3 Undervalued European Small Caps With Insider Action To Watch

Reviewed by Simply Wall St

In recent weeks, the European market has experienced mixed performance, with the pan-European STOXX Europe 600 Index ending slightly lower as investors evaluated various monetary policy decisions. In this context, small-cap stocks in Europe are gaining attention for their potential to offer unique opportunities amid shifting economic landscapes and central bank actions. Identifying promising small-cap stocks often involves looking at those with strong fundamentals and insider activity, which can signal confidence in a company's future prospects despite broader market uncertainties.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Cairn Homes | 11.8x | 1.5x | 27.81% | ★★★★★★ |

| Boozt | 16.9x | 0.7x | 39.67% | ★★★★★☆ |

| Bytes Technology Group | 17.4x | 4.4x | 11.45% | ★★★★☆☆ |

| Renold | 10.7x | 0.7x | 1.87% | ★★★★☆☆ |

| Fastighets AB Trianon | 13.5x | 4.4x | -207.43% | ★★★★☆☆ |

| Nyab | 22.4x | 1.0x | 34.70% | ★★★☆☆☆ |

| Oxford Instruments | 41.8x | 2.2x | 13.48% | ★★★☆☆☆ |

| FastPartner | 17.3x | 4.4x | -34.40% | ★★★☆☆☆ |

| CVS Group | 46.9x | 1.4x | 35.63% | ★★★☆☆☆ |

| Social Housing REIT | NA | 7.0x | 33.55% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

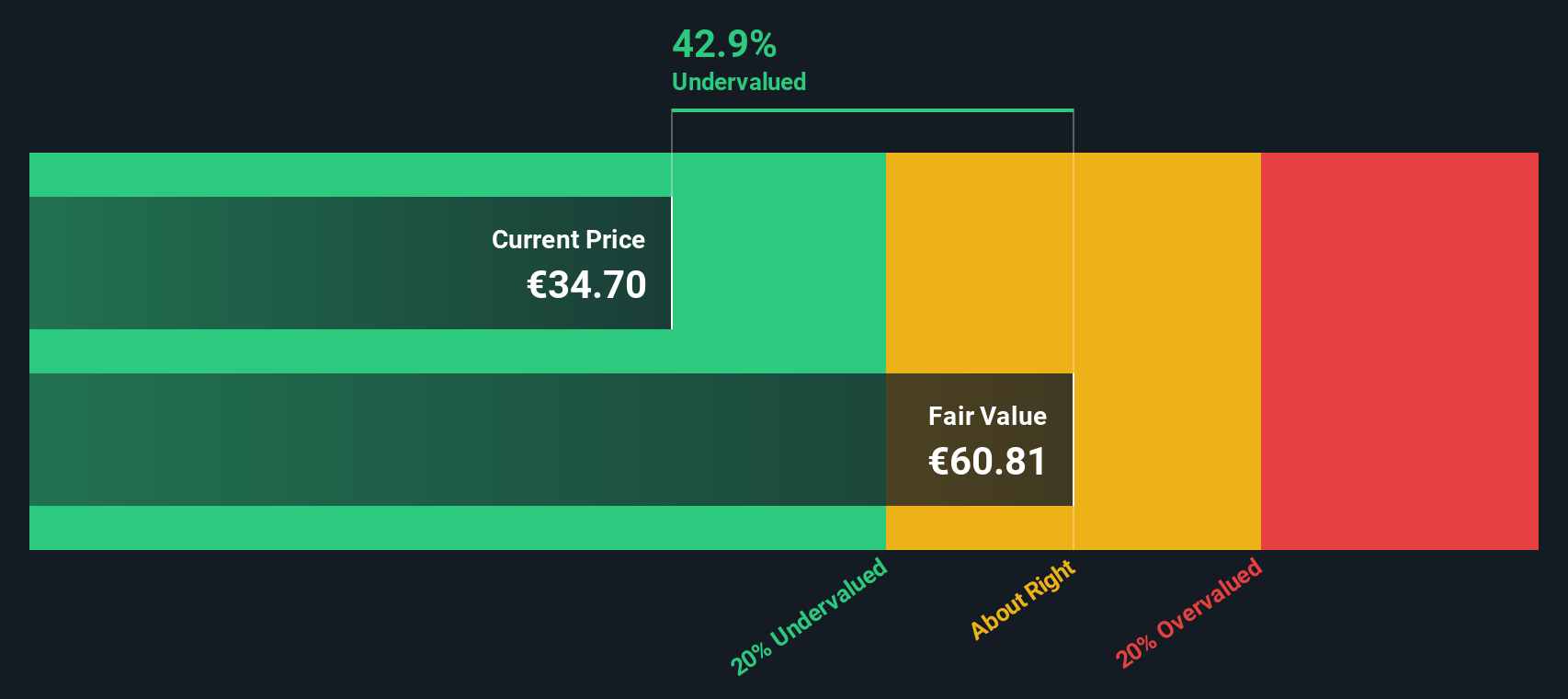

Harvia Oyj (HLSE:HARVIA)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Harvia Oyj is a company that specializes in the manufacturing and sale of sauna and spa products, with a market capitalization of €1.02 billion.

Operations: The company's revenue primarily stems from the Building Materials - HVAC Equipment segment, amounting to €188.89 million. Over recent periods, gross profit margin has shown an upward trend, reaching 64.94% by the latest quarter in 2025. Operating expenses have consistently been a significant part of the cost structure, with General & Administrative Expenses being a notable component.

PE: 29.6x

Harvia, a player in the sauna industry, is experiencing insider confidence with recent share purchases. Their earnings report for Q2 2025 showed sales of €47.25 million, an increase from €43.18 million in the previous year, though net income declined to €4.38 million from €5.87 million. The launch of their Fenix control panel and MyHarvia app marks a strategic move towards digital connectivity in saunas, potentially enhancing market positioning despite high debt levels and reliance on external funding sources.

- Delve into the full analysis valuation report here for a deeper understanding of Harvia Oyj.

Assess Harvia Oyj's past performance with our detailed historical performance reports.

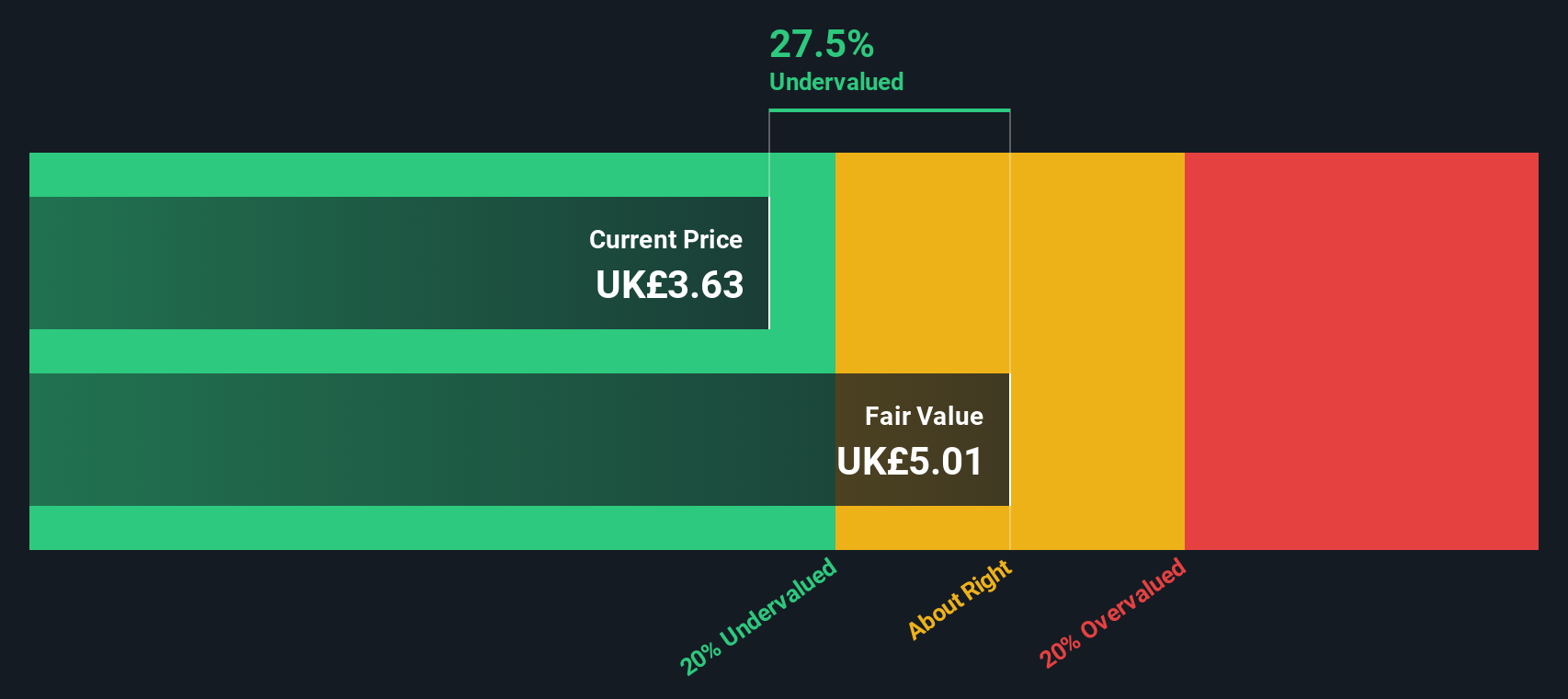

Bytes Technology Group (LSE:BYIT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Bytes Technology Group is an IT solutions provider with a focus on software, security, and cloud services, operating with a market cap of approximately £1.04 billion.

Operations: The company's revenue primarily comes from its IT Solutions segment, with a recent figure of £217.13 million. Over time, the gross profit margin has shown an upward trend, reaching 75.19% as of February 2025. Operating expenses have increased to £96.83 million, impacting net income margins which stood at 25.26% in the same period.

PE: 17.4x

Bytes Technology Group, a European tech company, has recently seen insider confidence with Sam Mudd purchasing 25,425 shares valued at approximately £99,498. Despite its small size in the market, the company anticipates an operating profit of no less than £33 million for the half-year ending August 2025. Additionally, a share repurchase program up to £5 million is underway. With earnings projected to grow annually by 3.51%, Bytes Technology presents potential growth opportunities amidst volatile share prices and external funding reliance.

- Get an in-depth perspective on Bytes Technology Group's performance by reading our valuation report here.

Understand Bytes Technology Group's track record by examining our Past report.

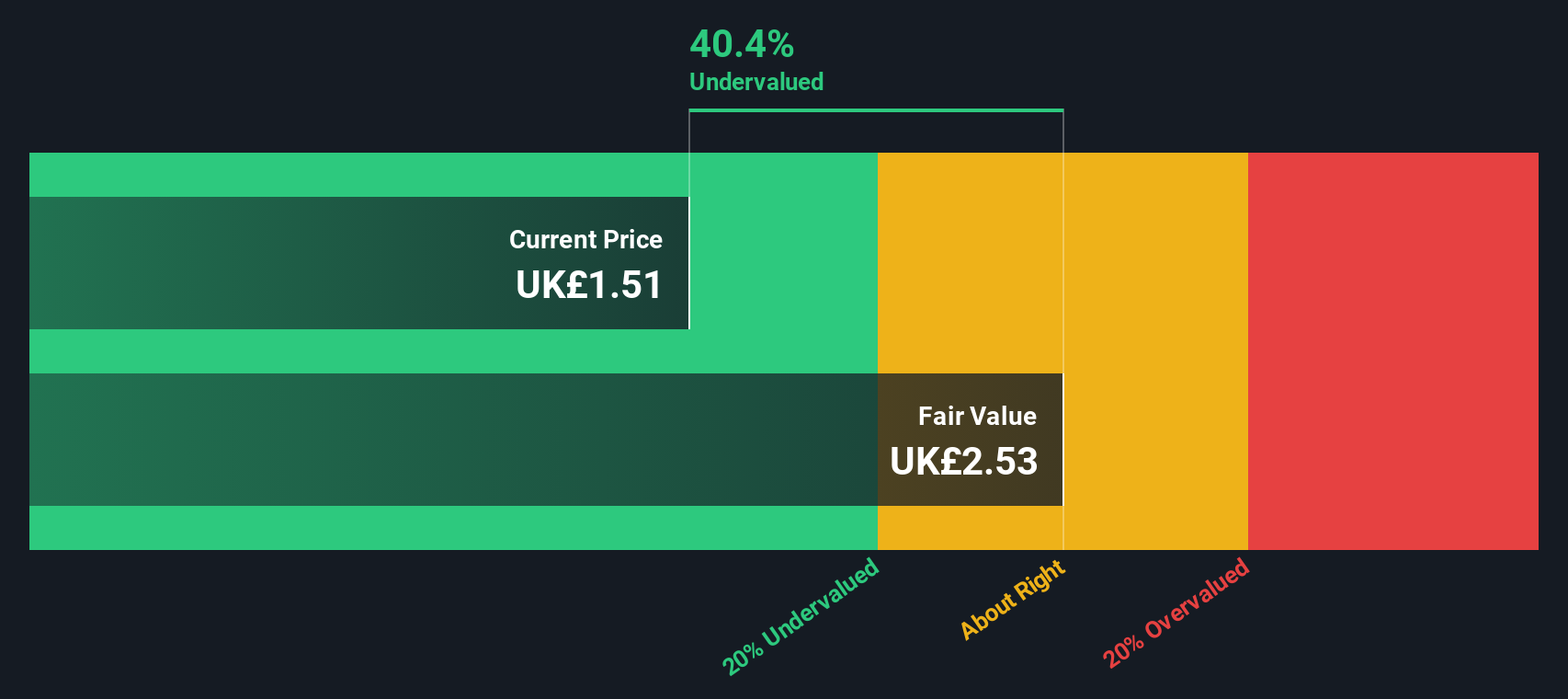

Stelrad Group (LSE:SRAD)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Stelrad Group specializes in the manufacture and distribution of radiators, with a market capitalization of approximately £0.16 billion.

Operations: The primary revenue stream for the company comes from the manufacture and distribution of radiators, with recent quarterly revenue reaching £283.94 million. The gross profit margin has shown an upward trend, reaching 30.97% in September 2024 before slightly decreasing to 29.95% by June 2025. Operating expenses are a significant cost component, consistently exceeding £59 million in recent quarters, primarily driven by sales and marketing expenses around £41 million.

PE: 40.6x

Stelrad Group, a European small cap, recently faced challenges with its financial results for H1 2025. Sales dipped to £136.48 million from £143.12 million the previous year, and it reported a net loss of £3.45 million compared to last year's profit of £8.02 million. Despite these setbacks, insider confidence is evident as they increased their holdings in recent months, signaling potential growth prospects as earnings are forecasted to grow by 37% annually. The company also raised its interim dividend by 2%, reflecting management's commitment to shareholder returns amidst external borrowing risks impacting its financial position.

- Click here to discover the nuances of Stelrad Group with our detailed analytical valuation report.

Evaluate Stelrad Group's historical performance by accessing our past performance report.

Seize The Opportunity

- Unlock more gems! Our Undervalued European Small Caps With Insider Buying screener has unearthed 43 more companies for you to explore.Click here to unveil our expertly curated list of 46 Undervalued European Small Caps With Insider Buying.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harvia Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:HARVIA

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives