Windar Photonics (LON:WPHO) pulls back 11% this week, but still delivers shareholders splendid 42% CAGR over 3 years

Windar Photonics PLC (LON:WPHO) shareholders might be concerned after seeing the share price drop 15% in the last month. But that doesn't change the fact that the returns over the last three years have been very strong. The share price marched upwards over that time, and is now 186% higher than it was. It's not uncommon to see a share price retrace a bit, after a big gain. The thing to consider is whether the underlying business is doing well enough to support the current price.

In light of the stock dropping 11% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive three-year return.

See our latest analysis for Windar Photonics

Because Windar Photonics made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Windar Photonics' revenue trended up 71% each year over three years. That's much better than most loss-making companies. Meanwhile, the share price performance has been pretty solid at 42% compound over three years. This suggests the market has recognized the progress the business has made, at least to a significant degree. Nonetheless, we'd say Windar Photonics is still worth investigating - successful businesses can often keep growing for long periods.

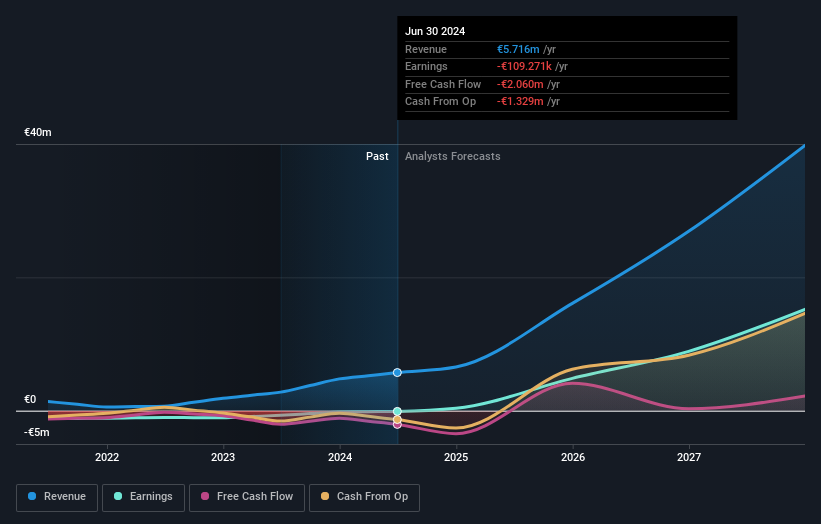

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for Windar Photonics in this interactive graph of future profit estimates.

A Different Perspective

It's nice to see that Windar Photonics shareholders have received a total shareholder return of 45% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 12% per year), it would seem that the stock's performance has improved in recent times. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. It's always interesting to track share price performance over the longer term. But to understand Windar Photonics better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Windar Photonics (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

Windar Photonics is not the only stock insiders are buying. So take a peek at this free list of small cap companies at attractive valuations which insiders have been buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Windar Photonics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:WPHO

Windar Photonics

Through its subsidiaries, develops light detection and ranging wind sensors, and related software suite for use on electricity generating wind turbines in Europe, China, the Americas, and rest of Asia.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives