- United Kingdom

- /

- Semiconductors

- /

- AIM:KMK

3 UK Penny Stocks With Market Caps Over £40M To Consider

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 closing lower due to weak trade data from China, highlighting global economic interdependencies. Amid such fluctuations, investors often seek opportunities beyond well-known names, turning their attention to penny stocks—smaller or newer companies that may offer unique potential. Despite the outdated connotations of the term "penny stock," these investments remain relevant for those looking to explore companies with strong financial foundations and potential for growth.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.75 | £542.46M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.24 | £180.96M | ✅ 4 ⚠️ 2 View Analysis > |

| Focusrite (AIM:TUNE) | £2.30 | £134.83M | ✅ 5 ⚠️ 1 View Analysis > |

| Ingenta (AIM:ING) | £0.94 | £14.19M | ✅ 2 ⚠️ 3 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.075 | £14.79M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.35 | £29.82M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.56 | $325.54M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.50 | £253.48M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.13 | £180.35M | ✅ 4 ⚠️ 2 View Analysis > |

| Braemar (LSE:BMS) | £2.30 | £70.08M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 297 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Corero Network Security (AIM:CNS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Corero Network Security plc offers distributed denial of service (DDoS) protection solutions on a global scale and has a market capitalization of £49.42 million.

Operations: The company generated $23.31 million in revenue from its DDoS protection solutions.

Market Cap: £49.42M

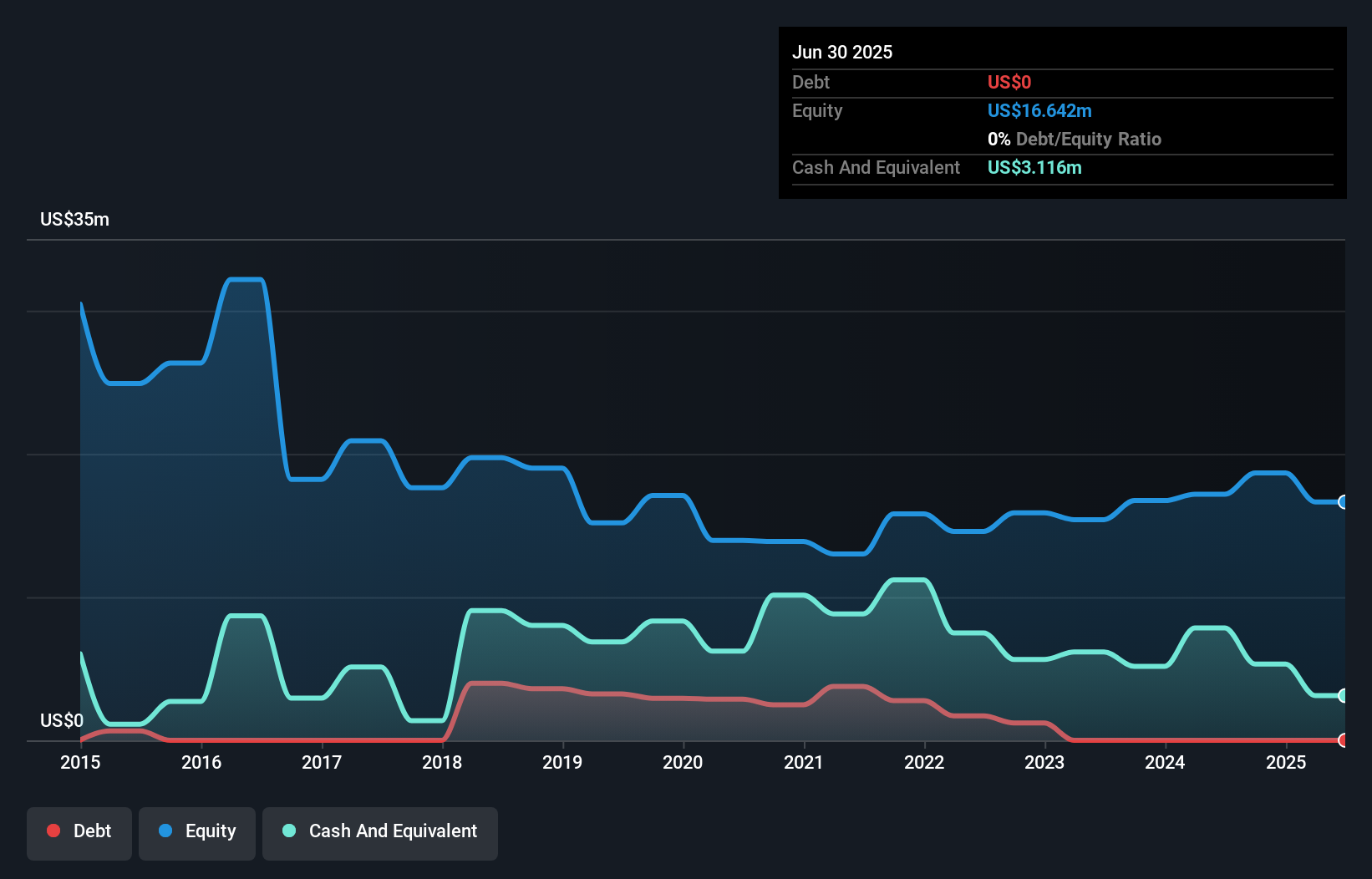

Corero Network Security, with a market cap of £49.42 million, has been focusing on expanding its global presence and enhancing its DDoS protection solutions. Despite being unprofitable, the company has reduced losses significantly over five years and remains debt-free. Recent developments include strategic partnerships in Asia-Pacific and the U.S., alongside product enhancements like SmartWall ONE to combat encrypted threats without added latency. While revenue is projected to grow modestly, Corero faces challenges with less than a year of cash runway based on current free cash flow, highlighting potential financial constraints despite operational advancements.

- Unlock comprehensive insights into our analysis of Corero Network Security stock in this financial health report.

- Examine Corero Network Security's earnings growth report to understand how analysts expect it to perform.

Kromek Group (AIM:KMK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Kromek Group plc, with a market cap of £48.47 million, develops, manufactures, and sells radiation detection components and bio-detection technology solutions for advanced imaging, CBRN detection, and biological threat detection markets.

Operations: The company's revenue is derived from two main segments: Advanced Imaging, contributing £27.83 million, and CBRN/Biological-Threat Detection, generating £7.66 million.

Market Cap: £48.47M

Kromek Group, with a market cap of £48.47 million, has shown significant revenue growth and profitability in the past year, reporting sales of £26.51 million compared to £19.4 million previously. The company's debt is well covered by operating cash flow and it maintains more cash than total debt, indicating solid financial health despite its high share price volatility. Recent earnings guidance suggests robust growth for the first half of 2026 driven by strong performance in its CBRN Detection division and an enablement agreement with Siemens Healthineers. Leadership changes include new board appointments aimed at enhancing strategic direction amidst ongoing expansion efforts.

- Jump into the full analysis health report here for a deeper understanding of Kromek Group.

- Assess Kromek Group's future earnings estimates with our detailed growth reports.

FDM Group (Holdings) (LSE:FDM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: FDM Group (Holdings) plc offers IT services across various regions including the UK, North America, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of £137.08 million.

Operations: The company generates revenue of £214.80 million from its Global Professional Services Provider segment.

Market Cap: £137.08M

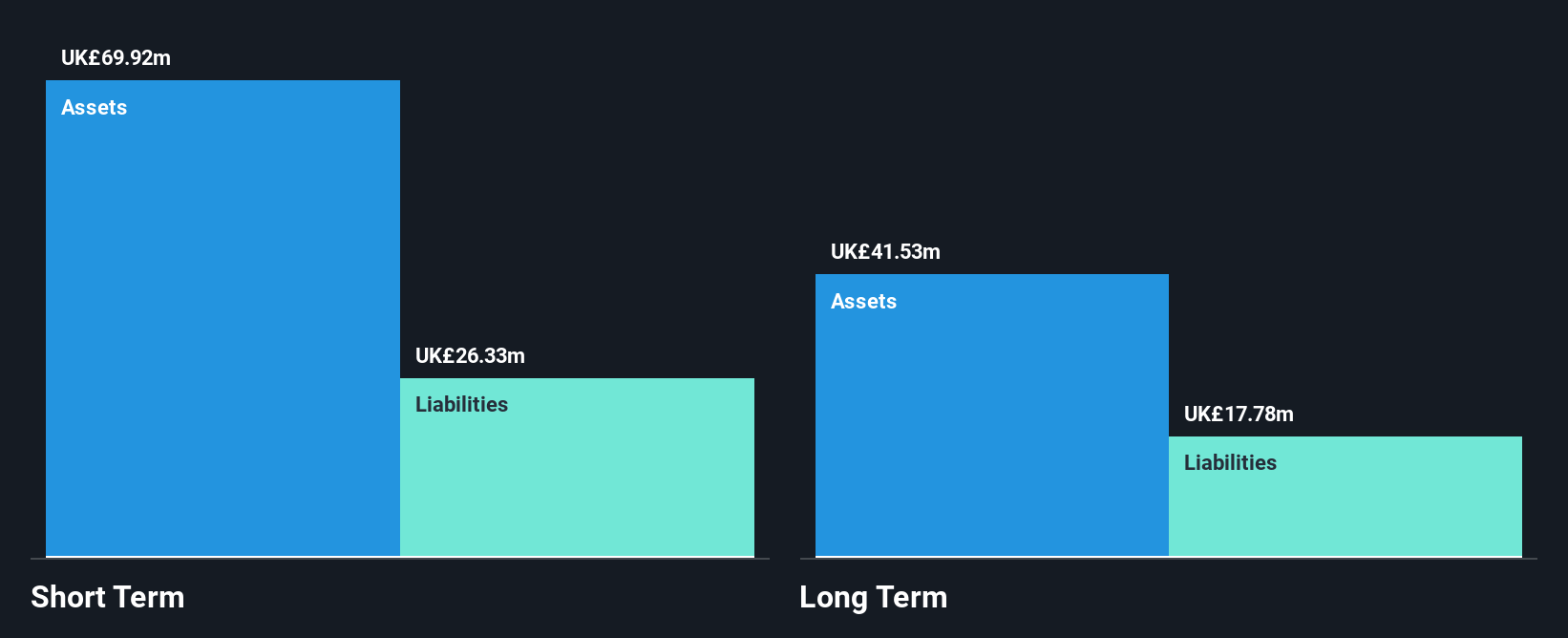

FDM Group, with a market cap of £137.08 million, operates debt-free and hasn't diluted shareholders over the past year. Despite trading at 21.5% below its estimated fair value, FDM faces challenges with declining earnings growth—down 49.1% last year—and forecasts suggesting further declines by an average of 10.8% annually over the next three years. Its profit margins have decreased to 7.2%, down from 10.3%. While short-term assets cover both short and long-term liabilities comfortably, its dividend yield of 14.75% is not well covered by earnings, posing sustainability concerns despite a high return on equity of 26.3%.

- Click here and access our complete financial health analysis report to understand the dynamics of FDM Group (Holdings).

- Learn about FDM Group (Holdings)'s future growth trajectory here.

Next Steps

- Embark on your investment journey to our 297 UK Penny Stocks selection here.

- Want To Explore Some Alternatives? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kromek Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:KMK

Kromek Group

Develops, manufactures, and sells radiation detection components and bio-detection technology solutions for the advanced imaging, CBRN detection, and biological threat detection markets.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives