- United Kingdom

- /

- Trade Distributors

- /

- LSE:MACF

Uncovering 3 Undiscovered Gems in the United Kingdom Market

Reviewed by Simply Wall St

The United Kingdom market has recently faced challenges, as reflected in the FTSE 100's decline following weak trade data from China, highlighting concerns over global economic recovery and its impact on UK companies. Despite these headwinds, there remain opportunities within the market for discerning investors who seek stocks with strong fundamentals and resilience to broader economic pressures.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| BioPharma Credit | NA | 7.22% | 7.91% | ★★★★★★ |

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| MS INTERNATIONAL | NA | 13.42% | 56.55% | ★★★★★★ |

| Rights and Issues Investment Trust | NA | -7.87% | -8.41% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.08% | 5.03% | ★★★★★★ |

| Nationwide Building Society | 277.32% | 10.61% | 23.42% | ★★★★★☆ |

| FW Thorpe | 2.95% | 11.79% | 13.49% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| AltynGold | 73.21% | 26.90% | 31.85% | ★★★★☆☆ |

| Law Debenture | 17.80% | 11.81% | 7.59% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Concurrent Technologies (AIM:CNC)

Simply Wall St Value Rating: ★★★★★★

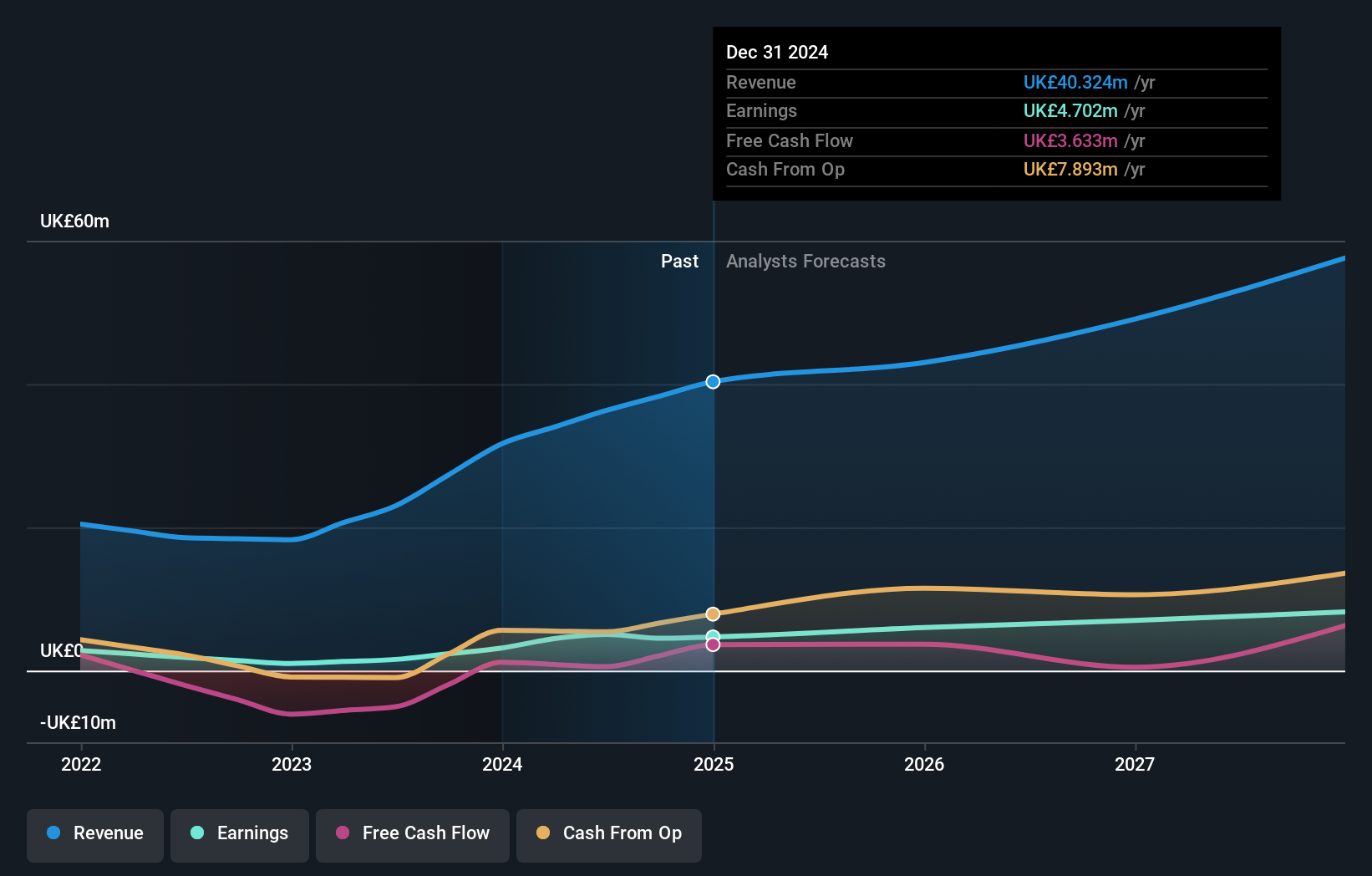

Overview: Concurrent Technologies Plc, along with its subsidiaries, specializes in designing, developing, manufacturing, and marketing single board computers for system integrators and original equipment manufacturers globally, with a market cap of £184.88 million.

Operations: The primary revenue stream for Concurrent Technologies comes from the design, manufacture, and supply of high-end embedded computer products, generating £40.32 million. The company's market cap stands at £184.88 million.

Concurrent Technologies, a nimble player in the tech sector, showcases impressive growth with earnings surging 48.8% last year, outpacing the industry average of 26.2%. The company is debt-free for five years and maintains high-quality earnings, contributing to its robust financial health. Recent expansion plans include a new headquarters and manufacturing facility costing £5 million, funded from existing reserves. Despite significant insider selling recently, prospects remain bright with forecasted earnings growth at 17.76% annually. A proposed dividend increase to 1.1 pence per share further underscores confidence in continued profitability and shareholder value enhancement.

Macfarlane Group (LSE:MACF)

Simply Wall St Value Rating: ★★★★★★

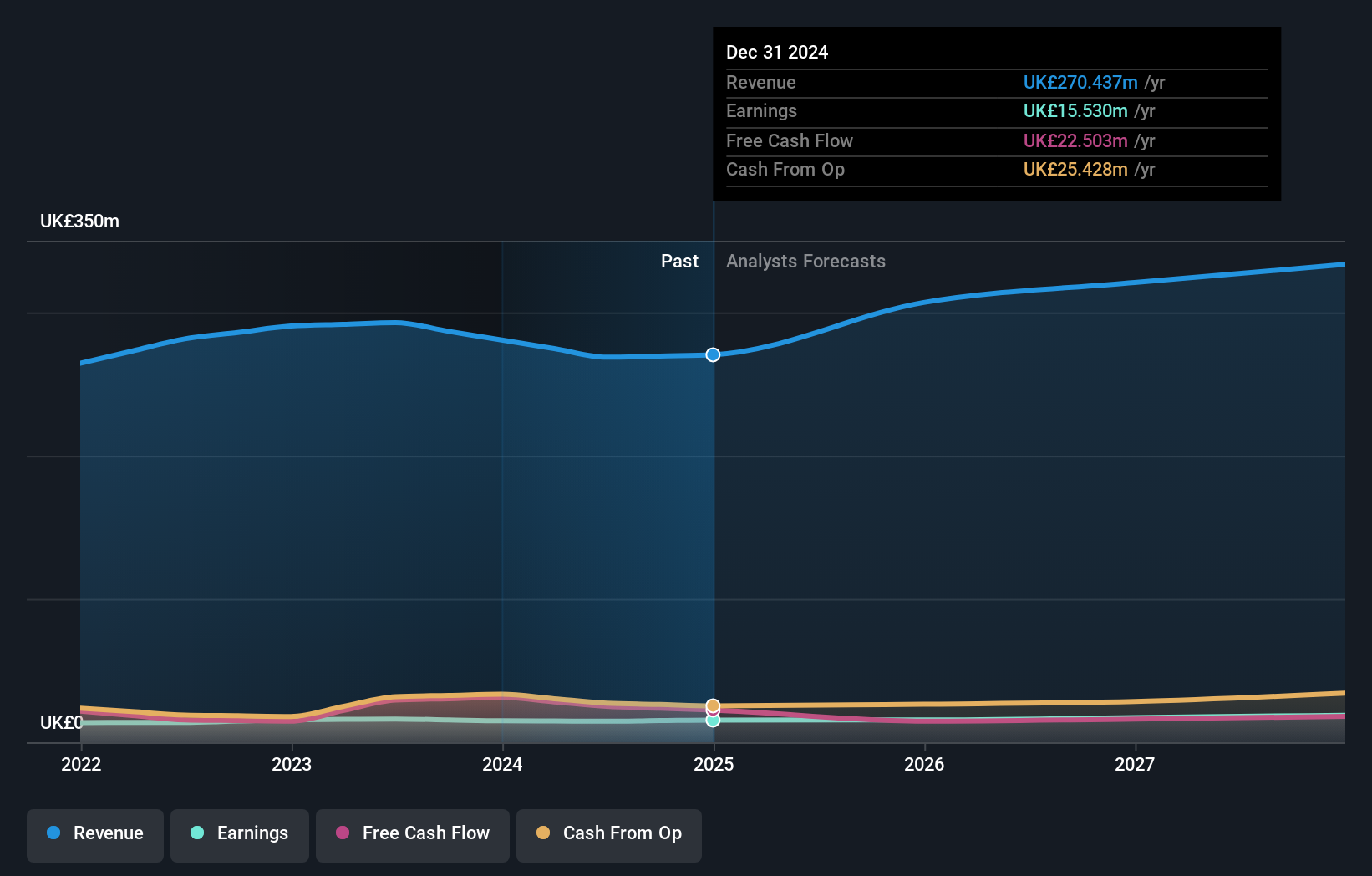

Overview: Macfarlane Group PLC designs, manufactures, and distributes protective packaging products to businesses in the United Kingdom and Europe, with a market capitalization of £190.38 million.

Operations: The company's primary revenue streams are Packaging Distribution, contributing £228.76 million, and Manufacturing Operations, generating £47.46 million.

Macfarlane Group, a nimble player in the packaging sector, is making strategic moves to strengthen its market position. The acquisition of Pitreavie enhances its footprint in Scotland's food and drink industry, potentially boosting gross margins through local manufacturing capabilities. With earnings growth at 3.7% last year, outpacing the industry average of -4.9%, Macfarlane shows resilience and adaptability. Its net debt to equity ratio of 1.6% reflects prudent financial management, while an EBIT coverage of interest payments by 8.4 times indicates robust profitability support. Despite insider selling recently, the company trades at a compelling discount to fair value estimates by 32%.

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Value Rating: ★★★★★★

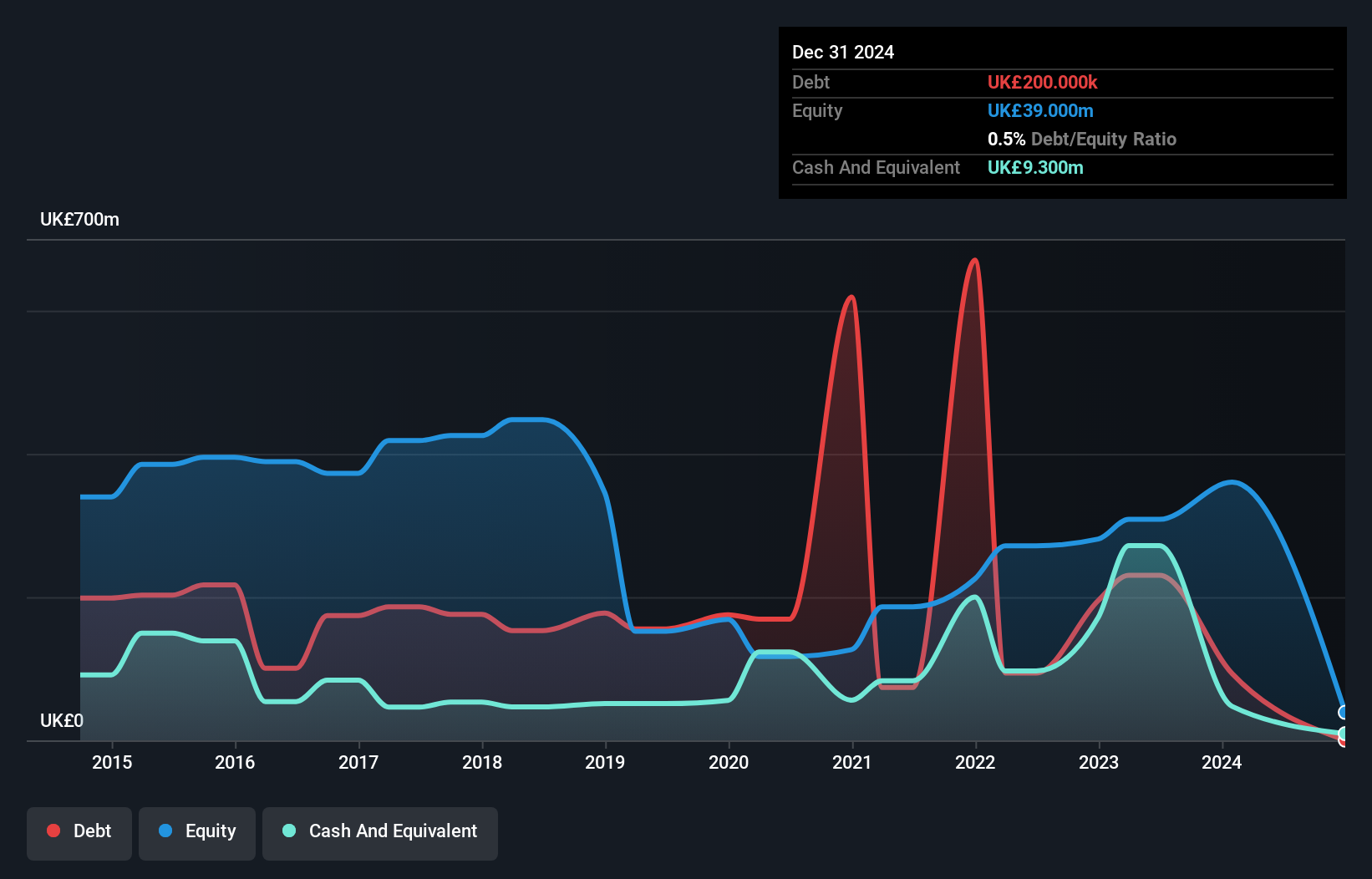

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider with operations spanning the United Kingdom, Europe, Africa, Asia, the Middle East, and other international markets; it has a market capitalization of £406.67 million.

Operations: Pinewood Technologies Group generates revenue primarily through its cloud-based dealer management software services. The company operates across multiple regions, including the United Kingdom, Europe, Africa, Asia, and the Middle East.

Pinewood Technologies Group, a dynamic player in the automotive software sector, is making waves with its strategic moves. Their acquisition of Seez AI promises to enhance cross-sell and upsell capabilities, potentially boosting revenue. Partnerships with UK giants like Marshalls and Lookers further strengthen their market position. Recent financials show sales at £31.2 million and net income of £5.7 million for the eleven months ending December 2024, reflecting robust performance despite a one-off £2.4 million loss impacting results. With earnings growth outpacing industry averages and debt-to-equity dropping from 103.8% to 0.5% over five years, Pinewood seems poised for continued expansion but must navigate international challenges carefully to sustain momentum.

Next Steps

- Click this link to deep-dive into the 58 companies within our UK Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MACF

Macfarlane Group

Through its subsidiaries, designs, manufactures, and distributes protective packaging products to businesses in the United Kingdom and Europe.

Adequate balance sheet average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion