David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Capita plc (LON:CPI) makes use of debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Capita

How Much Debt Does Capita Carry?

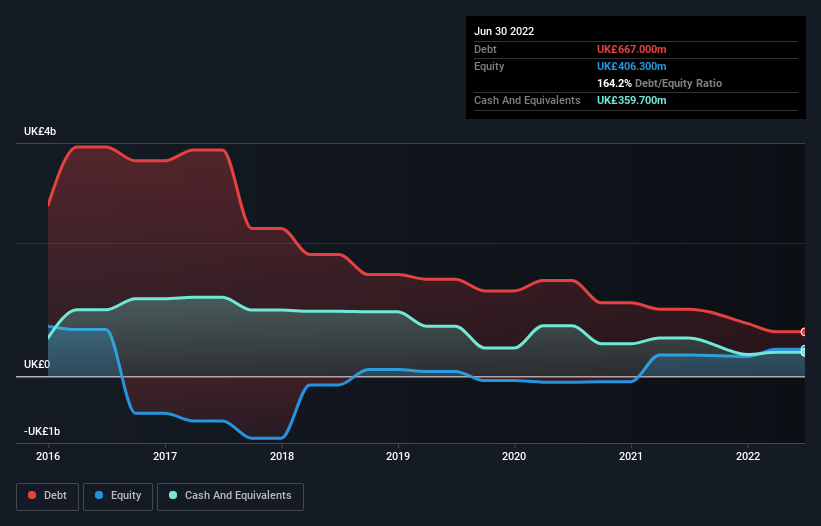

The image below, which you can click on for greater detail, shows that Capita had debt of UK£667.0m at the end of June 2022, a reduction from UK£1.01b over a year. However, because it has a cash reserve of UK£359.7m, its net debt is less, at about UK£307.3m.

A Look At Capita's Liabilities

Zooming in on the latest balance sheet data, we can see that Capita had liabilities of UK£1.72b due within 12 months and liabilities of UK£810.2m due beyond that. Offsetting these obligations, it had cash of UK£359.7m as well as receivables valued at UK£556.3m due within 12 months. So its liabilities total UK£1.62b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the UK£419.2m company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, Capita would probably need a major re-capitalization if its creditors were to demand repayment. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Capita can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Capita made a loss at the EBIT level, and saw its revenue drop to UK£3.1b, which is a fall of 5.6%. We would much prefer see growth.

Caveat Emptor

Importantly, Capita had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost a very considerable UK£206m at the EBIT level. If you consider the significant liabilities mentioned above, we are extremely wary of this investment. Of course, it may be able to improve its situation with a bit of luck and good execution. Nevertheless, we would not bet on it given that it vaporized UK£153m in cash over the last twelve months, and it doesn't have much by way of liquid assets. So we think this stock is risky, like walking through a dirty dog park with a mask on. For riskier companies like Capita I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:CPI

Capita

Operates an outsourcer that supports clients across the public and private sectors in the United Kingdom and rest of Europe.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives