- United Kingdom

- /

- Chemicals

- /

- AIM:EDEN

Big Technologies And 2 Other UK Penny Stocks To Watch

Reviewed by Simply Wall St

Over the last 7 days, the UK market has remained flat, while it has risen 6.1% over the past year and earnings are forecast to grow by 15% annually. For those looking to invest in smaller or newer companies, penny stocks—despite their somewhat outdated name—can still offer surprising value. Typically referring to smaller or relatively new companies, these stocks can provide a mix of affordability and growth potential when paired with strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.76 | £373.95M | ★★★★☆☆ |

| Solid State (AIM:SOLI) | £1.202751 | £69.6M | ★★★★★★ |

| Serabi Gold (AIM:SRB) | £0.8975 | £67.4M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.635825 | £190.08M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £1.225 | £104.12M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.278 | £197.1M | ★★★★★☆ |

| Stelrad Group (LSE:SRAD) | £1.38 | £175.75M | ★★★★★☆ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.39 | $226.72M | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | £3.20 | £409.48M | ★★★★★★ |

Click here to see the full list of 463 stocks from our UK Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Big Technologies (AIM:BIG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Big Technologies PLC develops and delivers remote monitoring technologies and services for the offender and remote personal monitoring industry under the Buddi brand across the Americas, Europe, and Asia-Pacific, with a market cap of £394.46 million.

Operations: The company generates £54.45 million in revenue from its electronic tracking devices, products, and services segment.

Market Cap: £394.46M

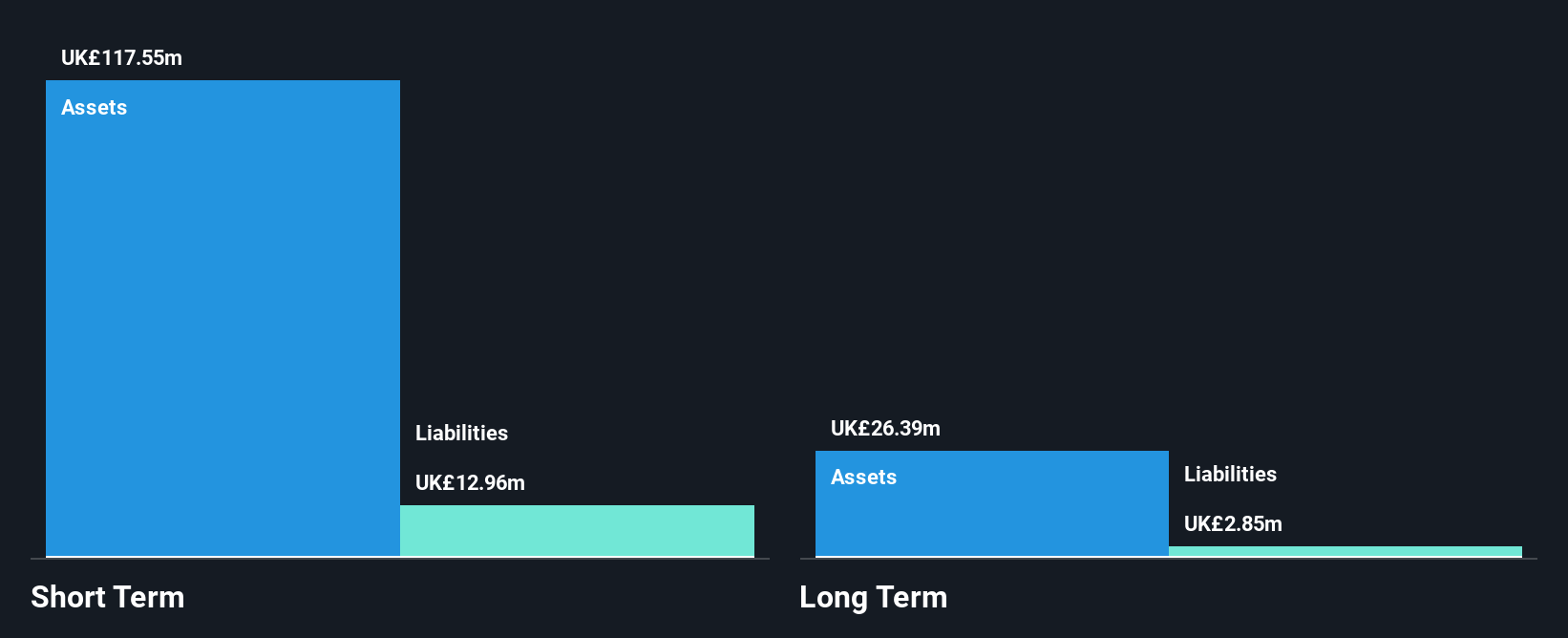

Big Technologies PLC, with a market cap of £394.46 million, is debt-free and maintains high-quality earnings, although recent earnings growth has been negative. The company reported a drop in net income for the half-year ending June 2024, at £3.94 million compared to £8.99 million previously. Despite this, its short-term assets significantly exceed both short and long-term liabilities. The firm recently initiated a share buyback program to repurchase up to 5 million shares by mid-2025, reflecting confidence in its financial stability despite reduced profit margins from last year’s 36.4% to the current 23%.

- Click here and access our complete financial health analysis report to understand the dynamics of Big Technologies.

- Understand Big Technologies' earnings outlook by examining our growth report.

Eden Research (AIM:EDEN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eden Research plc, with a market cap of £20.27 million, develops and sells biopesticide solutions for crop protection, animal health, and consumer products industries in the United Kingdom and Europe.

Operations: The company's revenue is derived from its Agrochemicals segment, contributing £3.86 million, and Consumer Products segment, adding £0.07 million.

Market Cap: £20.27M

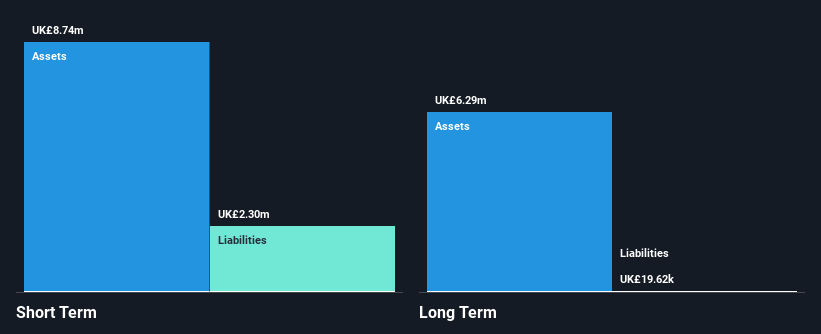

Eden Research plc, with a market cap of £20.27 million, operates in the biopesticide sector and remains debt-free. Despite being unprofitable with losses increasing over the past five years, its revenue has shown growth, reaching £1.89 million for H1 2024 compared to £1.14 million previously. The company recently delisted from the US OTCQB exchange due to low trading activity but continues trading on AIM. A recent product approval in Greece for Cedroz presents a commercial opportunity against wireworms in potatoes, potentially enhancing revenue streams amidst ongoing financial challenges and a forecasted annual revenue growth of 16%.

- Jump into the full analysis health report here for a deeper understanding of Eden Research.

- Review our growth performance report to gain insights into Eden Research's future.

Gear4music (Holdings) (AIM:G4M)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Gear4music (Holdings) plc is a retailer of musical instruments and equipment operating in the United Kingdom, Europe, and internationally, with a market cap of £33.56 million.

Operations: No specific revenue segments are reported for the company.

Market Cap: £33.56M

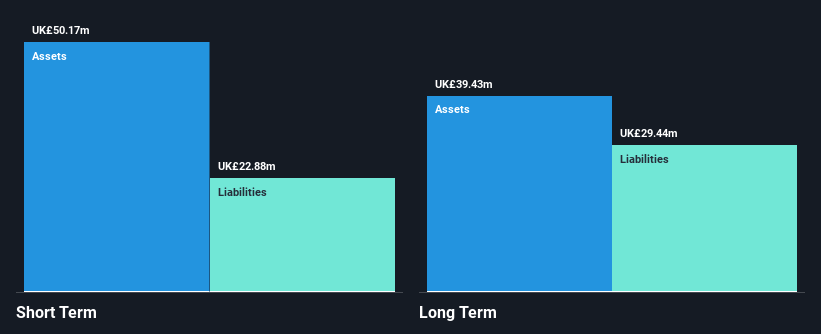

Gear4music (Holdings) plc, with a market cap of £33.56 million, has shown a stable financial position despite recent challenges. The company reported sales of £61.74 million for the half year ended September 2024, slightly down from the previous year. Although it posted a net loss of £1.23 million, this was an improvement over last year's loss. Gear4music's debt to equity ratio has improved over time and its debt is well covered by operating cash flow. However, its return on equity remains low at 2.6%, and interest payments are not well covered by EBIT, indicating some financial pressure persists.

- Get an in-depth perspective on Gear4music (Holdings)'s performance by reading our balance sheet health report here.

- Learn about Gear4music (Holdings)'s future growth trajectory here.

Where To Now?

- Embark on your investment journey to our 463 UK Penny Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Eden Research might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:EDEN

Eden Research

Engages in the development and sale of biopesticides in Europe and the United Kingdom.

Moderate risk with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion