Synectics (LON:SNX) Is Increasing Its Dividend To £0.03

Synectics plc's (LON:SNX) dividend will be increasing from last year's payment of the same period to £0.03 on 3rd of May. Based on this payment, the dividend yield for the company will be 1.7%, which is fairly typical for the industry.

See our latest analysis for Synectics

Synectics' Payment Has Solid Earnings Coverage

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Before making this announcement, Synectics was easily earning enough to cover the dividend. As a result, a large proportion of what it earned was being reinvested back into the business.

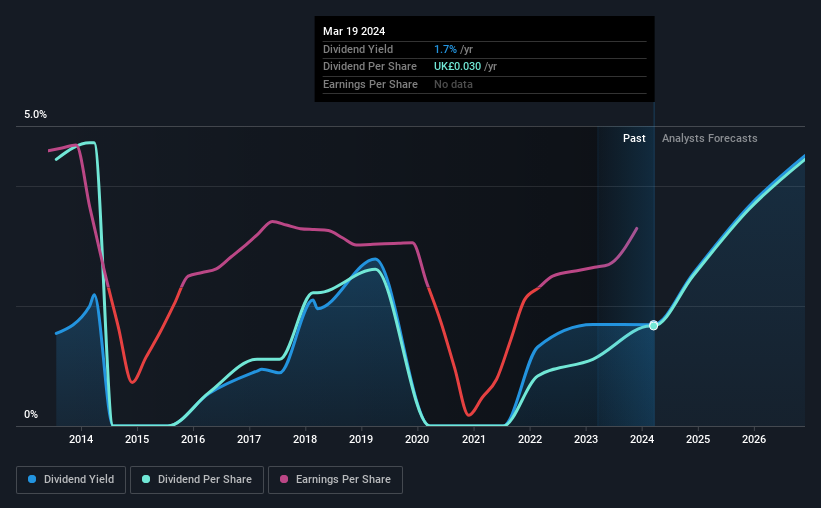

Looking forward, earnings per share is forecast to rise by 126.4% over the next year. Assuming the dividend continues along recent trends, we think the payout ratio could be 8.9% by next year, which is in a pretty sustainable range.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The annual payment during the last 10 years was £0.08 in 2014, and the most recent fiscal year payment was £0.03. Doing the maths, this is a decline of about 9.3% per year. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

We Could See Synectics' Dividend Growing

Dividends have been going in the wrong direction, so we definitely want to see a different trend in the earnings per share. We are encouraged to see that Synectics has grown earnings per share at 6.8% per year over the past five years. A low payout ratio and decent growth suggests that the company is reinvesting well, and it also has plenty of room to increase the dividend over time.

In Summary

In summary, it's great to see that the company can raise the dividend and keep it in a sustainable range. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. This looks like it could be a good dividend stock going forward, but we would note that the payout ratio has been at higher levels in the past so it could happen again.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 1 warning sign for Synectics that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SNX

Synectics

Provides specialist video based electronic surveillance systems and technology for use in security applications, environments, and transport applications in the United Kingdom, rest of Europe, North America, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)