- United Kingdom

- /

- Software

- /

- AIM:LOOP

One LoopUp Group plc (LON:LOOP) Analyst Just Cut Their EPS Forecasts

The latest analyst coverage could presage a bad day for LoopUp Group plc (LON:LOOP), with the covering analyst making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Revenue and earnings per share (EPS) forecasts were both revised downwards, with the analyst seeing grey clouds on the horizon. Investors however, have been notably more optimistic about LoopUp Group recently, with the stock price up a notable 13% to UK£0.84 in the past week. Whether the downgrade will have a negative impact on demand for shares is yet to be seen.

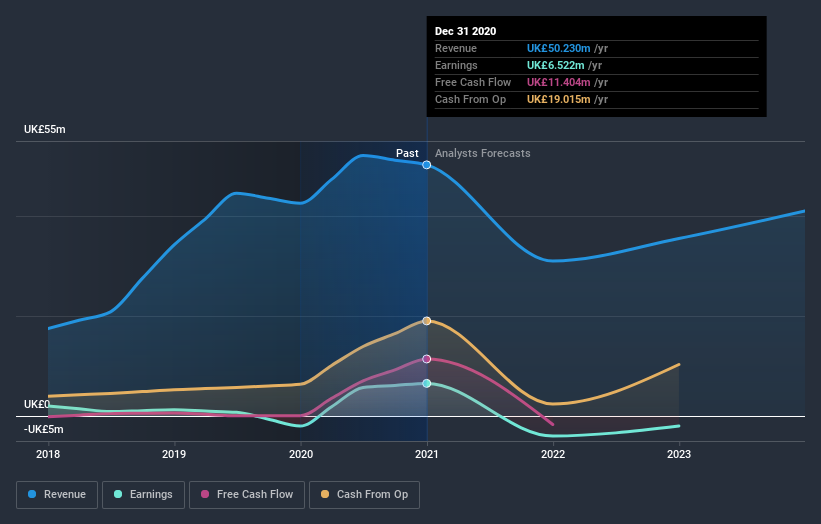

Following the latest downgrade, the sole analyst covering LoopUp Group provided consensus estimates of UK£30m revenue in 2021, which would reflect a stressful 40% decline on its sales over the past 12 months. Following this this downgrade, earnings are now expected to tip over into loss-making territory, with the analyst forecasting losses of UK£0.06 per share in 2021. Yet before this consensus update, the analyst had been forecasting revenues of UK£35m and losses of UK£0.038 per share in 2021. Ergo, there's been a clear change in sentiment, with the analyst administering a notable cut to this year's revenue estimates, while at the same time increasing their loss per share forecasts.

Check out our latest analysis for LoopUp Group

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 40% by the end of 2021. This indicates a significant reduction from annual growth of 34% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 13% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - LoopUp Group is expected to lag the wider industry.

The Bottom Line

The most important thing to take away is that the analyst increased their loss per share estimates for this year. Unfortunately the analyst also downgraded their revenue estimates, and industry data suggests that LoopUp Group's revenues are expected to grow slower than the wider market. We wouldn't be surprised to find shareholders feeling a bit shell-shocked, after these downgrades. It looks like the analyst has become a lot more bearish on LoopUp Group, and their negativity could be grounds for caution.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have analyst estimates for LoopUp Group going out as far as 2023, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

When trading LoopUp Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:LOOP

LoopUp Group

Provides cloud communications platform for business-critical external and specialist communications in the United Kingdom, the European Union, North America, and internationally.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

A formidable player in AI and enterprise computing.

Bad management practices jeopardize long-term future of VRSN

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks