- United Kingdom

- /

- Software

- /

- AIM:SMRT

Shareholders Will Probably Not Have Any Issues With Smartspace Software plc's (LON:SMRT) CEO Compensation

Despite strong share price growth of 98% for Smartspace Software plc (LON:SMRT) over the last few years, earnings growth has been disappointing, which suggests something is amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 07 July 2021. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

View our latest analysis for Smartspace Software

How Does Total Compensation For Frank Beechinor-Collins Compare With Other Companies In The Industry?

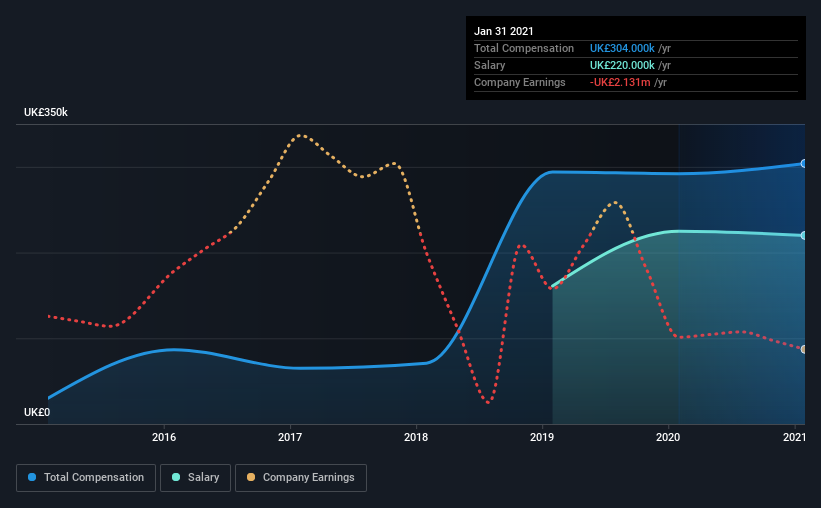

At the time of writing, our data shows that Smartspace Software plc has a market capitalization of UK£54m, and reported total annual CEO compensation of UK£304k for the year to January 2021. That's a fairly small increase of 4.1% over the previous year. We note that the salary portion, which stands at UK£220.0k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under UK£145m, the reported median total CEO compensation was UK£245k. From this we gather that Frank Beechinor-Collins is paid around the median for CEOs in the industry. Furthermore, Frank Beechinor-Collins directly owns UK£164k worth of shares in the company.

On an industry level, roughly 66% of total compensation represents salary and 34% is other remuneration. Although there is a difference in how total compensation is set, Smartspace Software more or less reflects the market in terms of setting the salary. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Smartspace Software plc's Growth

Smartspace Software plc has reduced its earnings per share by 9.1% a year over the last three years. In the last year, its revenue is down 8.9%.

Few shareholders would be pleased to read that EPS have declined. This is compounded by the fact revenue is actually down on last year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Smartspace Software plc Been A Good Investment?

Boasting a total shareholder return of 98% over three years, Smartspace Software plc has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us question whether these strong returns will continue. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 4 warning signs for Smartspace Software you should be aware of, and 1 of them can't be ignored.

Important note: Smartspace Software is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading Smartspace Software or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:SMRT

SmartSpace Software

Smartspace Software plc, together with its subsidiaries, develops and sells workplace software products in the United Kingdom, the United States, Australia, New Zealand, Canada, Sweden, and internationally.

Mediocre balance sheet with concerning outlook.

Market Insights

Weekly Picks

Looking to be second time lucky with a game-changing new product

PlaySide Studios: Market Is Sleeping on a Potential 10M+ Unit Breakout Year, FY26 Could Be the Rerate of the Decade

Inotiv NAMs Test Center

This isn’t speculation — this is confirmation.A Schedule 13G was filed, not a 13D, meaning this is passive institutional capital, not acti

Recently Updated Narratives

Goldman Sachs Group (GS) The Titan Reclaims Its Crown: Return to Core Excellence

Parker-Hannifin (PH) The Industrial Alchemist: Transforming Motion into Margin

Monolithic Power Systems (MPWR) Powering the Hyperscale Era: The Efficiency Moat

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

The "Physical AI" Monopoly – A New Industrial Revolution

Trending Discussion