Strix Group And 2 UK Penny Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

The UK market has recently faced headwinds, with the FTSE 100 and FTSE 250 indices both closing lower amid concerns about weak trade data from China, highlighting global economic uncertainties. Despite these challenges, investors often seek opportunities in lesser-known areas of the market where potential growth can be found. Penny stocks, though an outdated term, still represent a compelling investment area as they typically involve smaller or newer companies that may offer affordability and growth potential when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.215 | £301.38M | ✅ 5 ⚠️ 0 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.535 | £508.81M | ✅ 4 ⚠️ 0 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.395 | £42.74M | ✅ 5 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £4.25 | £53.93M | ✅ 3 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.856 | £316.53M | ✅ 4 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.04 | £313.01M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.245 | £198.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.82 | £11.29M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.26 | £69.82M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £2.17 | £819.53M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 296 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Strix Group (AIM:KETL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Strix Group Plc designs, manufactures, and supplies kettle safety controls and other components globally, with a market cap of £97.12 million.

Operations: The company's revenue is derived from three main segments: Controls (£67.26 million), Billi (£43.05 million), and Consumer Goods (£31.45 million).

Market Cap: £97.12M

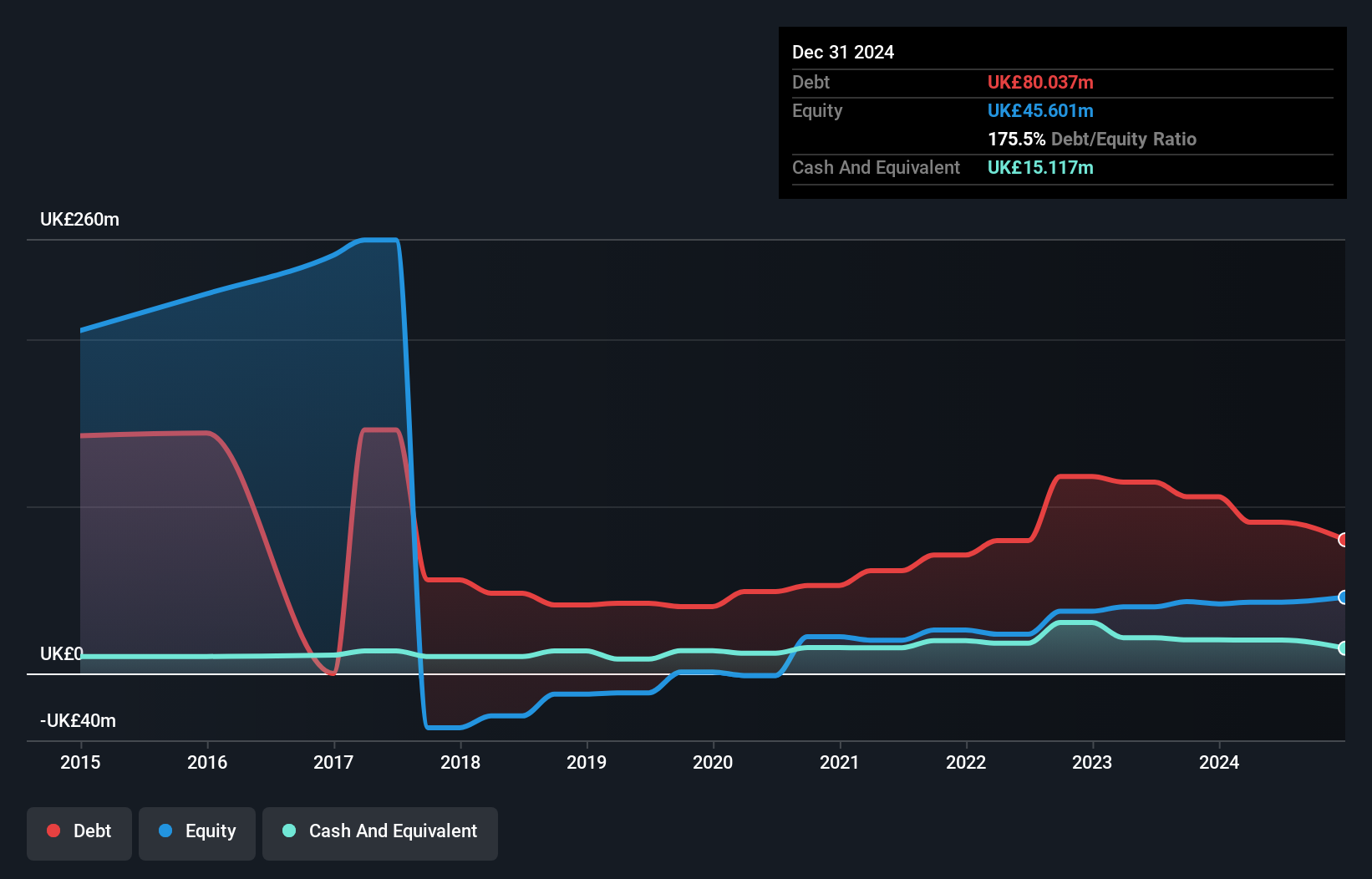

Strix Group Plc, with a market cap of £97.12 million, faces challenges typical of penny stocks, including high debt levels and recent earnings volatility. Its net debt to equity ratio is high at 142.4%, though interest payments are well-covered by EBIT. Despite stable short-term assets exceeding liabilities, the company reported a net loss of £1.38 million for 2024 due to large one-off losses impacting earnings quality. Recent management changes include Rachel Pallett's appointment as Chief Commercial Officer, potentially bringing valuable experience from her previous roles in Spirax Group plc and Renishaw plc to Strix's leadership team.

- Navigate through the intricacies of Strix Group with our comprehensive balance sheet health report here.

- Understand Strix Group's earnings outlook by examining our growth report.

Spectra Systems (AIM:SPSY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Spectra Systems Corporation invents, develops, and sells integrated optical systems in the United States and internationally, with a market cap of £111.37 million.

Operations: Spectra Systems generates revenue from three segments: Security Printing ($16.28 million), Software Security ($1.96 million), and Physical and Software Authentication ($30.96 million).

Market Cap: £111.37M

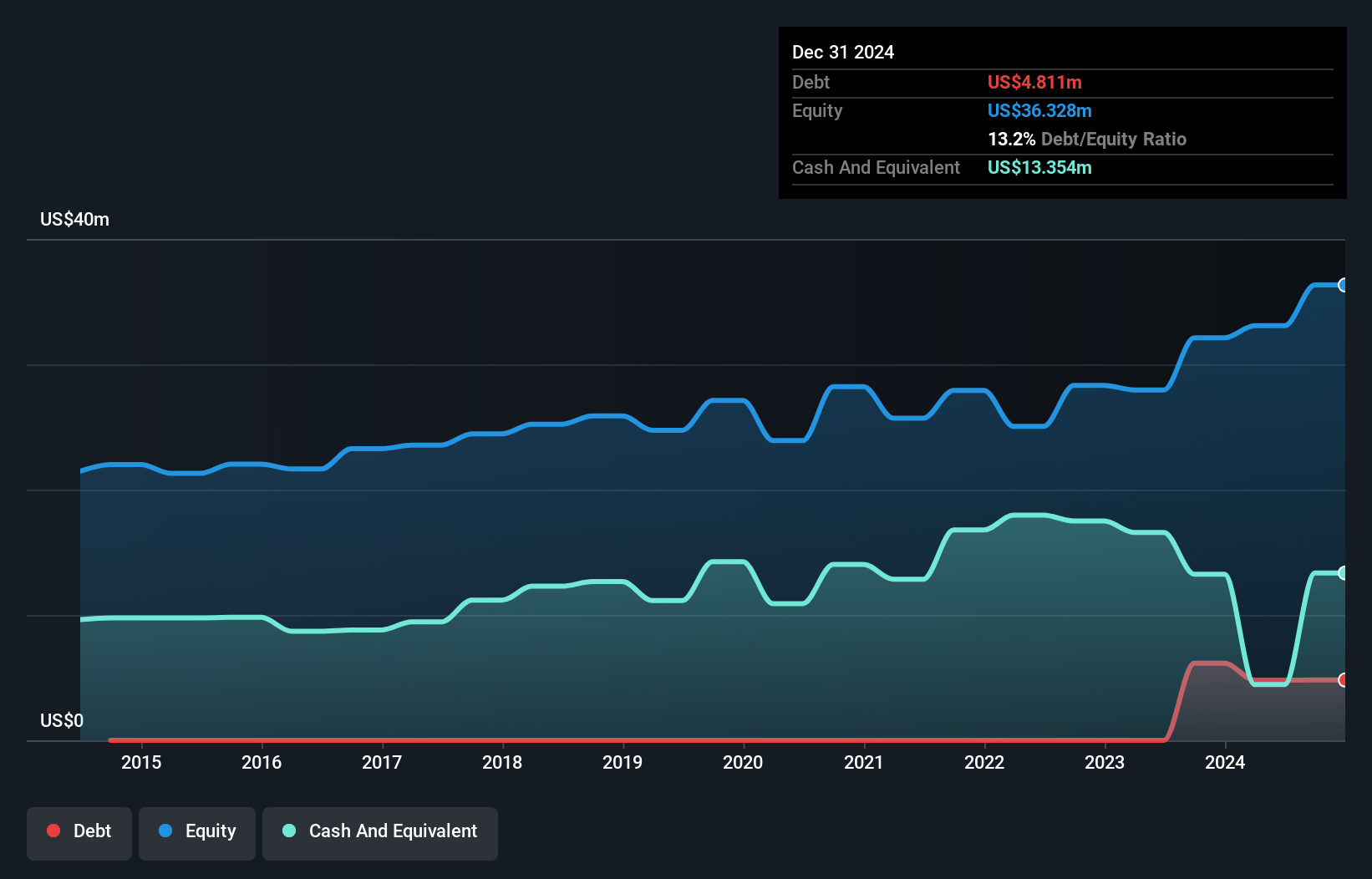

Spectra Systems Corporation, with a market cap of £111.37 million, demonstrates strengths typical of promising penny stocks. The company's earnings have grown significantly by 40.9% over the past year and are forecast to continue growing at 8.01% annually. Its debt management is robust, with interest payments well-covered by EBIT and operating cash flow exceeding debt levels substantially. Short-term assets comfortably cover both short- and long-term liabilities, while the company trades below its estimated fair value, indicating potential for appreciation. However, net profit margins have decreased from last year’s figures despite high-quality earnings and strong return on equity at 23.4%.

- Click here and access our complete financial health analysis report to understand the dynamics of Spectra Systems.

- Gain insights into Spectra Systems' outlook and expected performance with our report on the company's earnings estimates.

Motorpoint Group (LSE:MOTR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Motorpoint Group Plc operates as an independent omnichannel vehicle retailer in the United Kingdom with a market cap of £149.84 million.

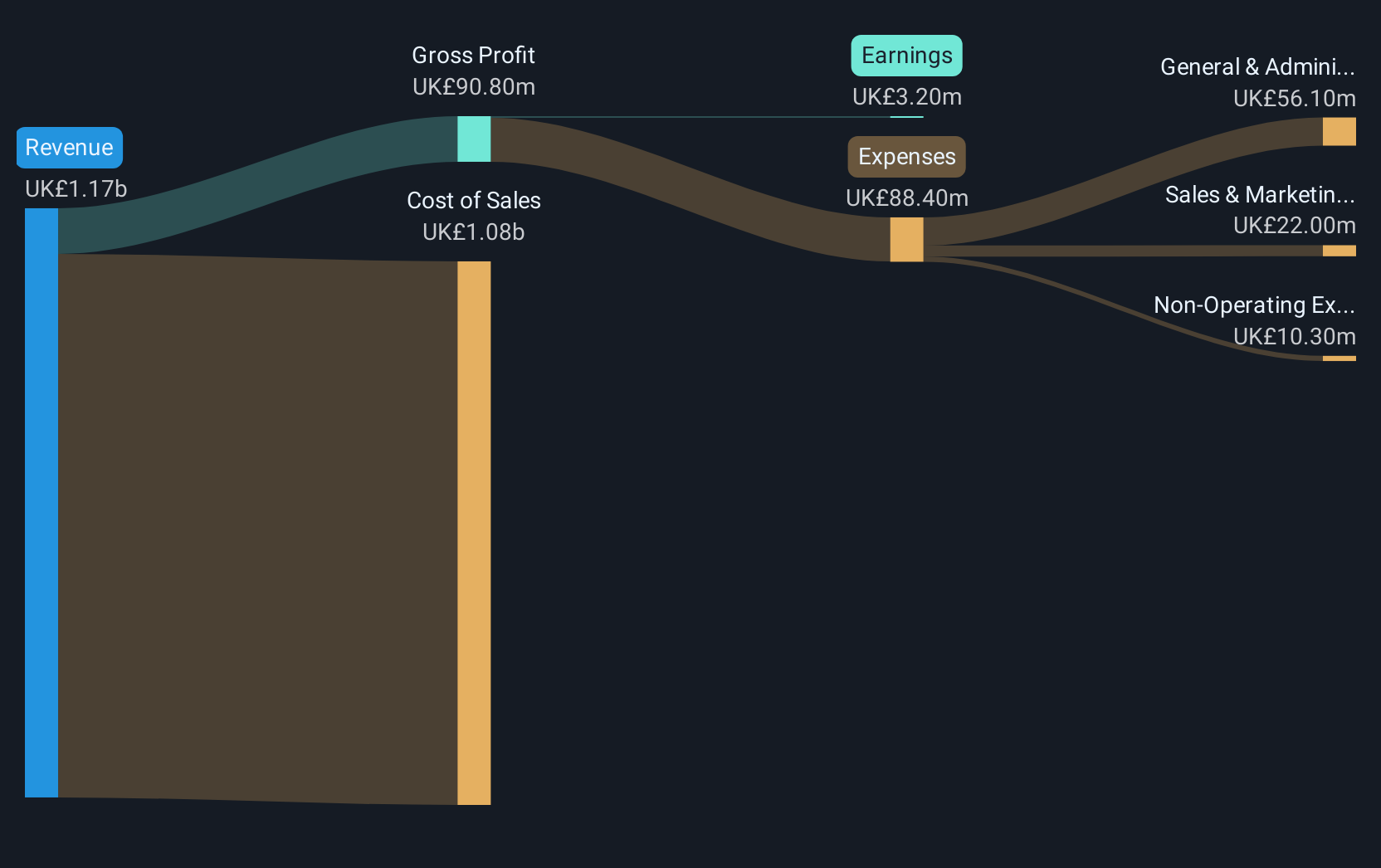

Operations: The company's revenue is derived from two segments: Retail, contributing £1.03 billion, and Wholesale, generating £144.7 million.

Market Cap: £149.84M

Motorpoint Group Plc, with a market cap of £149.84 million, showcases characteristics relevant to penny stocks in the UK. The company has transitioned to profitability this year, reporting net income of £3.2 million compared to a loss previously. Despite earnings declining by 53% annually over five years, recent growth is promising with forecasts suggesting significant future gains. The absence of debt enhances financial stability and short-term assets exceed liabilities comfortably. A share buyback program and proposed dividend indicate shareholder value focus but the return on equity remains low at 11.9%. Trading slightly below estimated fair value suggests potential for appreciation.

- Jump into the full analysis health report here for a deeper understanding of Motorpoint Group.

- Assess Motorpoint Group's future earnings estimates with our detailed growth reports.

Where To Now?

- Reveal the 296 hidden gems among our UK Penny Stocks screener with a single click here.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:SPSY

Spectra Systems

Spectra Systems Corporation invents, develops, and sells integrated optical systems in the United States and internationally.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion