- United Kingdom

- /

- Communications

- /

- AIM:AFRN

Aferian's (LON:AFRN) Upcoming Dividend Will Be Larger Than Last Year's

Aferian Plc's (LON:AFRN) dividend will be increasing to UK£0.021 on 22nd of April. This takes the annual payment to 2.3% of the current stock price, which is about average for the industry.

Check out our latest analysis for Aferian

Aferian's Payment Has Solid Earnings Coverage

Unless the payments are sustainable, the dividend yield doesn't mean too much. Prior to this announcement, Aferian's dividend was only 57% of earnings, however it was paying out 170% of free cash flows. This signals that the company is more focused on returning cash flow to shareholders, but it could mean that the dividend is exposed to cuts in the future.

EPS is set to fall by 2.3% over the next 12 months. If the dividend continues along the path it has been on recently, we estimate the payout ratio could be 37%, which is comfortable for the company to continue in the future.

Dividend Volatility

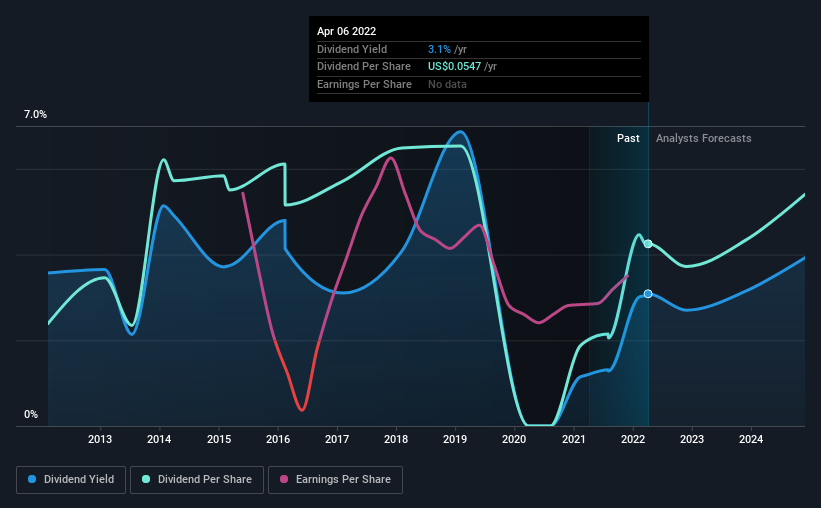

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2012, the dividend has gone from US$0.031 to US$0.055. This implies that the company grew its distributions at a yearly rate of about 5.9% over that duration. We have seen cuts in the past, so while the growth looks promising we would be a little bit cautious about its track record.

Aferian Could Grow Its Dividend

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Aferian has seen EPS rising for the last five years, at 8.4% per annum. The company is paying out a lot of its cash as a dividend, but it looks okay based on the payout ratio.

We'd also point out that Aferian has issued stock equal to 12% of shares outstanding. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Our Thoughts On Aferian's Dividend

In summary, while it's always good to see the dividend being raised, we don't think Aferian's payments are rock solid. While the low payout ratio is redeeming feature, this is offset by the minimal cash to cover the payments. We would be a touch cautious of relying on this stock primarily for the dividend income.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 3 warning signs for Aferian that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:AFRN

Aferian

Operates as a B2B video streaming solutions company in the United States, Latin America, the Netherlands, Europe, the Middle East, Africa, and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026