Why Croma Security Solutions Group's (LON:CSSG) CEO Pay Matters

This article will reflect on the compensation paid to Roberto Fiorentino who has served as CEO of Croma Security Solutions Group plc (LON:CSSG) since 2012. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Croma Security Solutions Group

How Does Total Compensation For Roberto Fiorentino Compare With Other Companies In The Industry?

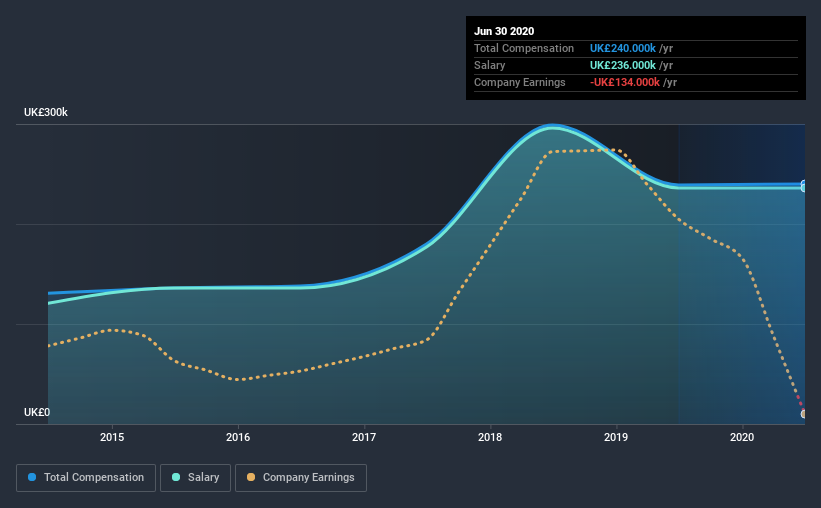

At the time of writing, our data shows that Croma Security Solutions Group plc has a market capitalization of UK£11m, and reported total annual CEO compensation of UK£240k for the year to June 2020. That is, the compensation was roughly the same as last year. In particular, the salary of UK£236.0k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below UK£146m, reported a median total CEO compensation of UK£240k. This suggests that Croma Security Solutions Group remunerates its CEO largely in line with the industry average. What's more, Roberto Fiorentino holds UK£2.8m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£236k | UK£236k | 98% |

| Other | UK£4.0k | UK£3.0k | 2% |

| Total Compensation | UK£240k | UK£239k | 100% |

Speaking on an industry level, nearly 78% of total compensation represents salary, while the remainder of 22% is other remuneration. Croma Security Solutions Group is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Croma Security Solutions Group plc's Growth Numbers

Croma Security Solutions Group plc has reduced its earnings per share by 11% a year over the last three years. Its revenue is down 6.6% over the previous year.

Overall this is not a very positive result for shareholders. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Croma Security Solutions Group plc Been A Good Investment?

With a three year total loss of 10% for the shareholders, Croma Security Solutions Group plc would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Croma Security Solutions Group pays its CEO a majority of compensation through a salary. As we touched on above, Croma Security Solutions Group plc is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. In the meantime, the company has reported declining EPS growth and shareholder returns over the last three years. We'd stop short of saying compensation is inappropriate, but we would understand if shareholders had questions regarding a future raise.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 2 warning signs for Croma Security Solutions Group that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade Croma Security Solutions Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:CSSG

Croma Security Solutions Group

Provides security services in the United Kingdom.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

GameStop will ace the financial crisis wave with its strategic Bitcoin investment and cash reserves

BABA Analysis: Buying the Fear, Holding the Cloud

Q3 Outlook modestly optimistic

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale