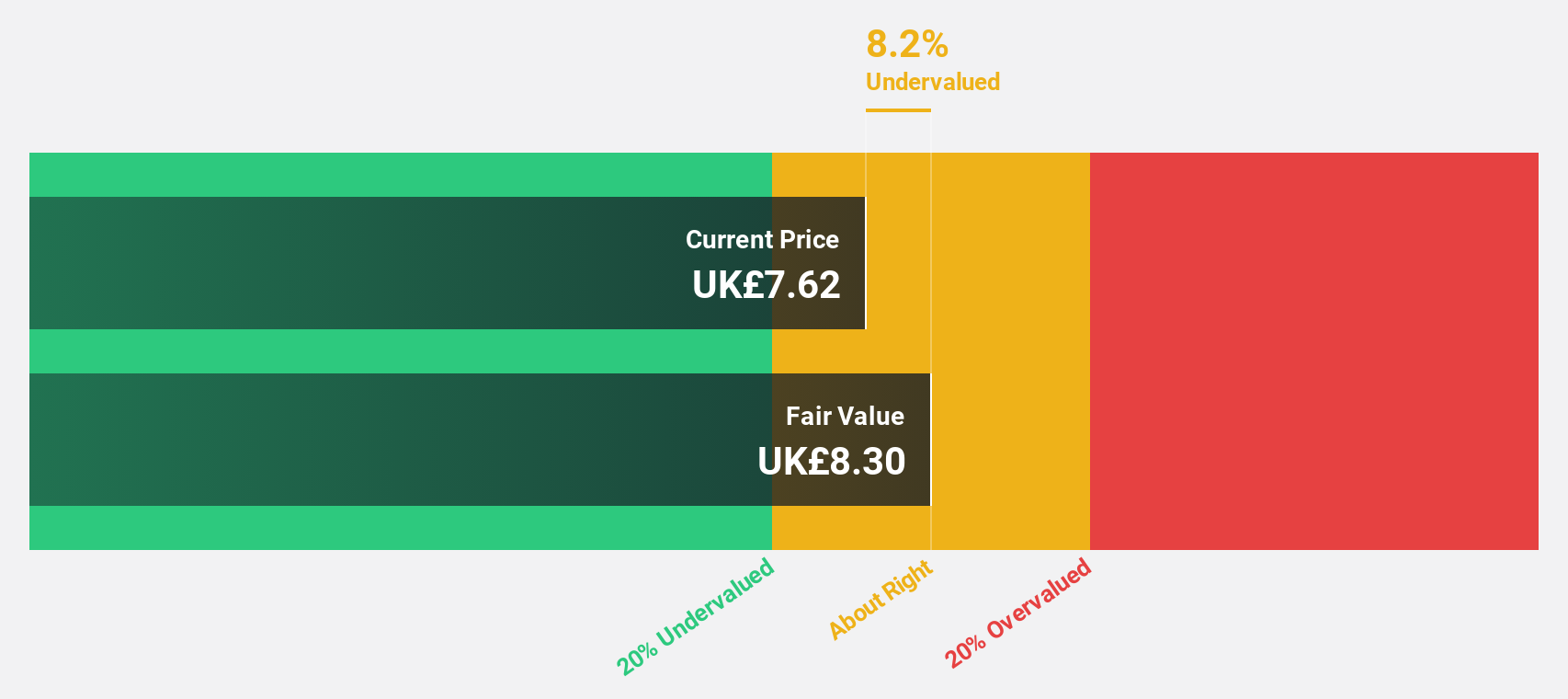

Estimated Discount To Fair Value: 12%

Kainos Group's stock is trading at £9.74, slightly below its estimated fair value of £11.06, suggesting it may be undervalued based on cash flows. Despite a volatile share price and a lower net profit margin compared to last year, the company's earnings are forecast to grow significantly at 23.6% annually over the next three years, outpacing the UK market average of 14.5%. Recent buybacks and dividend increases reflect strong cash flow management and shareholder returns focus.

- Our comprehensive growth report raises the possibility that Kainos Group is poised for substantial financial growth.

- Navigate through the intricacies of Kainos Group with our comprehensive financial health report here.

Vistry Group (LSE:VTY)

Overview: Vistry Group PLC, with a market cap of £2.04 billion, provides housing solutions in the United Kingdom through its subsidiaries.

Operations: The company's revenue is primarily generated from its Home Builders segment, which encompasses residential and commercial projects, amounting to £3.69 billion.

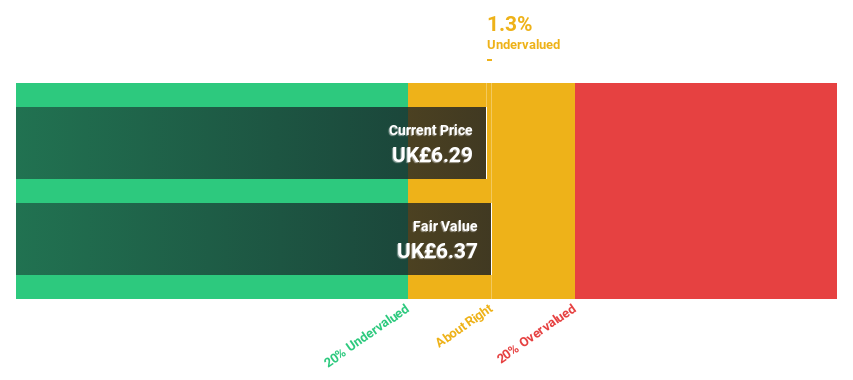

Estimated Discount To Fair Value: 40.3%

Vistry Group is trading at £6.37, well below its estimated fair value of £10.68, highlighting potential undervaluation based on cash flows. Despite a drop in net profit margin from last year, earnings are projected to grow significantly at 38.2% per year, surpassing the UK market average. Recent strategic moves include a joint venture with Homes England and significant share buybacks, reflecting robust cash flow management and commitment to long-term growth initiatives in housing development.

- The analysis detailed in our Vistry Group growth report hints at robust future financial performance.

- Click here to discover the nuances of Vistry Group with our detailed financial health report.

Zegona Communications (LSE:ZEG)

Overview: Zegona Communications plc offers integrated telecommunications services in Spain and has a market cap of £8.92 billion.

Operations: The company's revenue is primarily generated from its Internet Telephone segment, which accounted for €2.41 billion.

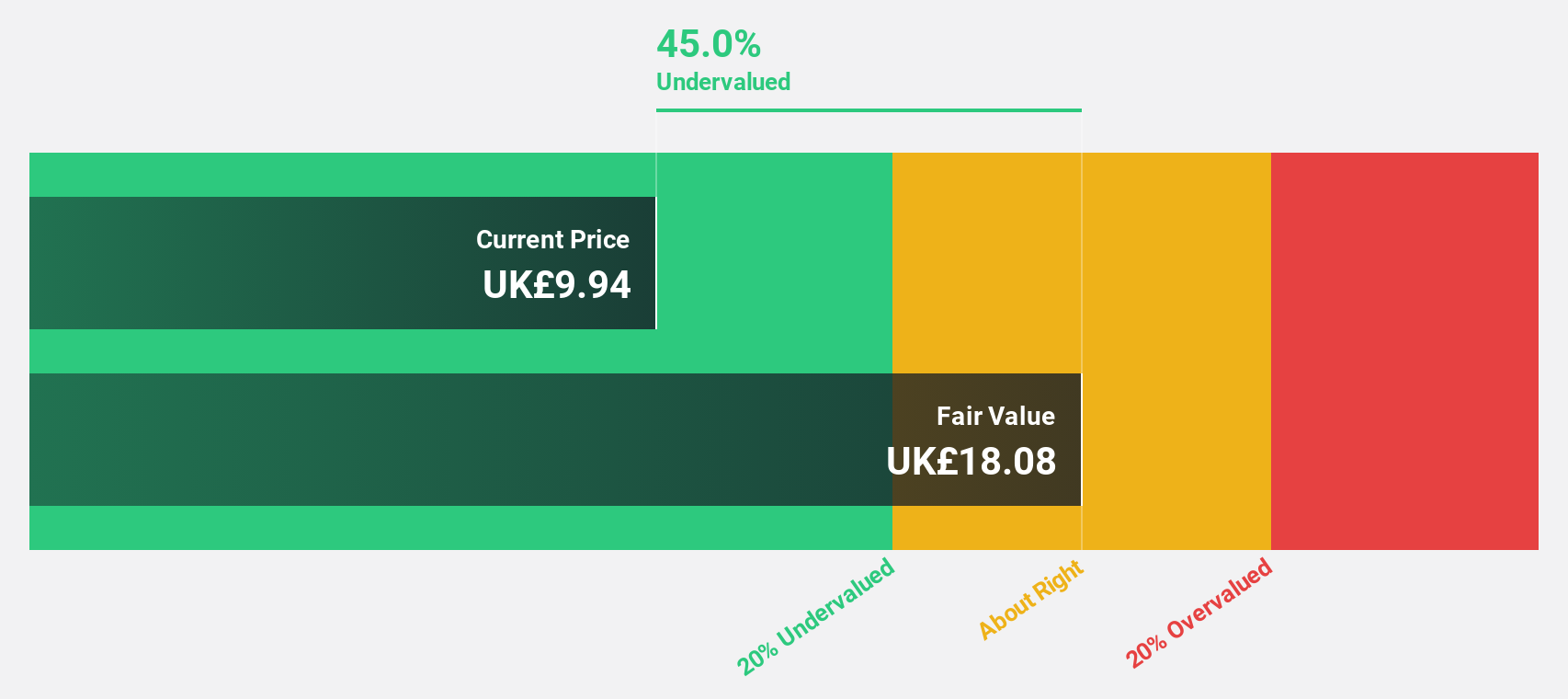

Estimated Discount To Fair Value: 31.2%

Zegona Communications is trading at £11.75, significantly below its estimated fair value of £17.07, suggesting undervaluation based on cash flows. Earnings are expected to grow at 64.43% annually, with revenue growth forecasted to outpace the UK market at 6.2% per year. The company is exploring a potential sale of data centers acquired from Vodafone Spain, valued around €100 million ($117 million), which could impact future cash flow positively if executed strategically.

- The growth report we've compiled suggests that Zegona Communications' future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Zegona Communications.

Make It Happen

- Access the full spectrum of 53 Undervalued UK Stocks Based On Cash Flows by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:VTY

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives