- United Kingdom

- /

- Software

- /

- AIM:IDOX

The IDOX (LON:IDOX) Share Price Has Gained 46% And Shareholders Are Hoping For More

If you want to compound wealth in the stock market, you can do so by buying an index fund. But investors can boost returns by picking market-beating companies to own shares in. To wit, the IDOX plc (LON:IDOX) share price is 46% higher than it was a year ago, much better than the market decline of around 8.3% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! In contrast, the longer term returns are negative, since the share price is 1.2% lower than it was three years ago.

Check out our latest analysis for IDOX

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

IDOX went from making a loss to reporting a profit, in the last year.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

However the year on year revenue growth of 6.2% would help. We do see some companies suppress earnings in order to accelerate revenue growth.

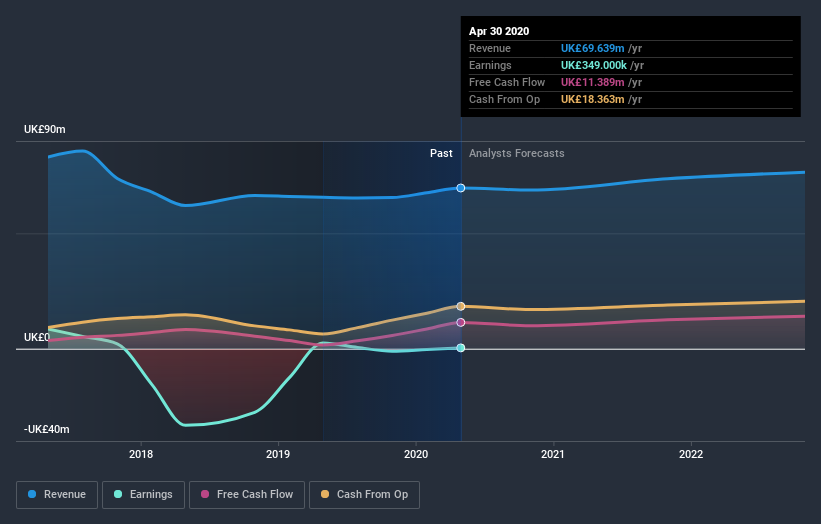

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling IDOX stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that IDOX shareholders have received a total shareholder return of 46% over one year. That's better than the annualised return of 4% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for IDOX (2 are concerning!) that you should be aware of before investing here.

We will like IDOX better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you decide to trade IDOX, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:IDOX

IDOX

Through its subsidiaries, provides software and services for the management of local government and other organizations in the United Kingdom, the United States, rest of Europe, and internationally.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026