- United Kingdom

- /

- Software

- /

- LSE:ALFA

Undiscovered Gems In The UK Featuring 3 Promising Small Caps With Strong Potential

Reviewed by Simply Wall St

Over the last seven days, the United Kingdom market has remained flat, yet it has shown a 12% increase over the past year with earnings forecasted to grow by 14% annually. In this context, identifying promising small-cap stocks with strong growth potential can be key to capitalizing on emerging opportunities within a steadily improving market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| Globaltrans Investment | 15.40% | 2.68% | 16.51% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Kodal Minerals | NA | nan | 72.74% | ★★★★★★ |

| VH Global Sustainable Energy Opportunities | NA | 18.30% | 20.03% | ★★★★★★ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| Goodwin | 52.21% | 9.26% | 13.12% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

Alfa Financial Software Holdings (LSE:ALFA)

Simply Wall St Value Rating: ★★★★★★

Overview: Alfa Financial Software Holdings PLC offers software and consultancy services to the auto and equipment finance industry across various regions including the UK, US, Europe, Middle East, Africa, and internationally with a market cap of £634.50 million.

Operations: Alfa Financial Software Holdings generates revenue primarily from the sale of software and related services, amounting to £101.40 million.

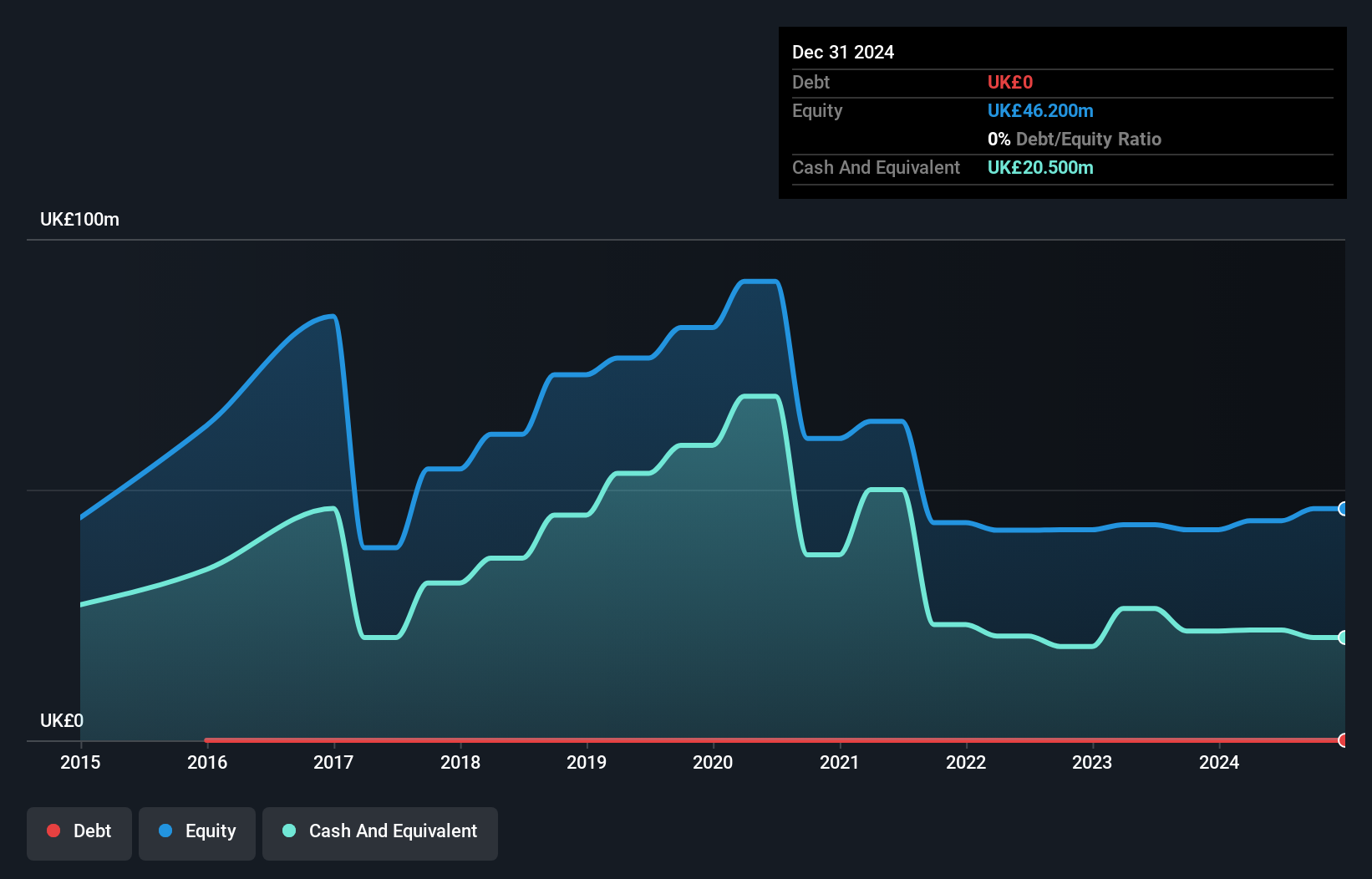

Alfa Financial Software Holdings, a nimble player in the UK market, shows promise despite recent challenges. The company remains debt-free for over five years, reflecting robust financial health. However, earnings dipped by 15.6% last year against an industry average growth of 21.2%, highlighting a competitive gap. Trading at a P/E ratio of 28.7x below the industry average of 33.2x suggests potential value for investors seeking entry points in the software sector. Alfa's free cash flow is positive, with £52.3 million sales and £11.9 million net income reported for H1 2024, alongside a special dividend announcement enhancing shareholder value perception.

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Cairn Homes plc is a holding company that functions as a home and community builder in Ireland, with a market capitalization of £1.13 billion.

Operations: Cairn Homes generates revenue primarily from its building and property development segment, amounting to €813.40 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

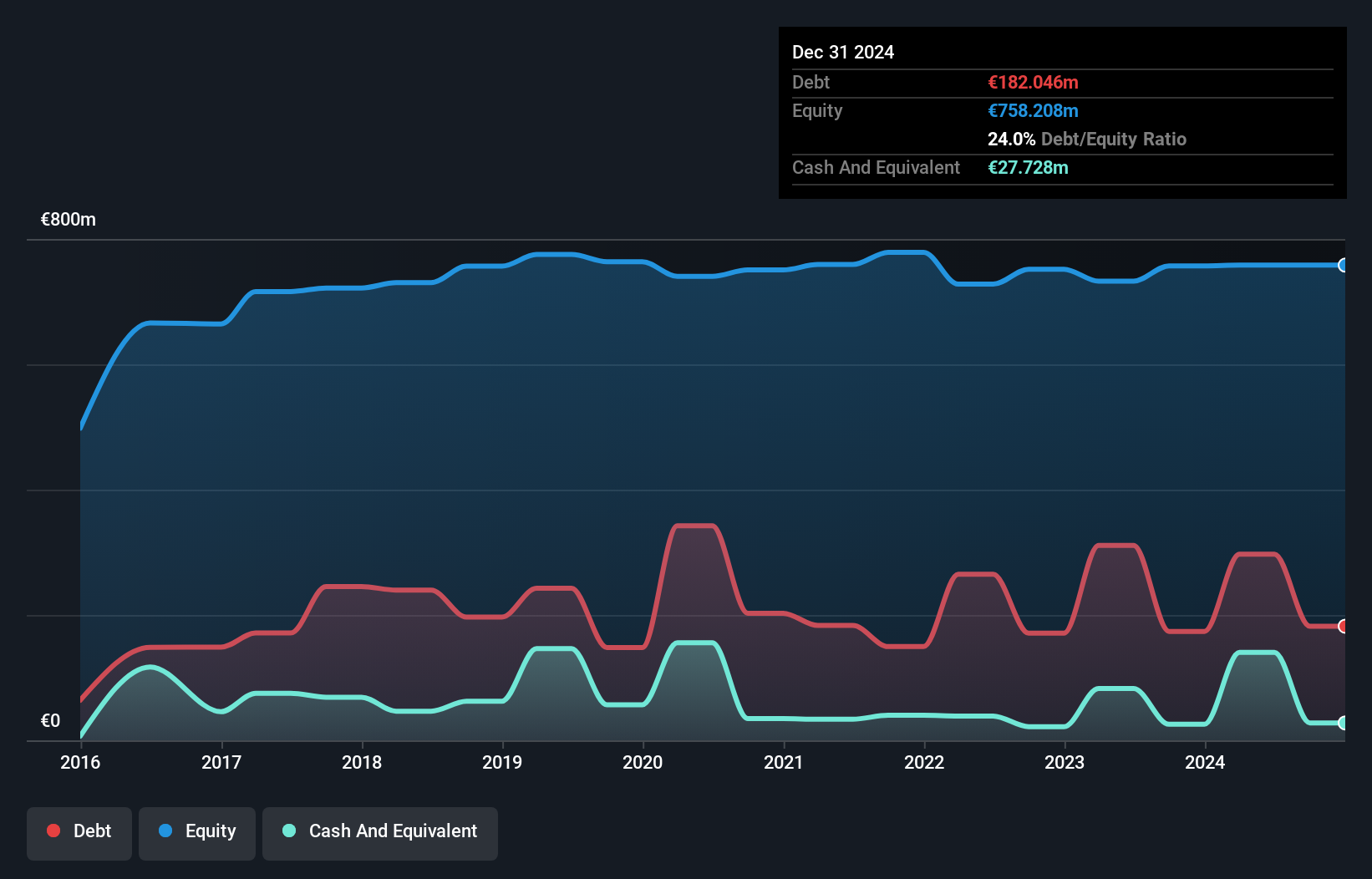

Cairn Homes, a notable player in the UK market, has shown impressive financial performance with earnings soaring by 49.5% over the past year, outpacing the Consumer Durables industry. The company's net debt to equity ratio stands at a satisfactory 20.7%, reflecting prudent financial management. Cairn's interest payments are well covered by EBIT at 9.5 times, indicating strong earnings quality and stability. The recent share buyback program saw repurchases totaling €70 million, enhancing shareholder value further. Additionally, its price-to-earnings ratio of 12.1x suggests it trades below the UK market average of 16.2x, highlighting potential investment appeal.

- Click to explore a detailed breakdown of our findings in Cairn Homes' health report.

Explore historical data to track Cairn Homes' performance over time in our Past section.

Pinewood Technologies Group (LSE:PINE)

Simply Wall St Value Rating: ★★★★★★

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider serving the automotive industry in the United Kingdom and internationally, with a market cap of £283.04 million.

Operations: Pinewood Technologies Group derives its revenue primarily from software sales, totaling £22.62 million.

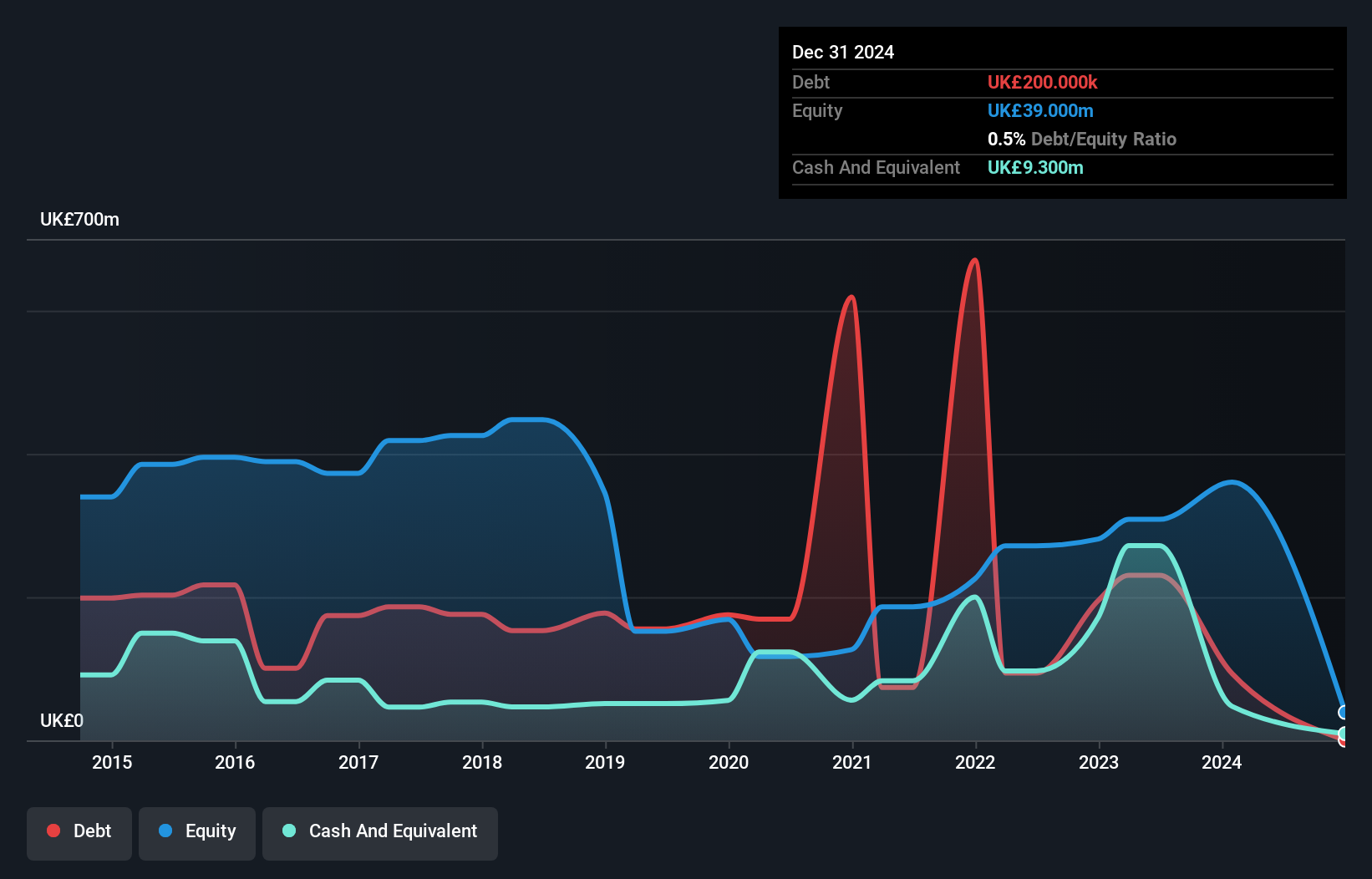

Pinewood Technologies, a small player in the UK tech scene, has faced challenges with an 81.6% dip in earnings over the past year, contrasting sharply with the software industry's 21.2% growth average. Despite this setback, Pinewood's future looks promising as earnings are expected to grow by 24.71% annually. The company's net debt to equity ratio stands at a satisfactory 12.7%, and its interest payments are comfortably covered by EBIT at 100 times coverage. Recent developments include securing a five-year contract with Marshall Motor Group, boosting Pinewood's presence in the automotive retail sector across approximately 120 dealerships in the UK.

Turning Ideas Into Actions

- Embark on your investment journey to our 82 UK Undiscovered Gems With Strong Fundamentals selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ALFA

Alfa Financial Software Holdings

Through its subsidiaries, provides software and related services to the auto and equipment finance industry in the United Kingdom, North America, Rest of Europe, the Middle East, Africa, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives