Is Renishaw (LON:RSW) Using Too Much Debt?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Renishaw plc (LON:RSW) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Renishaw

What Is Renishaw's Debt?

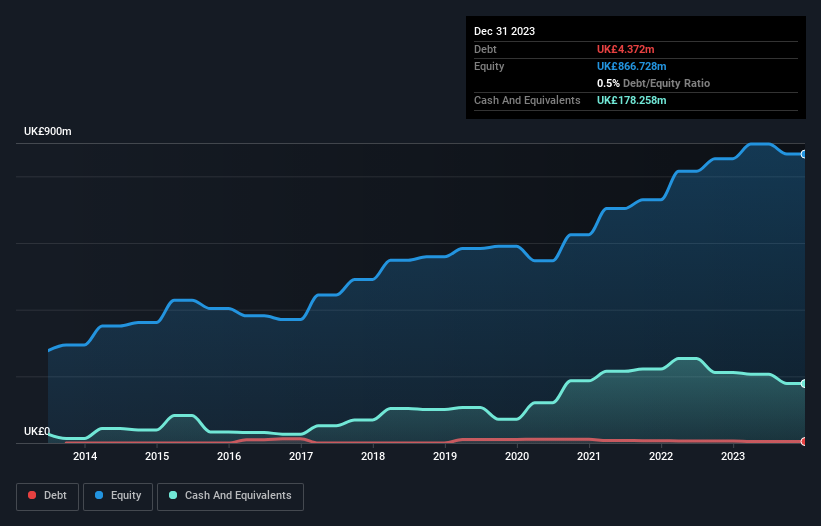

As you can see below, Renishaw had UK£4.37m of debt at December 2023, down from UK£5.89m a year prior. However, its balance sheet shows it holds UK£178.3m in cash, so it actually has UK£173.9m net cash.

How Healthy Is Renishaw's Balance Sheet?

We can see from the most recent balance sheet that Renishaw had liabilities of UK£86.8m falling due within a year, and liabilities of UK£34.2m due beyond that. Offsetting these obligations, it had cash of UK£178.3m as well as receivables valued at UK£171.2m due within 12 months. So it actually has UK£228.5m more liquid assets than total liabilities.

This surplus suggests that Renishaw has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Renishaw boasts net cash, so it's fair to say it does not have a heavy debt load!

It is just as well that Renishaw's load is not too heavy, because its EBIT was down 22% over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Renishaw can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Renishaw has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Looking at the most recent three years, Renishaw recorded free cash flow of 34% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that Renishaw has net cash of UK£173.9m, as well as more liquid assets than liabilities. So we don't have any problem with Renishaw's use of debt. Over time, share prices tend to follow earnings per share, so if you're interested in Renishaw, you may well want to click here to check an interactive graph of its earnings per share history.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:RSW

Renishaw

An engineering and scientific technology company, designs, manufactures, distributes, sells, and services technological products and services, and analytical instruments and medical devices worldwide.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success