- United Kingdom

- /

- Software

- /

- LSE:APTD

Exploring High Growth Tech Stocks in the UK for June 2025

Reviewed by Simply Wall St

The United Kingdom's market has recently experienced downturns, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over weak trade data from China, which has impacted companies closely tied to its economic fortunes. In this challenging environment, identifying high-growth tech stocks in the UK requires a focus on companies with strong innovation capabilities and resilience to global economic fluctuations.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Audioboom Group | 8.84% | 59.33% | ★★★★★☆ |

| ENGAGE XR Holdings | 22.08% | 84.46% | ★★★★★★ |

| YouGov | 3.98% | 64.42% | ★★★★★☆ |

| Pinewood Technologies Group | 24.99% | 40.16% | ★★★★★☆ |

| Oxford Biomedica | 16.89% | 80.47% | ★★★★★☆ |

| Windar Photonics | 37.85% | 47.21% | ★★★★★☆ |

| Huddled Group | 21.70% | 114.65% | ★★★★★☆ |

| Trustpilot Group | 15.20% | 40.20% | ★★★★★☆ |

| Quantum Base Holdings | 132.55% | 92.87% | ★★★★★☆ |

| Faron Pharmaceuticals Oy | 55.41% | 54.99% | ★★★★★☆ |

Click here to see the full list of 41 stocks from our UK High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Aptitude Software Group (LSE:APTD)

Simply Wall St Growth Rating: ★★★★☆☆

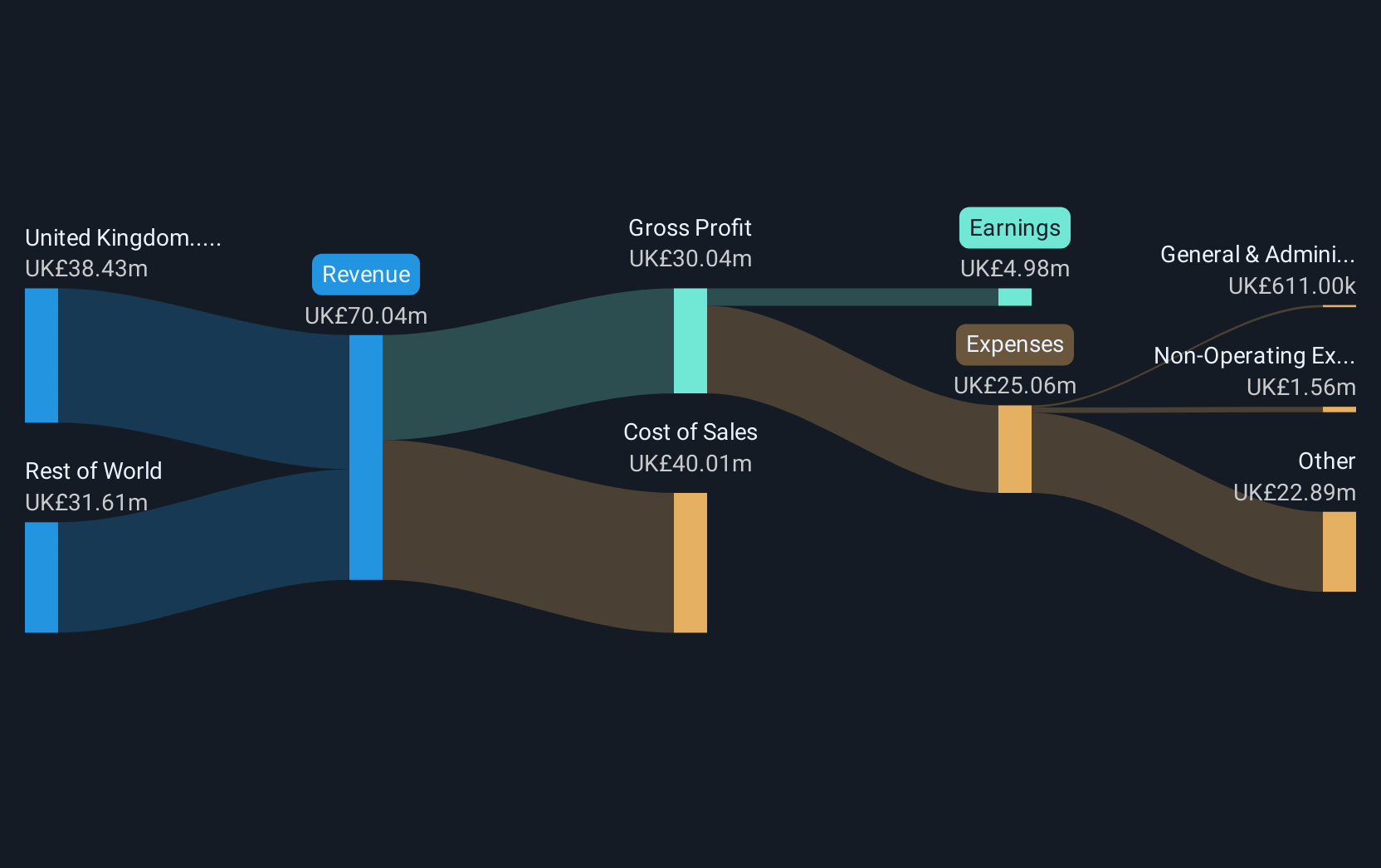

Overview: Aptitude Software Group plc, with a market cap of £185.73 million, offers financial management software solutions across the United Kingdom and international markets.

Operations: Aptitude Software Group generates revenue primarily through its financial management software segment, which reported £70.04 million in revenue.

Aptitude Software Group has demonstrated robust growth with earnings rising by 20.7% over the past year, surpassing the software industry's growth of 17.1%. This performance is underpinned by a strategic focus on innovative products like Fynapse, which recently secured a significant contract due to its advanced AI and data management capabilities, enhancing the company's recurring revenue streams. Additionally, Aptitude’s commitment to shareholder returns is evident from its recent share repurchase of £4 million and consistent dividend payments, reflecting confidence in its financial health and future prospects.

- Get an in-depth perspective on Aptitude Software Group's performance by reading our health report here.

Learn about Aptitude Software Group's historical performance.

Genus (LSE:GNS)

Simply Wall St Growth Rating: ★★★★☆☆

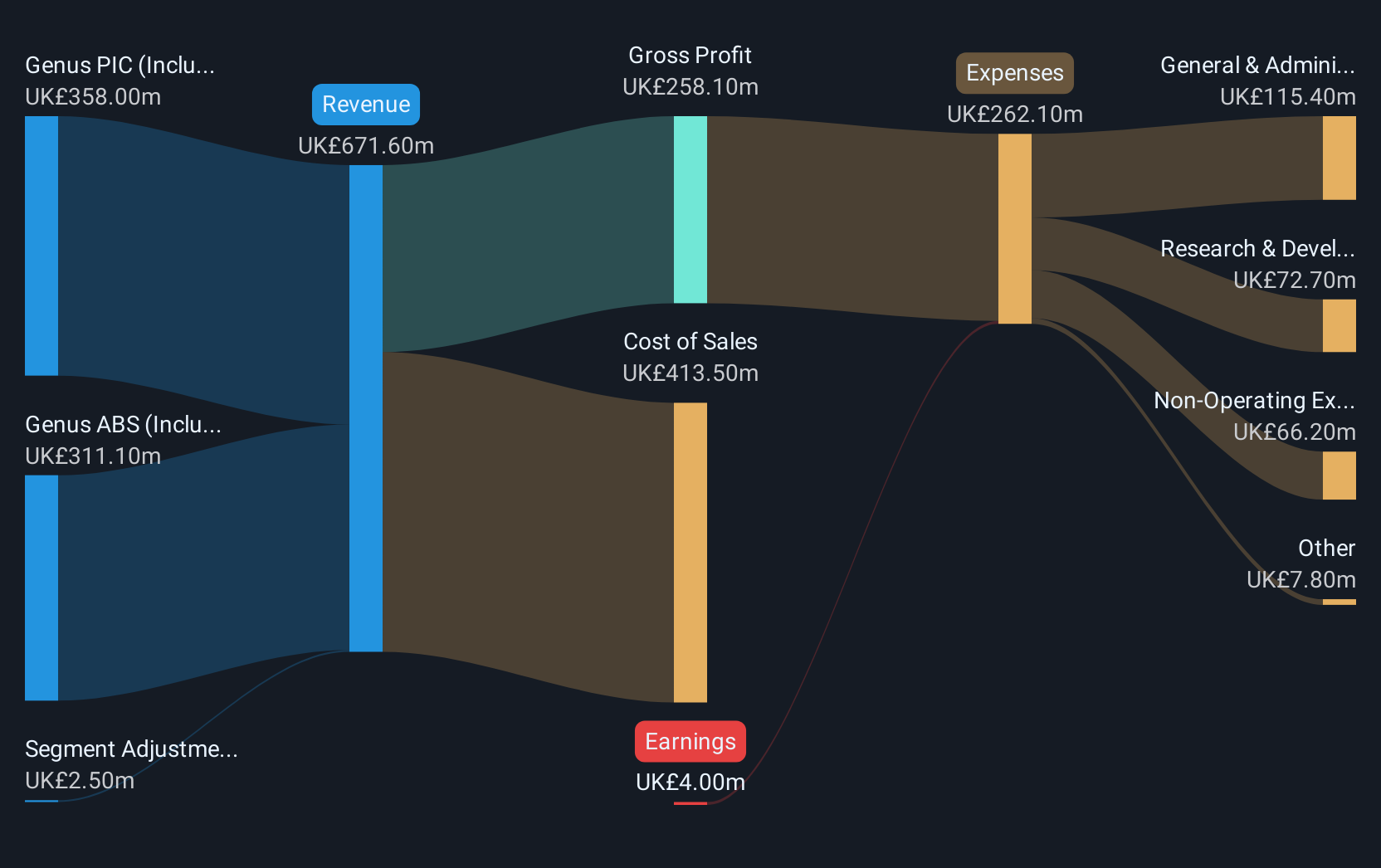

Overview: Genus plc is an animal genetics company with operations spanning North America, Latin America, the United Kingdom, Europe, the Middle East, Russia, Africa, and Asia and has a market capitalization of approximately £1.26 billion.

Operations: Genus generates revenue primarily through its two main segments: Genus ABS, which contributes approximately £311.10 million, and Genus PIC, contributing around £358 million. The company operates within the animal genetics industry across various global regions.

Genus's recent FDA approval marks a pivotal advancement, positioning it to capitalize on the U.S. food supply chain with its PRP gene edit technology—a significant stride given the global impact of PRRS on pig populations. This regulatory milestone complements Genus's robust R&D focus, where expenses have strategically fueled innovations critical to tackling industry-wide challenges like antibiotic resistance. Financially, Genus is navigating a path to profitability with expected earnings growth of 46.67% annually and revenue growth forecasts aligning slightly above the UK market average at 4% per year compared to 3.7%. This trajectory is supported by a positive free cash flow and an anticipated shift into profitability within three years, showcasing potential amidst a challenging biotech landscape.

- Click to explore a detailed breakdown of our findings in Genus' health report.

Gain insights into Genus' past trends and performance with our Past report.

Kainos Group (LSE:KNOS)

Simply Wall St Growth Rating: ★★★★☆☆

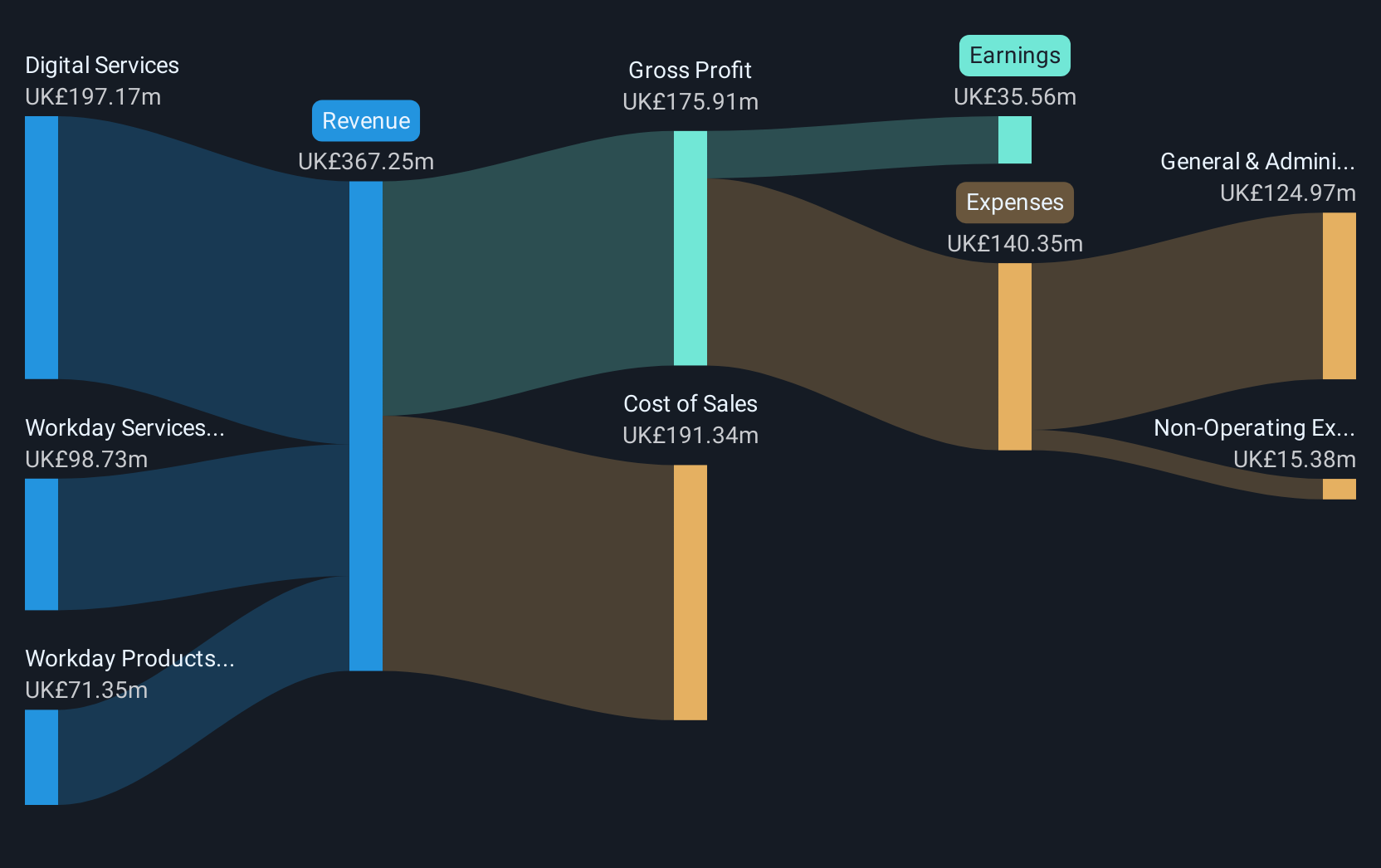

Overview: Kainos Group plc provides digital technology services across the United Kingdom, Ireland, North America, Central Europe, and internationally with a market cap of £912.94 million.

Operations: Kainos Group plc generates revenue primarily through its Digital Services (£197.17 million), Workday Products (£71.35 million), and Workday Services (£98.72 million) segments.

Kainos Group plc, a UK-based software company, demonstrates robust financial health with an expected annual revenue growth of 7.1%, outpacing the UK market average of 3.7%. This growth is complemented by an impressive forecast of earnings increasing at 16.9% annually. Recently, Kainos completed a significant share repurchase program, buying back shares worth £30 million, underscoring its commitment to shareholder value amidst challenging market conditions. The firm's strategic focus on enhancing its software solutions portfolio through consistent R&D investment positions it well within the competitive tech landscape despite a recent dip in net income to £35.56 million from last year's £48.72 million.

- Unlock comprehensive insights into our analysis of Kainos Group stock in this health report.

Assess Kainos Group's past performance with our detailed historical performance reports.

Make It Happen

- Take a closer look at our UK High Growth Tech and AI Stocks list of 41 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:APTD

Aptitude Software Group

Provides financial management software in the United Kingdom and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives