- United Kingdom

- /

- IT

- /

- LSE:KNOS

UK Growth Companies That Insiders Heavily Invest In

Reviewed by Simply Wall St

The United Kingdom's FTSE 100 index recently faced downward pressure, influenced by weak trade data from China, highlighting the interconnectedness of global economies and its impact on major markets. In such a challenging environment, companies with strong insider ownership can be appealing as they often indicate confidence in the business's long-term growth potential.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Taylor Maritime (LSE:TMI) | 20.7% | 65% |

| SRT Marine Systems (AIM:SRT) | 22.2% | 91.4% |

| Manolete Partners (AIM:MANO) | 38.1% | 29.5% |

| LSL Property Services (LSE:LSL) | 10.4% | 21.2% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 20.8% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 86.7% |

| Energean (LSE:ENOG) | 19% | 48.9% |

| B90 Holdings (AIM:B90) | 22.1% | 157.2% |

| Anglo Asian Mining (AIM:AAZ) | 39.7% | 134.7% |

| ActiveOps (AIM:AOM) | 19.5% | 43.3% |

Here's a peek at a few of the choices from the screener.

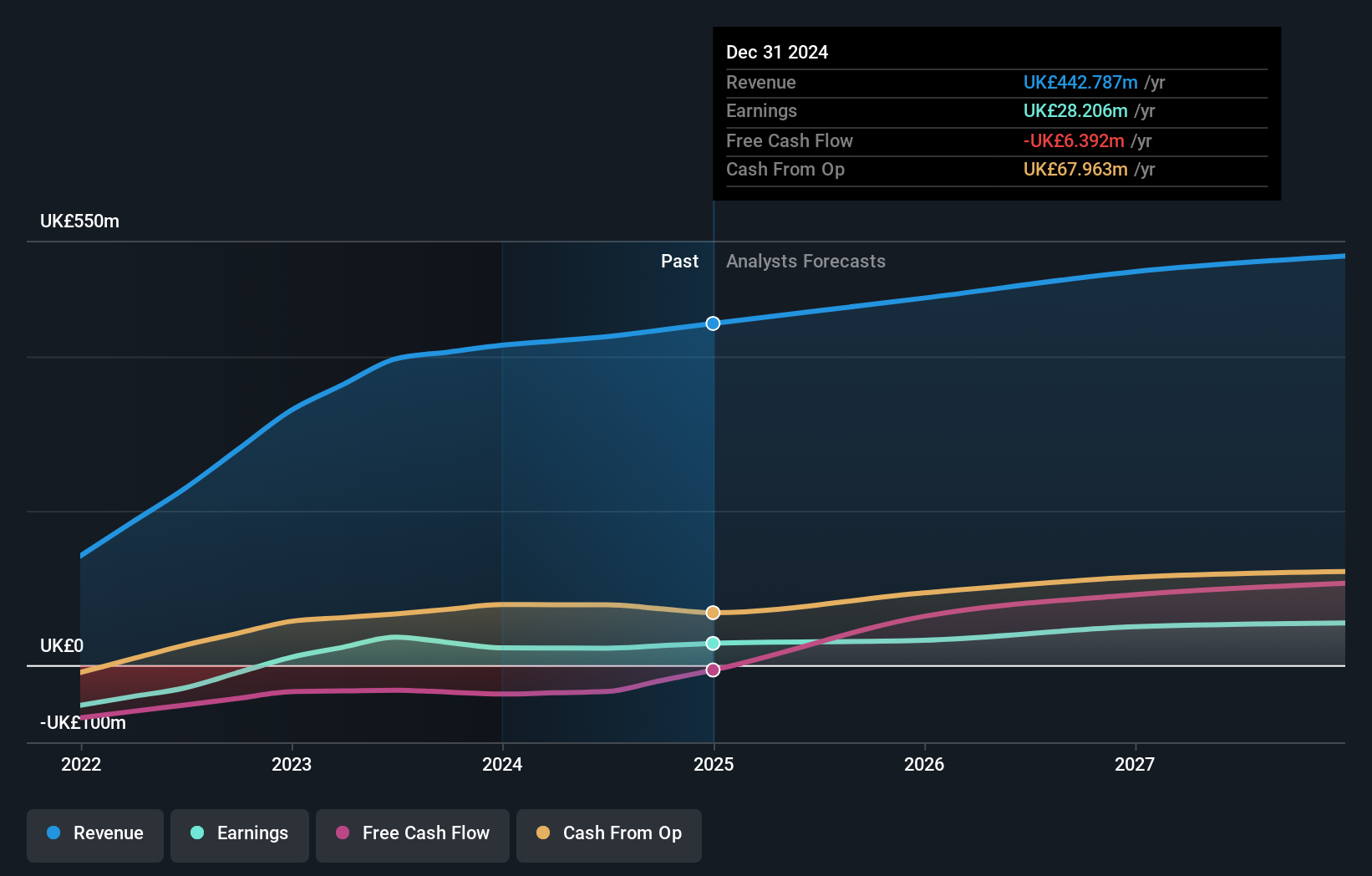

Evoke (LSE:EVOK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Evoke plc, along with its subsidiaries, operates as a betting and gaming company in the United Kingdom, Italy, Spain, Romania, Denmark, and internationally with a market cap of £210.02 million.

Operations: The company's revenue streams are divided into Retail (£499.90 million), UK&I Online (£690.80 million), and International (£589.60 million) segments.

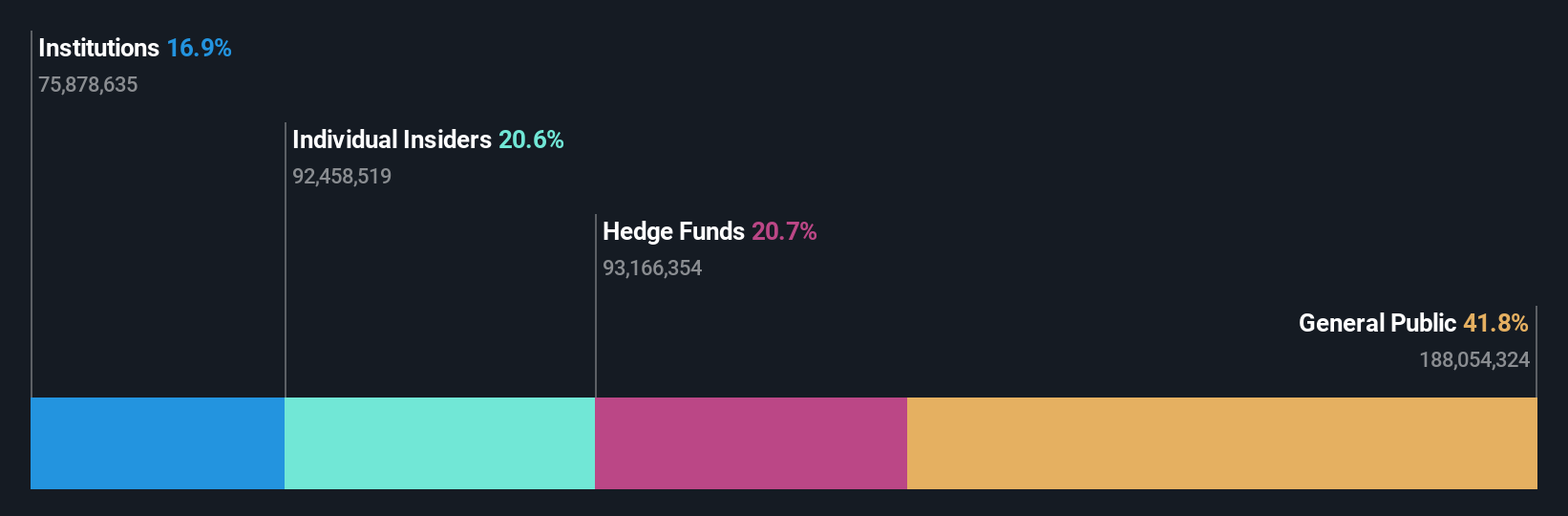

Insider Ownership: 20.6%

Evoke plc is trading at a significant discount to its estimated fair value and is expected to become profitable within three years, with earnings forecasted to grow substantially. Despite slower revenue growth projections, it surpasses the UK market average. Recent financial restructuring includes a £200 million revolving credit facility aimed at refinancing existing debt. The company's recent executive changes may enhance governance in gaming compliance, potentially supporting its strategic objectives and shareholder interests.

- Click here to discover the nuances of Evoke with our detailed analytical future growth report.

- According our valuation report, there's an indication that Evoke's share price might be on the cheaper side.

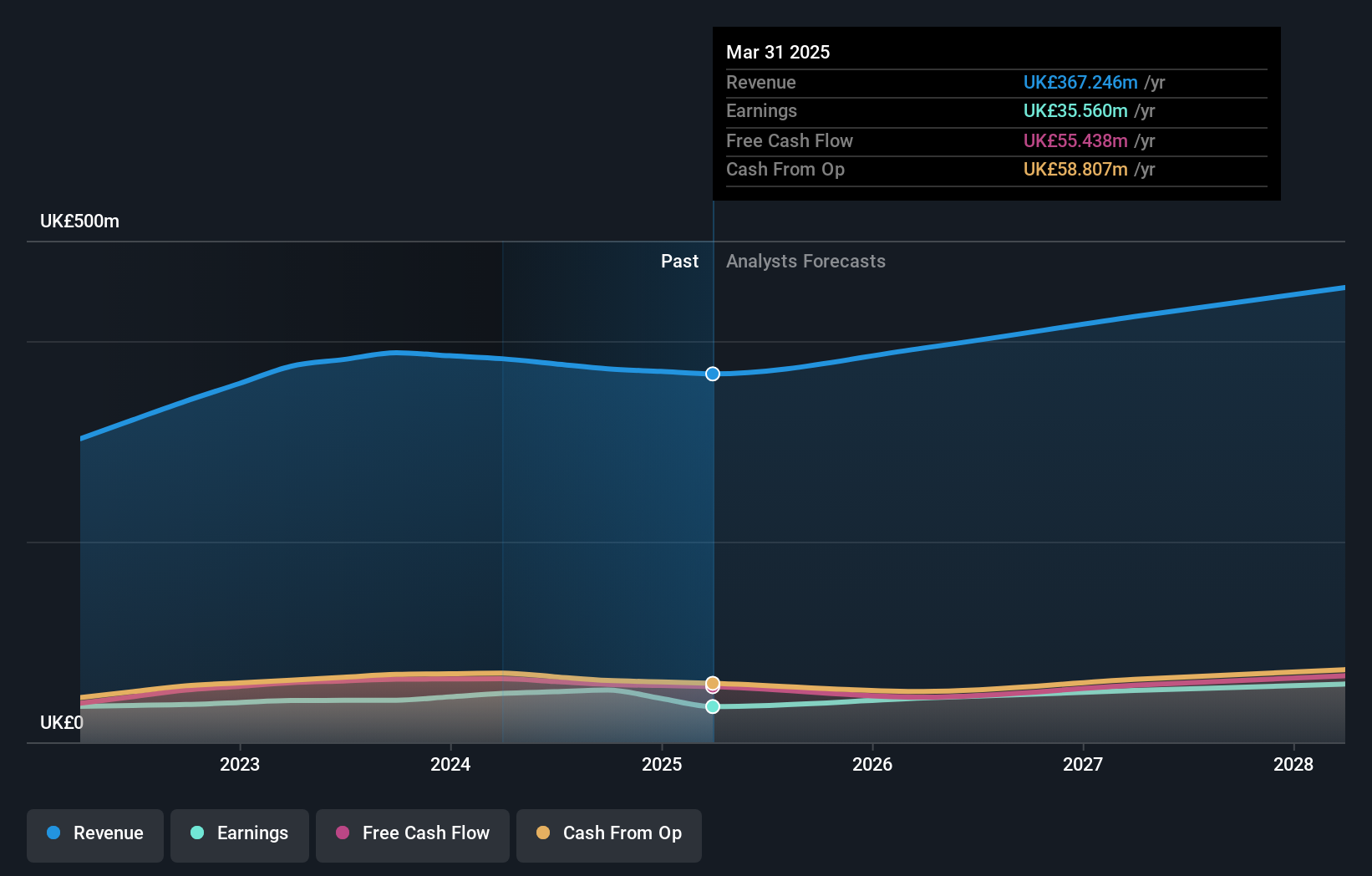

Kainos Group (LSE:KNOS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kainos Group plc provides digital technology services across the United Kingdom, Ireland, the Americas, Central Europe, and internationally, with a market cap of £1.16 billion.

Operations: The company's revenue is derived from three main segments: Digital Services (£197.17 million), Workday Products (£71.35 million), and Workday Services (£98.72 million).

Insider Ownership: 20.6%

Kainos Group's revenue is projected to grow at 7.1% annually, outpacing the UK market average of 4.2%, with earnings expected to increase by 16% per year. The company recently provided guidance indicating revenues for fiscal year ending March 2026 will likely reach the upper end of consensus forecasts, between £378 million and £393.4 million, driven by strong sales performance. Recent board changes include appointing Shruthi Chindalur as a director, potentially strengthening strategic oversight in technology sectors.

- Dive into the specifics of Kainos Group here with our thorough growth forecast report.

- According our valuation report, there's an indication that Kainos Group's share price might be on the expensive side.

PPHE Hotel Group (LSE:PPH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PPHE Hotel Group Limited is involved in owning, co-owning, developing, leasing, operating, and franchising hospitality real estate across several European countries including the Netherlands and the United Kingdom, with a market cap of £551.67 million.

Operations: The company's revenue segments include Management and Central Services (£56.70 million) and Owned Hotel Operations in the United Kingdom (£256.21 million), Croatia (£85.91 million), Germany (£23.33 million), and the Netherlands (£64.59 million).

Insider Ownership: 11.2%

PPHE Hotel Group's earnings are forecast to grow significantly at 28.13% annually, outpacing the UK market's 14.2%. Despite a recent net loss, insider buying activity and its addition to the S&P Global BMI Index signal confidence in future prospects. The company is expanding with a £17.5 million acquisition near London for a mixed-use development, aiming for high single-digit yields upon completion in 2029, enhancing its growth trajectory despite current financial challenges.

- Get an in-depth perspective on PPHE Hotel Group's performance by reading our analyst estimates report here.

- The analysis detailed in our PPHE Hotel Group valuation report hints at an inflated share price compared to its estimated value.

Taking Advantage

- Click here to access our complete index of 60 Fast Growing UK Companies With High Insider Ownership.

- Seeking Other Investments? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kainos Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:KNOS

Kainos Group

Engages in the provision of digital technology services in the United Kingdom, Ireland, the Americas, Central Europe, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives