- United Kingdom

- /

- Software

- /

- LSE:ALFA

Alfa Financial Software Holdings PLC's (LON:ALFA) 29% Share Price Surge Not Quite Adding Up

Alfa Financial Software Holdings PLC (LON:ALFA) shares have continued their recent momentum with a 29% gain in the last month alone. Looking further back, the 24% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

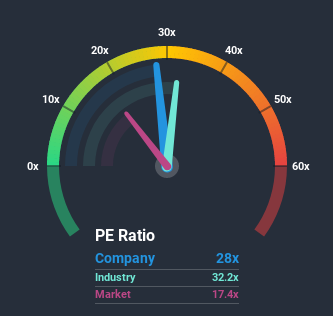

Following the firm bounce in price, Alfa Financial Software Holdings may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 28x, since almost half of all companies in the United Kingdom have P/E ratios under 17x and even P/E's lower than 10x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Alfa Financial Software Holdings has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

Check out our latest analysis for Alfa Financial Software Holdings

Is There Enough Growth For Alfa Financial Software Holdings?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Alfa Financial Software Holdings' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 45%. Regardless, EPS has managed to lift by a handy 26% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 14% per year as estimated by the four analysts watching the company. With the market predicted to deliver 15% growth per year, that's a disappointing outcome.

In light of this, it's alarming that Alfa Financial Software Holdings' P/E sits above the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh heavily on the share price eventually.

The Bottom Line On Alfa Financial Software Holdings' P/E

Alfa Financial Software Holdings' P/E is flying high just like its stock has during the last month. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Alfa Financial Software Holdings' analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its high P/E anywhere near as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Having said that, be aware Alfa Financial Software Holdings is showing 3 warning signs in our investment analysis, and 1 of those is concerning.

If these risks are making you reconsider your opinion on Alfa Financial Software Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

When trading Alfa Financial Software Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About LSE:ALFA

Alfa Financial Software Holdings

Through its subsidiaries, provides software and related services to the auto and equipment finance industry in the United Kingdom, North America, Rest of Europe, the Middle East, Africa, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives