- United Kingdom

- /

- Life Sciences

- /

- AIM:DXRX

UK Penny Stocks To Consider In December 2024

Reviewed by Simply Wall St

The UK market has experienced recent turbulence, with the FTSE 100 index closing lower due to weak trade data from China, highlighting ongoing global economic uncertainties. Despite these challenges, investors often seek opportunities in smaller or newer companies that can offer unique value propositions. Penny stocks, though an older term, still hold relevance as they can provide a mix of growth and stability when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.23 | £840.18M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.405 | £438.1M | ★★★★☆☆ |

| Ultimate Products (LSE:ULTP) | £1.18 | £100.7M | ★★★★★★ |

| Solid State (AIM:SOLI) | £1.25 | £71.31M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.30 | £200.5M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.40 | £178.29M | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4135 | $240.38M | ★★★★★★ |

| Tristel (AIM:TSTL) | £4.00 | £190.77M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £1.04 | £78.76M | ★★★★★★ |

Click here to see the full list of 469 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Diaceutics (AIM:DXRX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Diaceutics PLC is a diagnostic commercialisation company that offers data, data analytics, and implementation services to pharmaceutical companies globally, with a market cap of £98.41 million.

Operations: The company generates revenue of £26.10 million from its Medical Labs & Research segment.

Market Cap: £98.41M

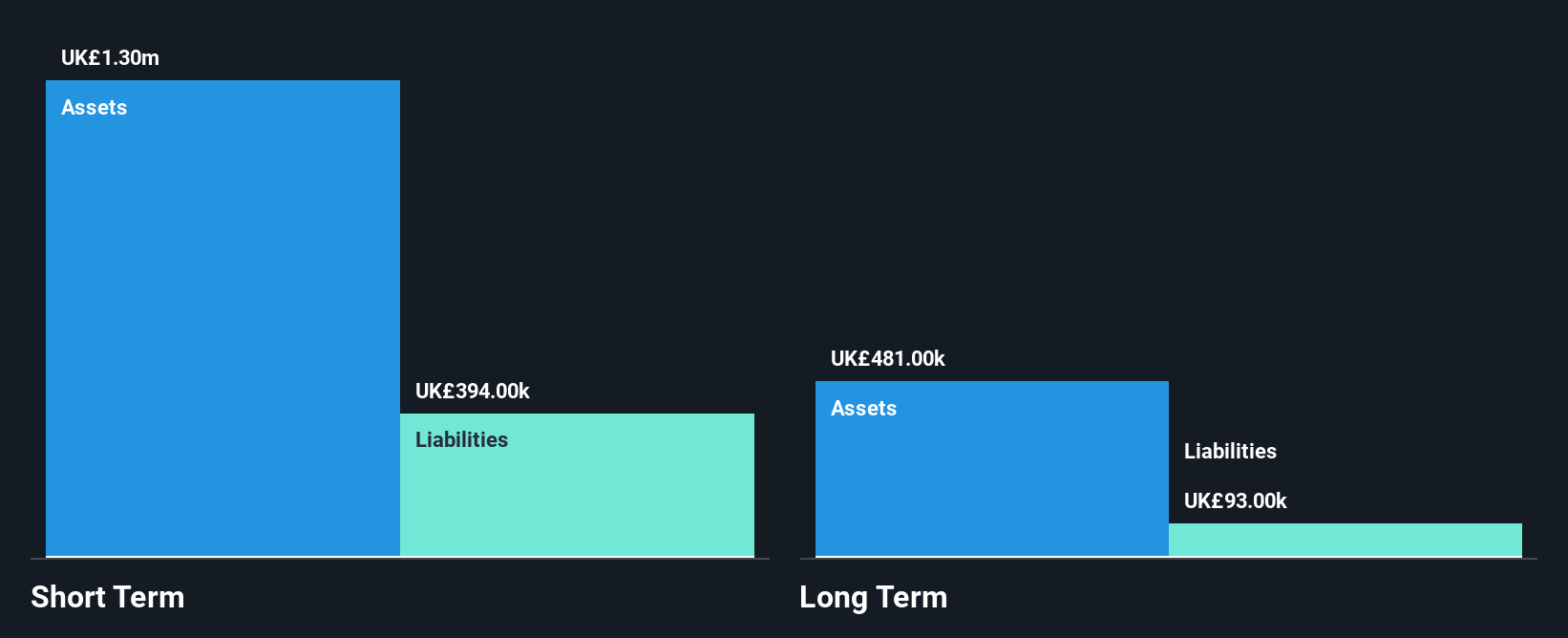

Diaceutics PLC, with a market cap of £98.41 million, is navigating the penny stock landscape with some financial challenges and strategic changes. Despite generating £26.10 million in revenue from its Medical Labs & Research segment, the company remains unprofitable, reporting increased net losses over recent periods. However, Diaceutics has no debt and maintains strong short-term asset coverage over liabilities. Recent board restructuring includes experienced industry leaders like Cheryl MacDiarmid joining as a Non-Executive Director. Analysts are optimistic about future growth prospects, forecasting significant earnings growth and suggesting potential undervaluation relative to fair value estimates.

- Get an in-depth perspective on Diaceutics' performance by reading our balance sheet health report here.

- Evaluate Diaceutics' prospects by accessing our earnings growth report.

Image Scan Holdings (AIM:IGE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Image Scan Holdings Plc, with a market cap of £3.76 million, operates through its subsidiary 3DX-Ray Limited to manufacture and sell portable X-ray systems for security and counter-terrorism across various global regions including the United Kingdom, Europe, the Middle East, Africa, Asia, Indian Subcontinent, and the Americas.

Operations: No specific revenue segments are reported for Image Scan Holdings.

Market Cap: £3.76M

Image Scan Holdings Plc, with a market cap of £3.76 million, demonstrates financial stability in the penny stock sector by maintaining no debt and covering both short-term (£870.8K) and long-term (£102.5K) liabilities with assets (£2.2M). The company reported sales of £2.86 million for FY24, reflecting a slight decrease from the previous year but an increase in net income to £0.207 million from £0.124 million, showcasing improved profitability margins (7.2%). Strategic growth is evident through recent contract wins like the significant NP Aerospace deal valued at approximately £3 million over three years, indicating potential for future revenue expansion.

- Click to explore a detailed breakdown of our findings in Image Scan Holdings' financial health report.

- Assess Image Scan Holdings' previous results with our detailed historical performance reports.

Mind Gym (AIM:MIND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mind Gym plc is a behavioural science company operating in the United Kingdom, Singapore, the United States, and Canada with a market cap of £19.55 million.

Operations: Revenue segments for the company are not reported.

Market Cap: £19.55M

Mind Gym plc, with a market cap of £19.55 million, operates without debt and has short-term assets of £7.5 million that do not fully cover its short-term liabilities (£7.9M). The management team and board are experienced, with average tenures of 4.9 and 5.3 years respectively. Despite being unprofitable, recent earnings for the half-year showed a reduced net loss of £0.787 million compared to £11.36 million previously, indicating some improvement in financial performance. The company anticipates underlying revenue growth in FY26 despite expected headline revenue declines due to the conclusion of an energy framework agreement in December 2024.

- Take a closer look at Mind Gym's potential here in our financial health report.

- Understand Mind Gym's earnings outlook by examining our growth report.

Summing It All Up

- Gain an insight into the universe of 469 UK Penny Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:DXRX

Diaceutics

A diagnostic commercialisation company, provides data, data analytics, and implementation services for pharmaceutical companies worldwide.

Flawless balance sheet and good value.