Here's Why I Think UniVision Engineering (LON:UVEL) Might Deserve Your Attention Today

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in UniVision Engineering (LON:UVEL). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for UniVision Engineering

UniVision Engineering's Improving Profits

In the last three years UniVision Engineering's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like the last firework on New Year's Eve accelerating into the sky, UniVision Engineering's EPS shot from UK£0.0015 to UK£0.004, over the last year. Year on year growth of 174% is certainly a sight to behold.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). The good news is that UniVision Engineering is growing revenues, and EBIT margins improved by 5.3 percentage points to 16%, over the last year. That's great to see, on both counts.

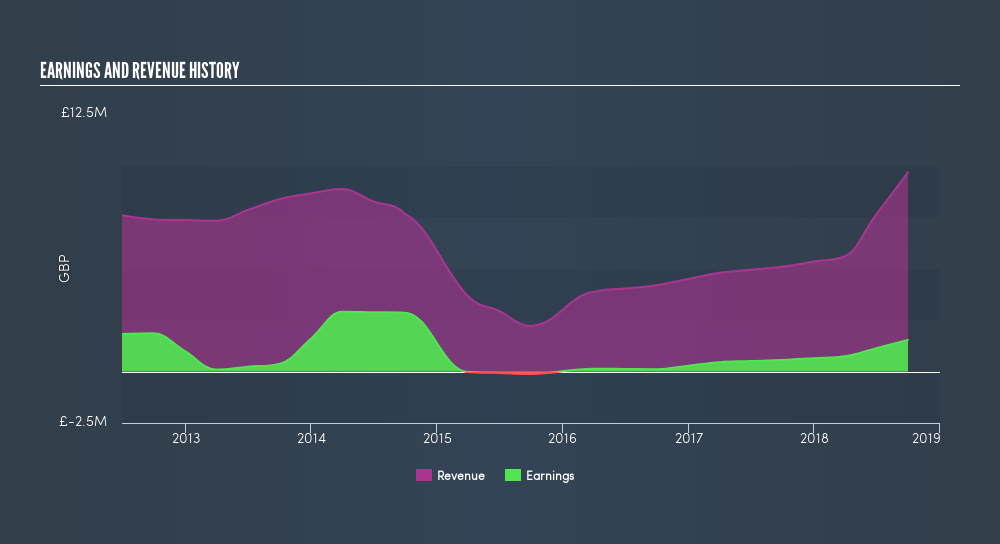

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since UniVision Engineering is no giant, with a market capitalization of UK£7.9m, so you should definitely check its cash and debtbefore getting too excited about its prospects.

Are UniVision Engineering Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So we're pleased to report that UniVision Engineering insiders own a meaningful share of the business. In fact, hey own 73% of the company, so they will share in the same delights and challenged experienced by the ordinary shareholders. This makes me think they will be incentivised to plan for the long term - something I like to see. Of course, UniVision Engineering is a very small company, with a market cap of only UK£7.9m. So despite a large proportional holding, insiders only have UK£5.8m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

It means a lot to see insiders invested in the business, but I find myself wondering if remuneration policies are shareholder friendly. Well, based on the CEO pay, I'd say they are indeed. I discovered that the median total compensation for the CEOs of companies like UniVision Engineering with market caps under UK£152m is about UK£237k.

The UniVision Engineering CEO received total compensation of just UK£81k in the year to March 2018. That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Does UniVision Engineering Deserve A Spot On Your Watchlist?

UniVision Engineering's earnings have taken off like any random crypto-currency did, back in 2017. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The strong EPS improvement suggests the businesses is humming along. Big growth can make big winners, so I do think UniVision Engineering is worth considering carefully. Now, you could try to make up your mind on UniVision Engineering by focusing on just these factors, oryou could also consider how its price-to-earnings ratio compares to other companies in its industry.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdictionWe aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About AIM:UVEL

UniVision Engineering

UniVision Engineering Limited designs, supplies, consults, installs, and maintains closed circuit televisions and surveillance systems in the People’s Republic of China.

Slightly overvalued with weak fundamentals.

Market Insights

Community Narratives