Here's Why Solid State (LON:SOLI) Can Manage Its Debt Responsibly

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Solid State plc (LON:SOLI) makes use of debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Solid State

What Is Solid State's Debt?

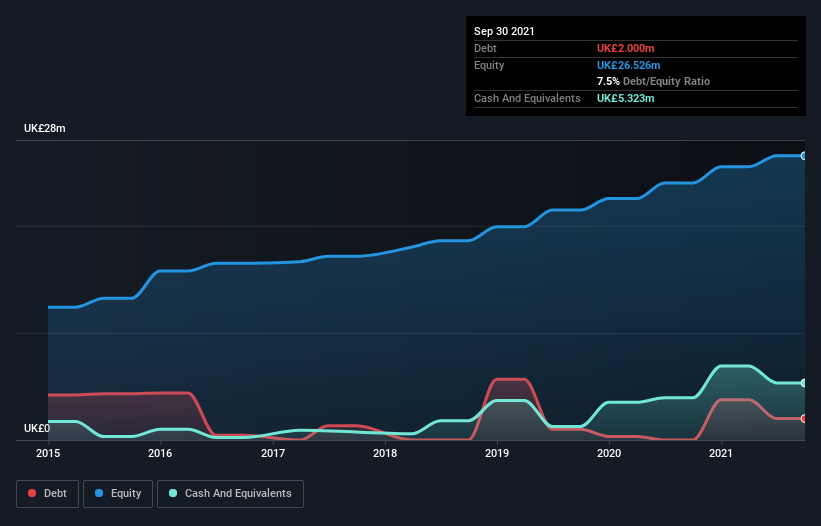

You can click the graphic below for the historical numbers, but it shows that as of September 2021 Solid State had UK£2.00m of debt, an increase on none, over one year. However, its balance sheet shows it holds UK£5.32m in cash, so it actually has UK£3.32m net cash.

A Look At Solid State's Liabilities

According to the last reported balance sheet, Solid State had liabilities of UK£21.4m due within 12 months, and liabilities of UK£6.99m due beyond 12 months. Offsetting this, it had UK£5.32m in cash and UK£15.0m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by UK£8.04m.

Of course, Solid State has a market capitalization of UK£111.1m, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. While it does have liabilities worth noting, Solid State also has more cash than debt, so we're pretty confident it can manage its debt safely.

Solid State's EBIT was pretty flat over the last year, but that shouldn't be an issue given the it doesn't have a lot of debt. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Solid State's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. Solid State may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Solid State actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing up

We could understand if investors are concerned about Solid State's liabilities, but we can be reassured by the fact it has has net cash of UK£3.32m. The cherry on top was that in converted 152% of that EBIT to free cash flow, bringing in UK£8.2m. So we don't think Solid State's use of debt is risky. Over time, share prices tend to follow earnings per share, so if you're interested in Solid State, you may well want to click here to check an interactive graph of its earnings per share history.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SOLI

Solid State

Designs, manufactures, distributes and supplies electronic equipment in the United Kingdom, rest of Europe, Asia, North America, and Internationally.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

A formidable player in AI and enterprise computing.

Bad management practices jeopardize long-term future of VRSN

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks