- United Kingdom

- /

- Biotech

- /

- LSE:OXB

High Growth Tech Stocks In The UK For May 2025

Reviewed by Simply Wall St

The United Kingdom's market has recently faced challenges, with the FTSE 100 index experiencing a decline due to weak trade data from China, highlighting concerns about global economic recovery and its impact on UK companies tied to international markets. In this environment, identifying high growth tech stocks requires focusing on companies that demonstrate resilience and adaptability in the face of fluctuating global conditions.

Top 10 High Growth Tech Companies In The United Kingdom

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Audioboom Group | 8.84% | 59.33% | ★★★★★☆ |

| YouGov | 4.12% | 64.42% | ★★★★★☆ |

| Redcentric | 5.32% | 67.90% | ★★★★★☆ |

| Huddled Group | 21.70% | 114.65% | ★★★★★☆ |

| Oxford Biomedica | 16.52% | 82.05% | ★★★★★☆ |

| Windar Photonics | 37.17% | 46.73% | ★★★★★☆ |

| Trustpilot Group | 15.02% | 40.20% | ★★★★★☆ |

| Faron Pharmaceuticals Oy | 55.41% | 56.79% | ★★★★★☆ |

| Cordel Group | 33.50% | 148.58% | ★★★★★☆ |

| Vinanz | 113.60% | 125.86% | ★★★★★☆ |

Click here to see the full list of 38 stocks from our UK High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Redcentric (AIM:RCN)

Simply Wall St Growth Rating: ★★★★★☆

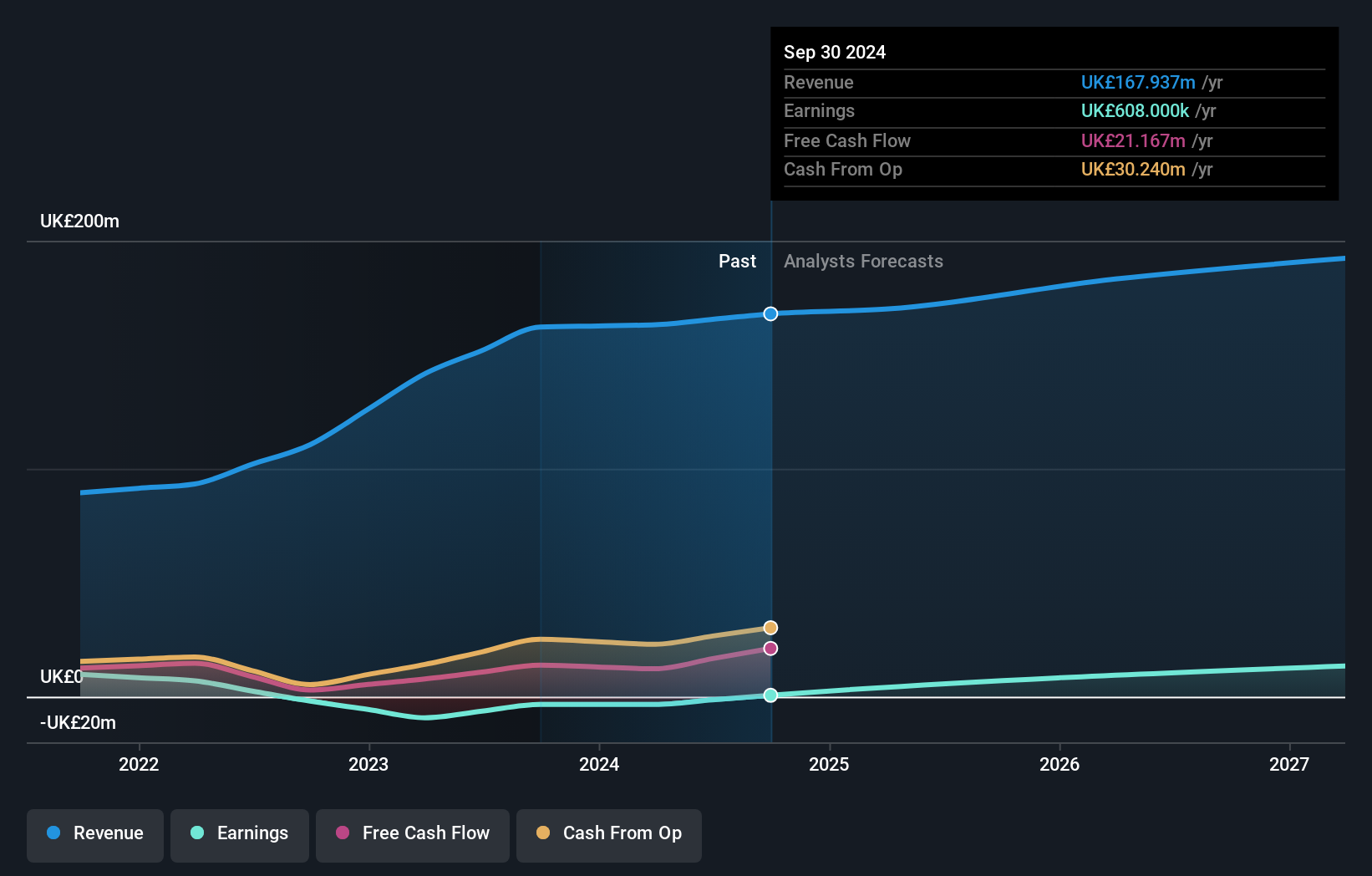

Overview: Redcentric plc is a UK-based company that offers IT managed services to both public and private sectors, with a market capitalization of £201.47 million.

Operations: The company generates revenue primarily from the provision of managed services to customers, amounting to £167.94 million.

Redcentric, a UK-based IT managed service provider, has demonstrated robust financial health with an impressive 67.9% forecasted annual earnings growth. Despite a challenging industry backdrop where the IT sector saw an average decline of 13.6% in earnings, Redcentric has transitioned to profitability this year. The company's strategic focus on R&D is evident from its investment in this area, which supports its innovative edge in a competitive market. With the recent appointment of Michelle Senecal De Fonseca as CEO, who brings extensive experience from Vodafone and Citrix Systems, Redcentric is poised to enhance its leadership in cloud and hosting services while maintaining a strong dividend payout of 3.6 pence per share for FY2025.

Oxford Biomedica (LSE:OXB)

Simply Wall St Growth Rating: ★★★★★☆

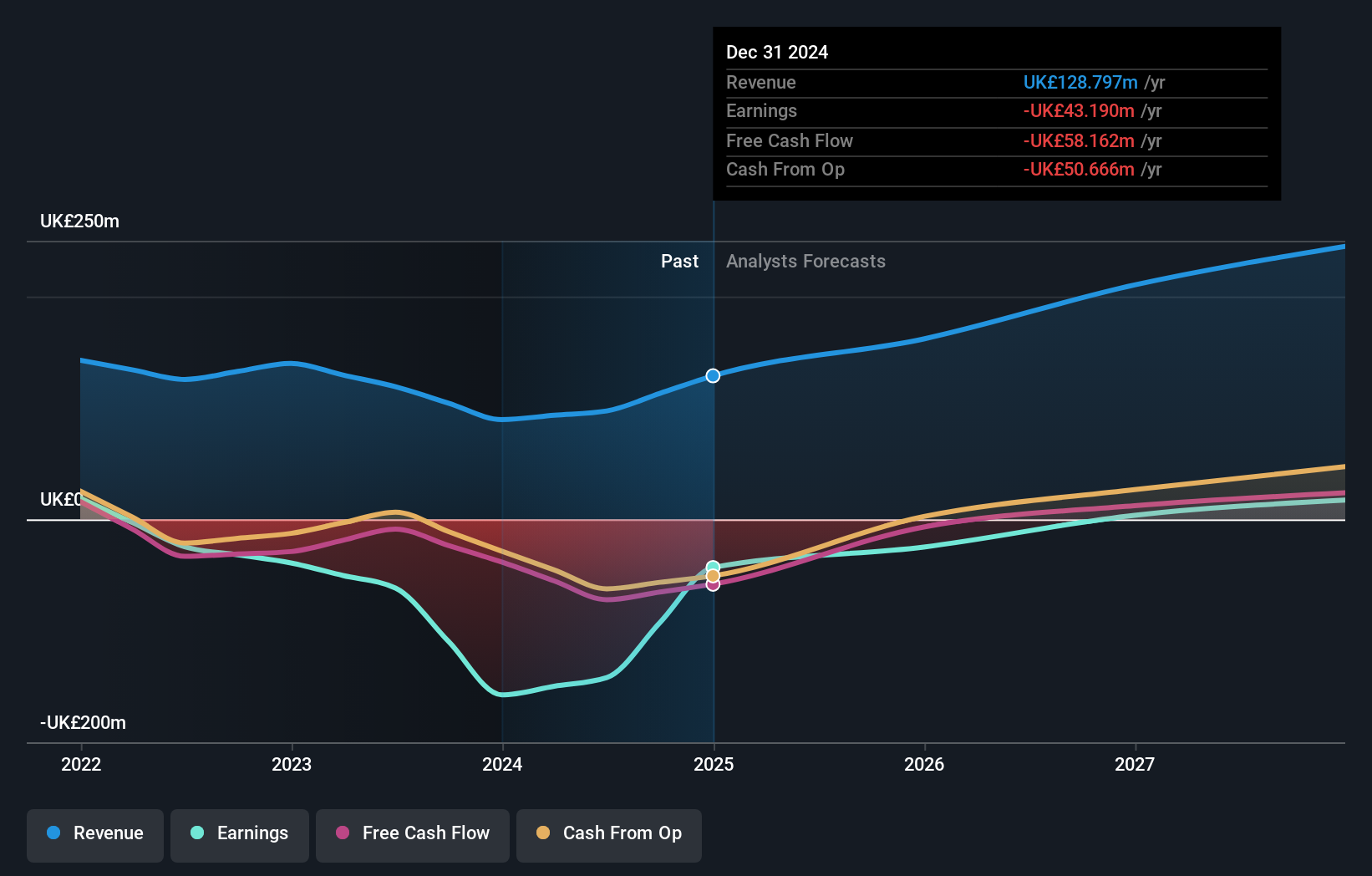

Overview: Oxford Biomedica plc is a contract development and manufacturing organization specializing in delivering therapies globally, with a market capitalization of £314.28 million.

Operations: Oxford Biomedica generates revenue primarily from manufacturing services (£68.35 million) and development activities (£47.27 million), with additional income from license fees and incentives (£7.33 million) and procurement and storage services (£5.85 million).

Oxford Biomedica stands out in the biotech sector with its strategic pivot towards profitability, anticipating a significant earnings growth of 82% annually. This trajectory is supported by a robust R&D framework that not only fuels innovation but also aligns with projected revenue increases from £128.8 million to between £160 million and £170 million by year-end 2025. The firm's recent collaboration with Boehringer Ingelheim on a pioneering gene therapy for cystic fibrosis underscores its capability as a trusted CDMO, enhancing its growth prospects and industry standing amidst volatile market conditions.

- Navigate through the intricacies of Oxford Biomedica with our comprehensive health report here.

Assess Oxford Biomedica's past performance with our detailed historical performance reports.

Raspberry Pi Holdings (LSE:RPI)

Simply Wall St Growth Rating: ★★★★☆☆

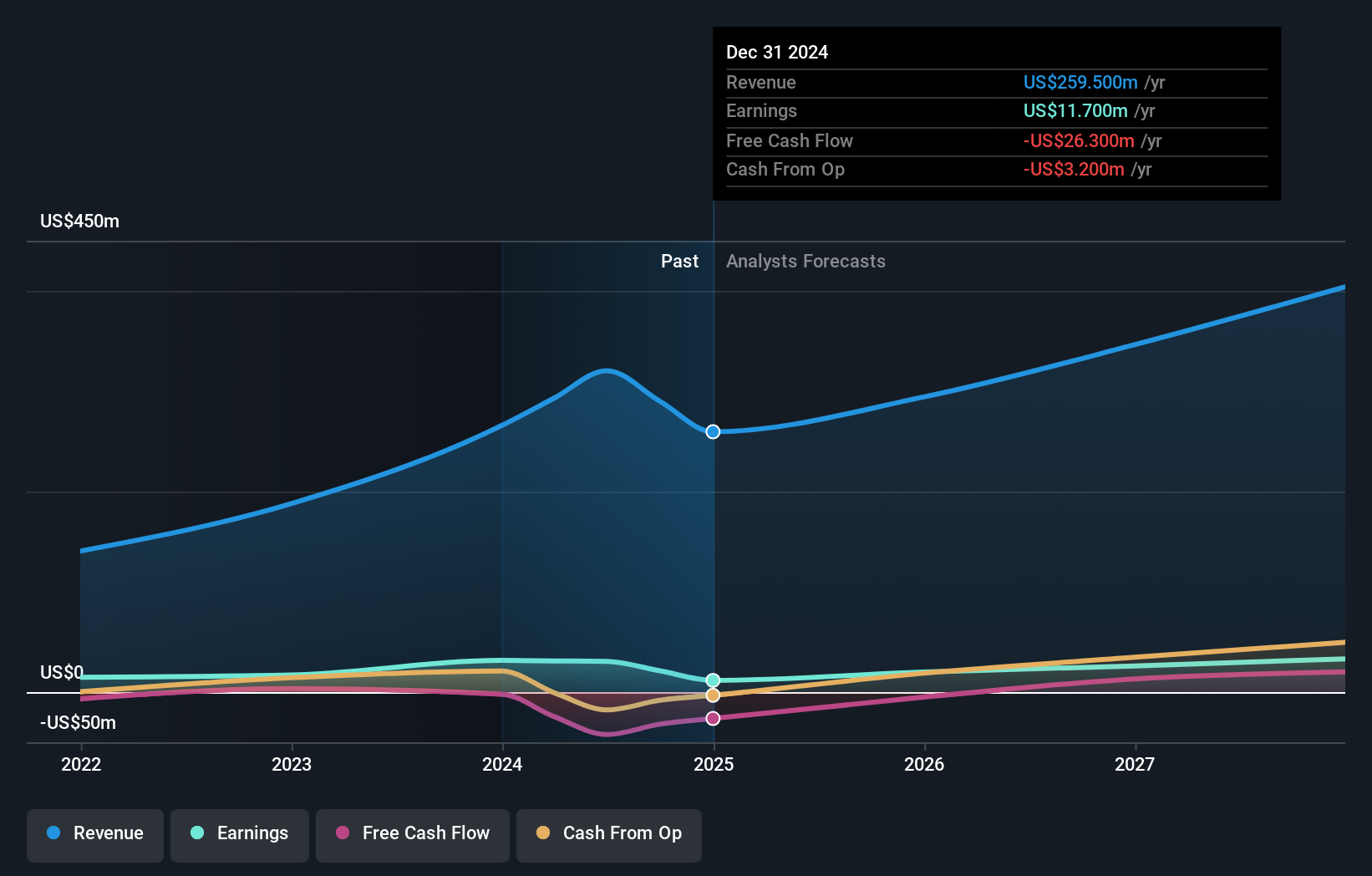

Overview: Raspberry Pi Holdings plc designs and develops single board computers and compute modules worldwide, with a market cap of £905.19 million.

Operations: Raspberry Pi Holdings generates revenue primarily from its computer hardware segment, amounting to $259.50 million.

Despite a challenging year with net income dropping to $11.7 million from $31.6 million, Raspberry Pi Holdings maintains a promising trajectory with expected revenue growth of 15% annually, outpacing the UK market average of 3.9%. At the recent Hardware Pioneers MAX conference, CEO Eben Upton highlighted innovations that could rejuvenate its product lineup and market position. However, investors should note the significant volatility in share price and a lower profit margin of 4.5%, down from last year's 11.9%. This blend of innovation alongside financial fluctuations presents a nuanced view for stakeholders considering future prospects in an evolving tech landscape.

Where To Now?

- Delve into our full catalog of 38 UK High Growth Tech and AI Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:OXB

Oxford Biomedica

A contract development and manufacturing organization, focuses on delivering therapies to patients worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion