- United Kingdom

- /

- Tech Hardware

- /

- AIM:CNC

Optimistic Investors Push Concurrent Technologies Plc (LON:CNC) Shares Up 27% But Growth Is Lacking

Despite an already strong run, Concurrent Technologies Plc (LON:CNC) shares have been powering on, with a gain of 27% in the last thirty days. The last month tops off a massive increase of 113% in the last year.

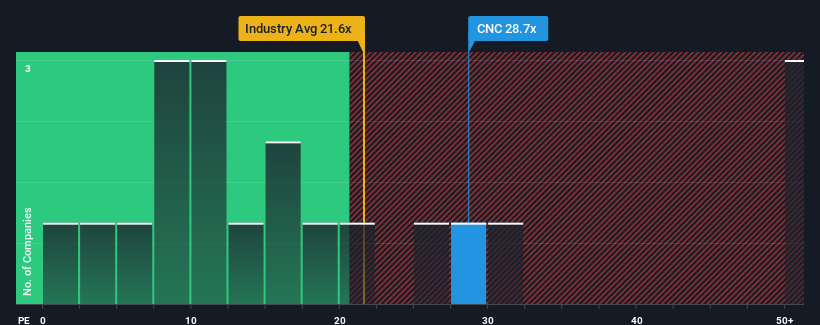

Since its price has surged higher, given close to half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") below 15x, you may consider Concurrent Technologies as a stock to avoid entirely with its 28.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Concurrent Technologies certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Concurrent Technologies

Is There Enough Growth For Concurrent Technologies?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Concurrent Technologies' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 182%. The strong recent performance means it was also able to grow EPS by 39% in total over the last three years. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 14% per year during the coming three years according to the two analysts following the company. With the market predicted to deliver 13% growth per year, the company is positioned for a comparable earnings result.

In light of this, it's curious that Concurrent Technologies' P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Key Takeaway

Shares in Concurrent Technologies have built up some good momentum lately, which has really inflated its P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Concurrent Technologies currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Concurrent Technologies, and understanding should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:CNC

Concurrent Technologies

Designs, develops, manufactures, and markets single board computers for system integrators and original equipment manufacturers.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

The Green Consolidator

EDP as a safe capital allocation with a potential upside of 28% with steady dividends

#1 Silver Play with Positive Cashflow Gold Miner (Top Notch Team)

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion