- United Kingdom

- /

- IT

- /

- AIM:SYS

If You Had Bought SysGroup (LON:SYS) Stock Five Years Ago, You'd Be Sitting On A 43% Loss, Today

The main aim of stock picking is to find the market-beating stocks. But every investor is virtually certain to have both over-performing and under-performing stocks. At this point some shareholders may be questioning their investment in SysGroup plc (LON:SYS), since the last five years saw the share price fall 43%. And we doubt long term believers are the only worried holders, since the stock price has declined 21% over the last twelve months. The falls have accelerated recently, with the share price down 14% in the last three months.

View our latest analysis for SysGroup

SysGroup isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last half decade, SysGroup saw its revenue increase by 36% per year. That's well above most other pre-profit companies. Shareholders are no doubt disappointed with the loss of 11%, each year, in that time. You could say that the market has been harsh, given the top line growth. If that's the case, now might be the smart time to take a close look at it.

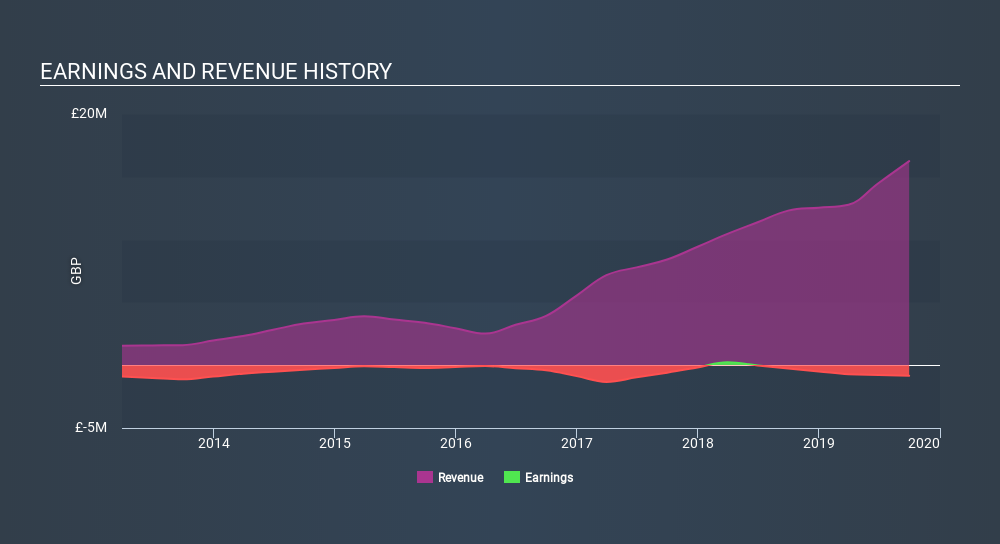

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for SysGroup in this interactive graph of future profit estimates.

A Different Perspective

SysGroup shareholders are down 21% for the year, but the market itself is up 19%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 3 warning signs we've spotted with SysGroup (including 1 which is is significant) .

SysGroup is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About AIM:SYS

SysGroup

Provides managed information technology (IT) services specializing in the delivery of cloud, data, and security services to power AI and ML transformation in the United Kingdom and internationally.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives