- United Kingdom

- /

- Software

- /

- AIM:TRCS

This Is Why Tracsis plc's (LON:TRCS) CEO Compensation Looks Appropriate

Under the guidance of CEO Chris Barnes, Tracsis plc (LON:TRCS) has performed reasonably well recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 18 January 2023. Here is our take on why we think the CEO compensation looks appropriate.

Check out our latest analysis for Tracsis

Comparing Tracsis plc's CEO Compensation With The Industry

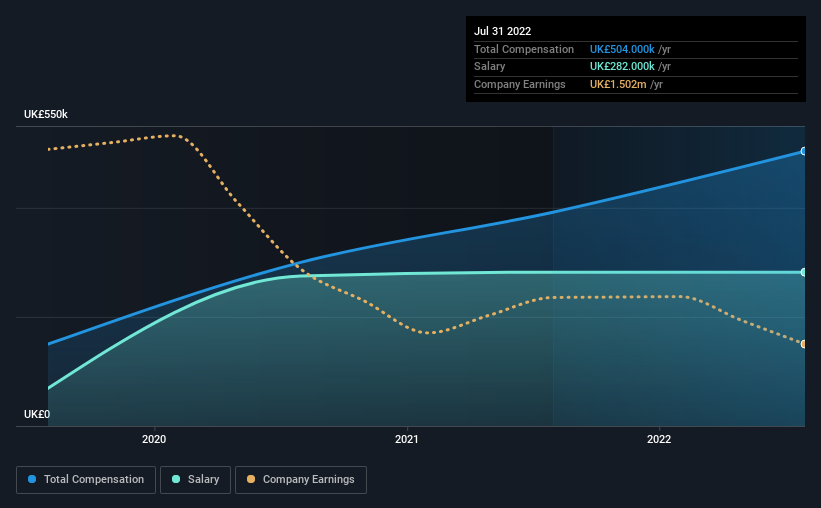

Our data indicates that Tracsis plc has a market capitalization of UK£282m, and total annual CEO compensation was reported as UK£504k for the year to July 2022. That's a notable increase of 29% on last year. Notably, the salary which is UK£282.0k, represents a considerable chunk of the total compensation being paid.

For comparison, other companies in the British Software industry with market capitalizations ranging between UK£165m and UK£658m had a median total CEO compensation of UK£626k. This suggests that Tracsis remunerates its CEO largely in line with the industry average. What's more, Chris Barnes holds UK£105k worth of shares in the company in their own name.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | UK£282k | UK£282k | 56% |

| Other | UK£222k | UK£110k | 44% |

| Total Compensation | UK£504k | UK£392k | 100% |

On an industry level, around 63% of total compensation represents salary and 37% is other remuneration. It's interesting to note that Tracsis allocates a smaller portion of compensation to salary in comparison to the broader industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Tracsis plc's Growth

Tracsis plc has reduced its earnings per share by 34% a year over the last three years. It achieved revenue growth of 37% over the last year.

The reduction in EPS, over three years, is arguably concerning. On the other hand, the strong revenue growth suggests the business is growing. It's hard to reach a conclusion about business performance right now. This may be one to watch. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Tracsis plc Been A Good Investment?

With a total shareholder return of 30% over three years, Tracsis plc shareholders would, in general, be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

The overall company performance has been commendable, however there are still areas for improvement. Still, we think that until shareholders see an improvement in EPS growth, they may find it hard to justify a pay rise for the CEO.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 1 warning sign for Tracsis that investors should be aware of in a dynamic business environment.

Important note: Tracsis is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Tracsis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TRCS

Tracsis

Engages in the provision of software, hardware, data analytics and geographic information systems, and services in the United Kingdom, Ireland, rest of Europe, Europe, North America, and internationally.

Very undervalued with flawless balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion