- United Kingdom

- /

- Software

- /

- LSE:PINE

High Growth UK Tech Stocks to Watch in July 2025

Reviewed by Simply Wall St

The UK market has recently experienced a downturn, with the FTSE 100 and FTSE 250 indices closing lower due to weak trade data from China, highlighting ongoing challenges in global economic recovery. In this environment, identifying high growth tech stocks involves focusing on companies that demonstrate resilience and adaptability amidst fluctuating demand and supply chain disruptions.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ENGAGE XR Holdings | 22.08% | 84.46% | ★★★★★★ |

| Audioboom Group | 8.84% | 59.33% | ★★★★★☆ |

| YouGov | 3.98% | 64.42% | ★★★★★☆ |

| ActiveOps | 14.40% | 43.34% | ★★★★★☆ |

| Oxford Biomedica | 16.89% | 80.47% | ★★★★★☆ |

| Trustpilot Group | 14.91% | 38.67% | ★★★★★☆ |

| Quantum Base Holdings | 132.55% | 92.87% | ★★★★★☆ |

| Windar Photonics | 36.00% | 48.66% | ★★★★★☆ |

| Faron Pharmaceuticals Oy | 55.41% | 54.99% | ★★★★★☆ |

| SRT Marine Systems | 45.54% | 91.35% | ★★★★★★ |

Click here to see the full list of 43 stocks from our UK High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Faron Pharmaceuticals Oy (AIM:FARN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Faron Pharmaceuticals Oy is a clinical stage drug discovery and development company with a market cap of £240.70 million.

Operations: The company focuses on drug discovery and development, operating as a clinical stage entity.

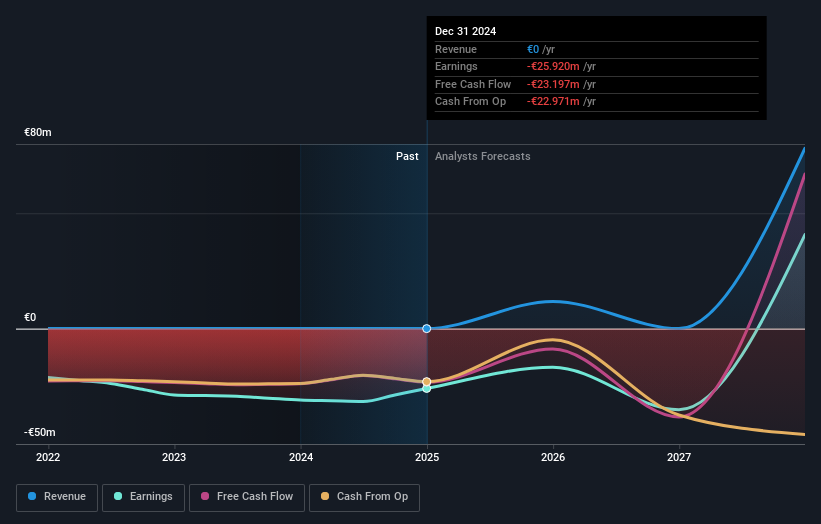

Faron Pharmaceuticals Oy, a UK-based biotech firm, is making significant strides in high-growth tech through its innovative research in immunotherapy. With an expected annual revenue growth of 55.4%, Faron outpaces the UK market average of 3.6%. Despite current unprofitability, the company's earnings are forecasted to surge by approximately 55% annually over the next three years, signaling robust future prospects. Recent studies published by Faron have unveiled groundbreaking findings on Clever-1 receptors' role in cancer immunosuppression, enhancing the therapeutic potential of their lead asset bexmarilimab across various cancer treatments and potentially revolutionizing autoimmune therapies. This positions Faron not only as a key innovator but also as a potential leader in redefining effective cancer treatment paradigms.

- Click to explore a detailed breakdown of our findings in Faron Pharmaceuticals Oy's health report.

Understand Faron Pharmaceuticals Oy's track record by examining our Past report.

SRT Marine Systems (AIM:SRT)

Simply Wall St Growth Rating: ★★★★★★

Overview: SRT Marine Systems plc, along with its subsidiaries, focuses on developing and supplying AIS-based maritime domain awareness technologies, products, and systems, with a market cap of £188.91 million.

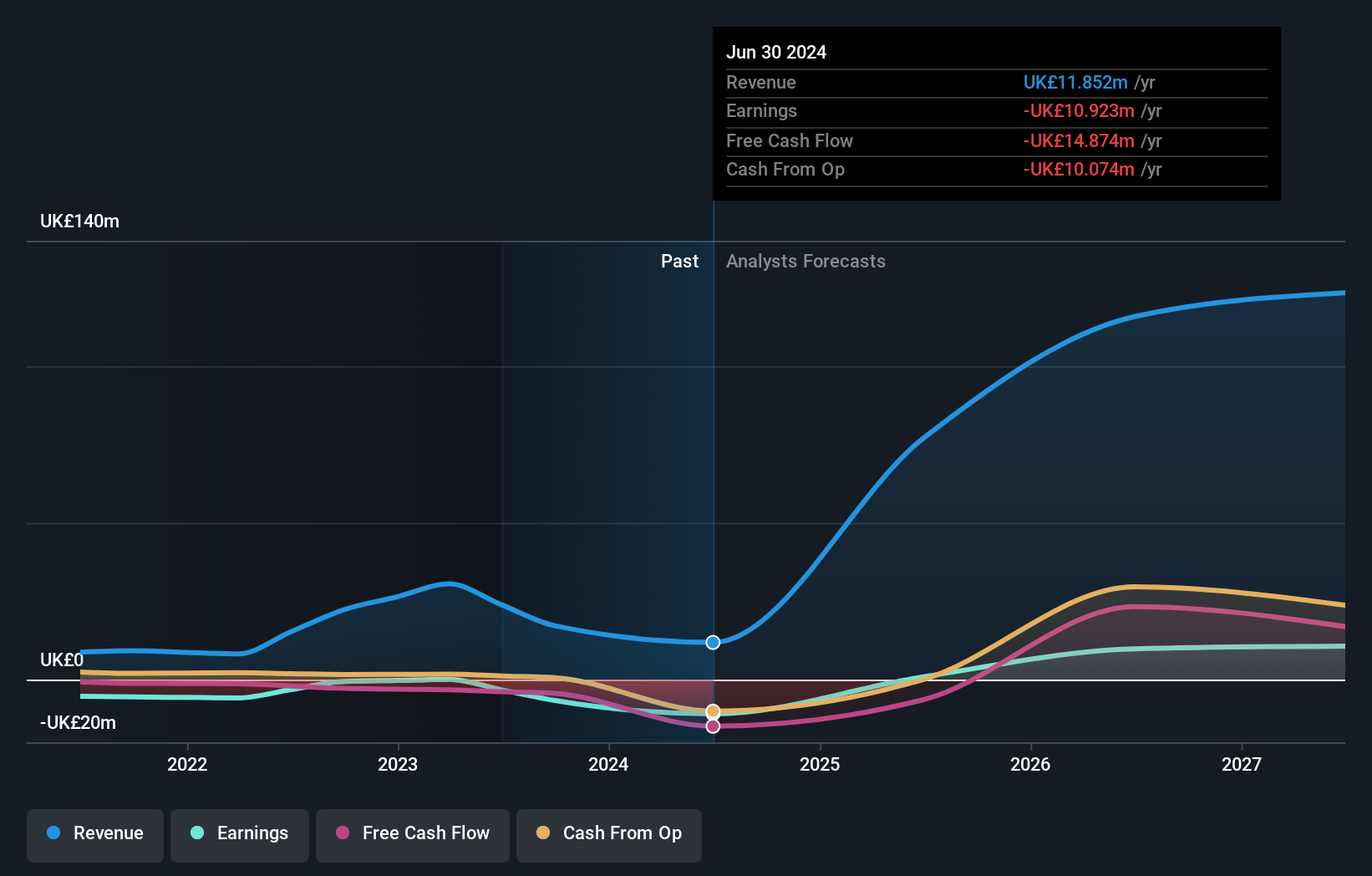

Operations: Specializing in AIS-based maritime domain awareness, SRT Marine Systems generates revenue primarily from its Marine Technology Business, which reported earnings of £11.85 million.

SRT Marine Systems is distinguishing itself in the UK's high-tech sector, particularly with its recent EUR 167 million NMSS project for the Indonesian Coast Guard. This initiative underscores SRT's innovative edge by integrating AI-driven intelligence into maritime surveillance and command systems. With a projected revenue growth of 45.5% annually, SRT is outpacing the average UK market growth significantly. Moreover, earnings are expected to surge by 91.35% annually over the next three years as it moves towards profitability, highlighting its potential amid a competitive landscape. This blend of advanced technology and strong financial forecasts positions SRT to expand its influence in global maritime security solutions effectively.

- Click here and access our complete health analysis report to understand the dynamics of SRT Marine Systems.

Assess SRT Marine Systems' past performance with our detailed historical performance reports.

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider operating in the United Kingdom, Europe, Africa, Asia, the Middle East, and internationally with a market capitalization of £459.45 million.

Operations: Pinewood Technologies Group generates revenue primarily through its cloud-based dealer management software services across multiple regions, including the UK, Europe, Africa, Asia, and the Middle East. The company's market capitalization stands at approximately £459.45 million.

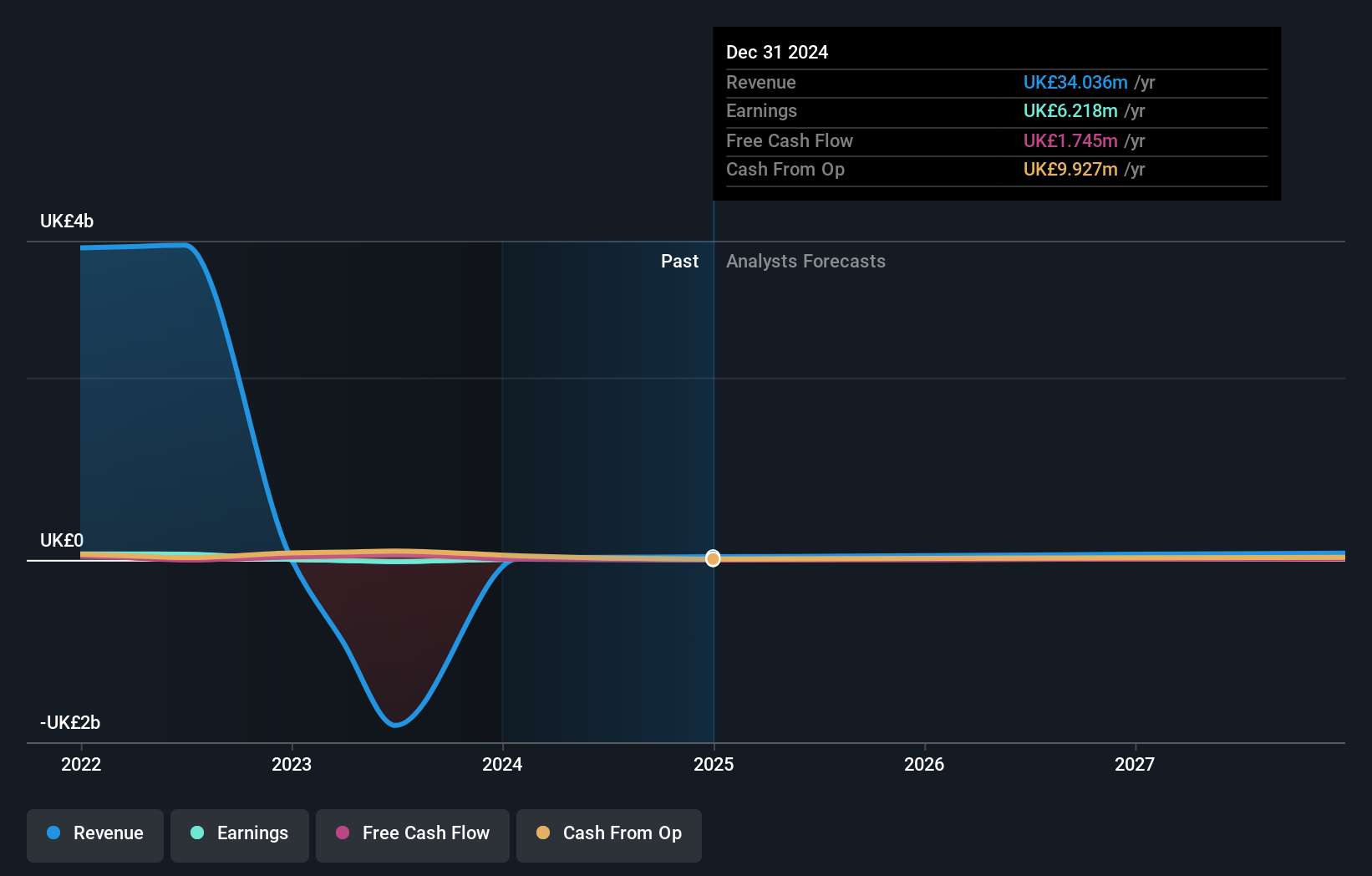

Pinewood Technologies Group is making significant strides in the UK's tech landscape, particularly with its recent contract to integrate its Automotive Intelligence platform across approximately 350 Volkswagen and Audi dealerships in Japan. This move not only expands Pinewood's global footprint but also aligns with its strategic goals, enhancing its market position. Financially, the company is on a robust growth trajectory with revenues expected to grow by 25% annually and earnings by an impressive 40.2% per year. Moreover, a notable one-off loss of £2.4 million last fiscal year underscores challenges but doesn't overshadow their strong financial outlook or their commitment to innovation as evidenced by their substantial R&D investments relative to revenue.

Next Steps

- Explore the 43 names from our UK High Growth Tech and AI Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PINE

Pinewood Technologies Group

Operates as a cloud-based dealer management software provider in the United Kingdom, rest of Europe, Africa, Asia, the Middle East, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives