Seeing Machines (LON:SEE) adds UK£15m to market cap in the past 7 days, though investors from three years ago are still down 71%

This week we saw the Seeing Machines Limited (LON:SEE) share price climb by 18%. But that is meagre solace in the face of the shocking decline over three years. To wit, the share price sky-dived 71% in that time. Arguably, the recent bounce is to be expected after such a bad drop. The thing to think about is whether the business has really turned around.

While the stock has risen 18% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

We've discovered 3 warning signs about Seeing Machines. View them for free.Because Seeing Machines made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years, Seeing Machines saw its revenue grow by 21% per year, compound. That is faster than most pre-profit companies. So on the face of it we're really surprised to see the share price down 20% a year in the same time period. The share price makes us wonder if there is an issue with profitability. Sometimes fast revenue growth doesn't lead to profits. If the company is low on cash, it may have to raise capital soon.

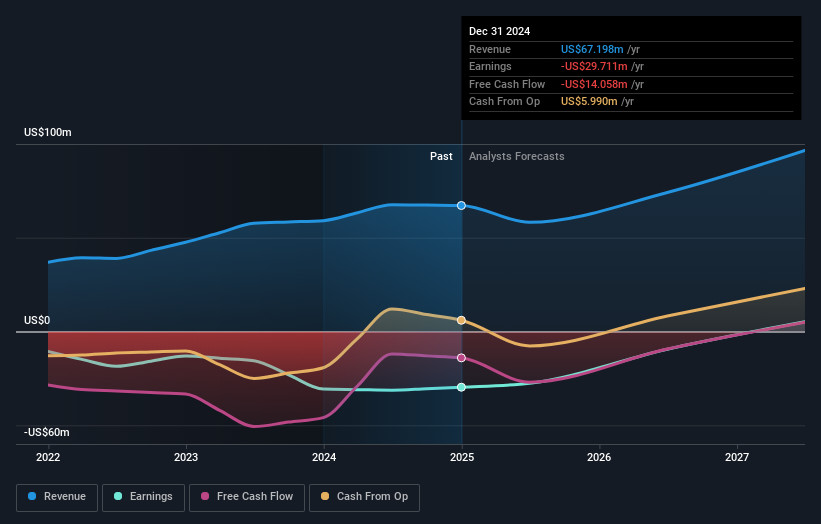

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. If you are thinking of buying or selling Seeing Machines stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

While the broader market gained around 5.3% in the last year, Seeing Machines shareholders lost 60%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 3% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Seeing Machines (1 is a bit concerning) that you should be aware of.

Seeing Machines is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:SEE

Seeing Machines

Provides driver and occupant monitoring system technologies in Australia, North America, the Asia Pacific, Europe, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives