- United Kingdom

- /

- IT

- /

- AIM:ING

Shareholders May Be Wary Of Increasing Ingenta plc's (LON:ING) CEO Compensation Package

Ingenta plc (LON:ING) has not performed well recently and CEO Gregory Winner will probably need to up their game. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 30 June 2021. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. We present the case why we think CEO compensation is out of sync with company performance.

See our latest analysis for Ingenta

Comparing Ingenta plc's CEO Compensation With the industry

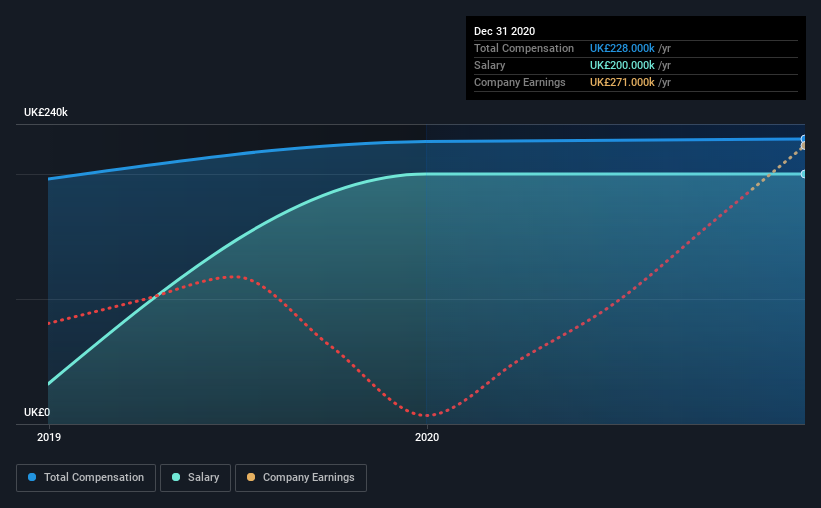

Our data indicates that Ingenta plc has a market capitalization of UK£11m, and total annual CEO compensation was reported as UK£228k for the year to December 2020. This means that the compensation hasn't changed much from last year. In particular, the salary of UK£200.0k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the industry with market capitalizations below UK£143m, reported a median total CEO compensation of UK£239k. From this we gather that Gregory Winner is paid around the median for CEOs in the industry.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | UK£200k | UK£200k | 88% |

| Other | UK£28k | UK£26k | 12% |

| Total Compensation | UK£228k | UK£226k | 100% |

On an industry level, around 66% of total compensation represents salary and 34% is other remuneration. Ingenta is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Ingenta plc's Growth Numbers

Ingenta plc has reduced its earnings per share by 35% a year over the last three years. It saw its revenue drop 6.8% over the last year.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Ingenta plc Been A Good Investment?

With a total shareholder return of -48% over three years, Ingenta plc shareholders would by and large be disappointed. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 3 warning signs for Ingenta that investors should think about before committing capital to this stock.

Switching gears from Ingenta, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Ingenta, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:ING

Ingenta

Provides content management, advertising, and commercial enterprise solutions and services in the United Kingdom, the United States, the Netherlands, France, and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion