- United Kingdom

- /

- Software

- /

- AIM:ZOO

Investors in ZOO Digital Group (LON:ZOO) from a year ago are still down 72%, even after 16% gain this past week

ZOO Digital Group plc (LON:ZOO) shareholders should be happy to see the share price up 20% in the last month. But that isn't much consolation for the painful drop we've seen in the last year. During that time the share price has plummeted like a stone, down 72%. So the rise may not be much consolation. The real question is whether the company can turn around its fortunes.

On a more encouraging note the company has added UK£5.6m to its market cap in just the last 7 days, so let's see if we can determine what's driven the one-year loss for shareholders.

Check out our latest analysis for ZOO Digital Group

ZOO Digital Group wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

ZOO Digital Group's revenue didn't grow at all in the last year. In fact, it fell 37%. That's not what investors generally want to see. The share price fall of 72% in a year tells the story. Holders should not lose the lesson: loss making companies should grow revenue. Of course, extreme share price falls can be an opportunity for those who are willing to really dig deeper to understand a high risk company like this.

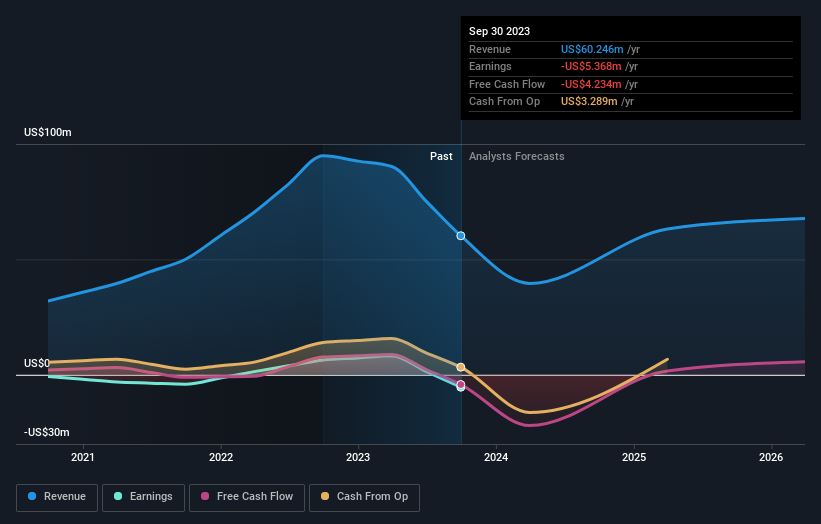

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

While the broader market gained around 6.3% in the last year, ZOO Digital Group shareholders lost 72%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 2% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for ZOO Digital Group (1 is potentially serious!) that you should be aware of before investing here.

ZOO Digital Group is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

If you're looking to trade ZOO Digital Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ZOO Digital Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:ZOO

ZOO Digital Group

Through its subsidiaries, provides cloud-based localisation and digital distribution services in the United Kingdom, India, and the United States.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives