Roger Bullen has been the CEO of Rosslyn Data Technologies plc (LON:RDT) since 2016, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also assess whether Rosslyn Data Technologies pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Rosslyn Data Technologies

Comparing Rosslyn Data Technologies plc's CEO Compensation With the industry

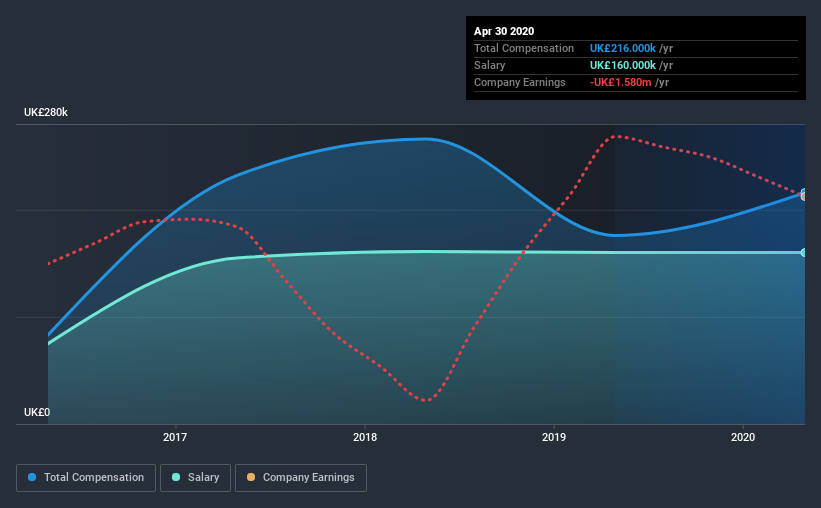

At the time of writing, our data shows that Rosslyn Data Technologies plc has a market capitalization of UK£23m, and reported total annual CEO compensation of UK£216k for the year to April 2020. That's a notable increase of 23% on last year. We note that the salary portion, which stands at UK£160.0k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below UK£147m, we found that the median total CEO compensation was UK£239k. This suggests that Rosslyn Data Technologies remunerates its CEO largely in line with the industry average. What's more, Roger Bullen holds UK£219k worth of shares in the company in their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£160k | UK£160k | 74% |

| Other | UK£56k | UK£16k | 26% |

| Total Compensation | UK£216k | UK£176k | 100% |

Talking in terms of the industry, salary represented approximately 67% of total compensation out of all the companies we analyzed, while other remuneration made up 33% of the pie. Rosslyn Data Technologies is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Rosslyn Data Technologies plc's Growth Numbers

Over the past three years, Rosslyn Data Technologies plc has seen its earnings per share (EPS) grow by 49% per year. It achieved revenue growth of 2.1% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's also good to see modest revenue growth, suggesting the underlying business is healthy. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Rosslyn Data Technologies plc Been A Good Investment?

Rosslyn Data Technologies plc has served shareholders reasonably well, with a total return of 29% over three years. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

In Summary...

As previously discussed, Roger is compensated close to the median for companies of its size, and which belong to the same industry. However, it's admirable that over the last three years, EPS growth for the company has been impressive, though the same can't be said for investor returns. So considering these factors, we think the compensation is probably quite reasonable, but investor returns need a boost moving forward.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 3 warning signs for Rosslyn Data Technologies you should be aware of, and 1 of them makes us a bit uncomfortable.

Switching gears from Rosslyn Data Technologies, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you decide to trade Rosslyn Data Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:RDT

Rosslyn Data Technologies

Provides data analytics solutions in the United Kingdom, Europe, and North America.

Excellent balance sheet with moderate risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion